ALEXANDRIA, Va. — It hasn’t reached the level of “Mad Max,” but spectrum is a scarce resource. The proliferation of connected devices and a boom in large satellite constellations has raised the question of how to effectively share the finite amount of usable bandwidth between competing terrestrial and space-based interests.

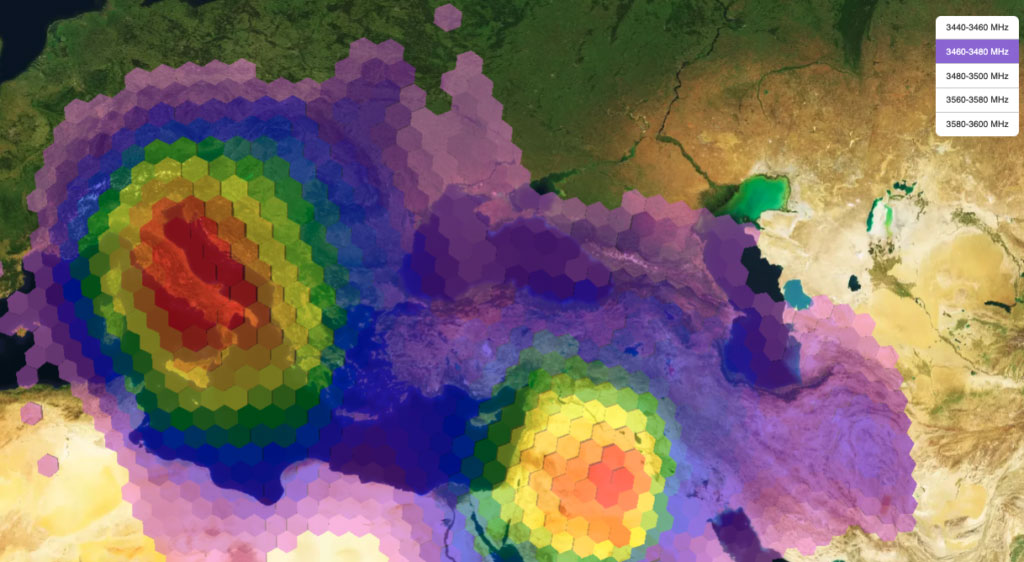

RF mapping of a network in the 3.5 GHz range. Red indicates a stronger signal. (Aurora Insight)

RF mapping of a network in the 3.5 GHz range. Red indicates a stronger signal. (Aurora Insight)

“The situation is evolving to be much more of a joint interest where satellite operators and terrestrial users need to be coexisting,” explained Aurora Insight CEO Jennifer Alvarez. “It’s getting that way more and more because there are so many actors now involved.”

Aurora Insight, based in Denver, Co., has documented the growth of wireless network activity, infrastructure deployment and spectrum use across frequencies since 2017. The company collects radio frequency data through its network of terrestrial, aerial and satellite sensors, analyzes it and provides it to commercial, regulatory and government customers to better understand the RF environment.

Since deploying its first satellite in 2018, Aurora Insight has documented a global map of spectrum use that is “agnostic” to specific signal frequencies.

“We vacuum up all the spectrum, in all the frequency bands we’re able to, so we can tell a story about spectrum use anywhere in the world,” said Alvarez.

Aurora Insight currently has two satellites in orbit collecting data and updating the global map daily. Another satellite is scheduled for launch in April 2023.

Data as a ‘Truth Measurement’

One of the stories that has emerged from Aurora Insight’s data is the level of wireless network deployment in any given location.

Aurora Insight’s Bravo, a 6U satellite, being integrated into launch vehicle ahead of an April 2021 launch. (Aurora Insight)

Aurora Insight’s Bravo, a 6U satellite, being integrated into launch vehicle ahead of an April 2021 launch. (Aurora Insight)

In recent years, countries around the globe have authorized billions of dollars in subsidies and incentives to mobile network operators to develop and deploy services. This is particularly true for governments trying to deploy wireless services in hard-to-reach areas.

However, there’s often a difference in how spectrum is allocated and licensed and how it’s actually used. Collecting data on the signal power of specific frequencies can provide real-time oversight into how mobile network operators and wireless carriers are progressing toward connectivity goals—or not. This has proven to be a valuable tool for both regulators and wireless service providers.

“Our data is a truth measurement of how spectrum is being used,” said Alvarez. “We provide an unbiased measurement of what’s on the air.”

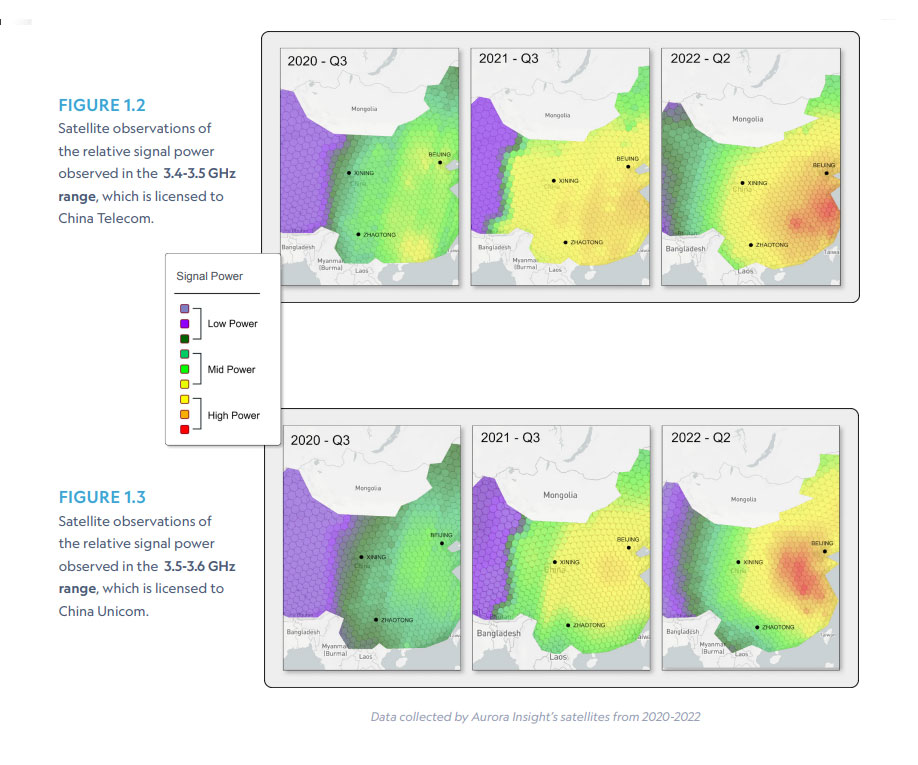

The company’s satellite sensors also provided documentation of the meteoric rise of 5G deployment across China fueled by the close collaboration of two giant telecoms. The implications of Aurora Insight’s July 2022 report, “The Expansion of China’s 5G Mid-band” sparked significant interest from the U.S. national security community. It also demonstrated to the wireless industry how rapidly and widespread 5G could be deployed.

(“Mid-band Report: The Expansion of China’s 5G Mid-band”/Aurora Insight)

(“Mid-band Report: The Expansion of China’s 5G Mid-band”/Aurora Insight)

Who Are the Spectrum Hogs?

Fights continue between mobile network operators and unlicensed Wifi, satcom operators and mobile, new space entrants and incumbents, aviation authorities and 5G providers, military and commercial.

“Every different type of user of spectrum believes they need more,” said Alvarez. “I can’t say whether that’s valid or not, but every user wants more because they recognize the importance and scarcity of the resource. Their businesses depend on access to spectrum.”

Part of resolving these conflicts has been a push for more efficient use of allocated bandwidth. Currently, regulators license and monitor terrestrial spectrum use based on geography and frequency range, but not how often the spectrum is used. Aurora Insight data can show spectrum utilization based on both time and geography. If an allocated frequency is only being used half of the time, there could be an opportunity to increase occupancy and improve efficiency.

By 2025, there are projected to be some 27 billion connected devices globally and up to 10,000 satellites. Alvarez noted, “The question becomes, how do all of these complicated systems that rely on spectrum coexist when that resource is finite?”

Explore More:

Crowded Spectrum Pushing Satcom Operators into Q/V Band

Where’s the Bigger Value Add in Geospatial Services: The Satellites or the Analytics?

Podcast: Benefits of Virtualization and Unique Opportunities in SmallSat