Credit: Maxar

Credit: Maxar

PARIS — Which side of the geospatial imagery industry should be more afraid of commoditization: Satellite fleet owners of providers of geospatial analytics?

Companies like Maxar Technologies and BlackSky have focused on their analytics value add, with machine learning and AI, as being just as important as their satellite fleets.

As multiple fleet owners move toward once-a-day coverage or better, with satellite sensors providing ever-sharper imagery, the pixel makers do appear exposed, especially as customers place higher value on the package of data provided, and not just the picture.

But Satellogic Chief Executive Emiliano Kargieman said it’s the analytics side that is about to be made less relevant as multiple companies spring up to employ ML and AI techniques.

“We are happy to race other peers on this panel down to the bottom,” Kargieman said June 2 at Asia Satellite Business Week, organized by Euroconsult as part of Asia Tech x Singapore 2022.

Representatives from BlackSky, Maxar, and Head Aerospace were also on the stage.

Kargieman has long touted Satellogic’s low per-satellite cost of less than $1 million in orbit as unbeatable. Now with 26 satellites in orbit, Satellogic expects its fleet of 70-cm-resolution satellites to grow to 65 by the end of this year and over 100 in 2023.

Emiliano Kargieman, Satellogic. Credit: Euroconsult video

Emiliano Kargieman, Satellogic. Credit: Euroconsult video

“It’s a lot easier to commoditize analytics, to commoditize machine learning on top of the satellite data, than it is to commoditized the satellite data,” Kargieman said. “We can build more efficient satellites but this is still a capital-intensive industry. It takes 100s of millions to build an infrastructure in orbit.”

“Think about two students in a dorm room who can build a machine learning analytics company. Hundreds of thousands of startup sright now are doing machine learning and analytics. That is easy to commoditize,” Kargieman said.

“Most of the algorithms we use to look at imagery have been developed by people who wanted to classify pictures of cats on the internet. They are driving innovation. We are not.

“In the end, you’re looking at the Earth always from the same direction and the objects are always the same size. That’s a lot easier than trying to have an autonomous car that has to deal with stuff happening in real time at different scales. The real value add in this industry is not going to be the machine learning and AI. It’s definitely going to be an understanding of cusortme needs and generating the data sets that deliver those solutions, but the intermediaries, the ML and computer analytics companies, will get completely squeezed in this market.”

Andy Stephenson, BlackSky. Credit: Euroconsult video

Andy Stephenson, BlackSky. Credit: Euroconsult video

None of the other panelists chose to challenge Kargieman, but Andy Stephenson, BlackSky’s head of global sales and business development, stressed the benefits to customers of a complete information pack in which imagery is only a part.

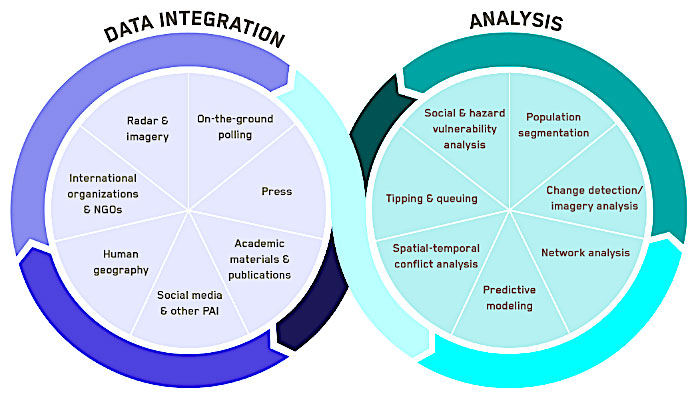

“It’s not about the satellites, it’s more about the data — that’s where BlackSky is focused,” Stephenson said. We operate a fleet of 14 1-meter-resolution satellites that we feed into Spectra AI,” which is also fed by open-source third-party data including social media, news sources and other types of satellite sensors.

“As soon as you start talking about the price per pixel and the commoditization of pixels, it’s a race to the bottom.

“I am not trying to sell [customers] a pixel. It’s downstream analysis, patterns of life, helping them answer questions is where we need to be focused. Especially for the commercial market, nine times out of 10 the client doesn’t care about the source of the data. Just give them the right answer.”

Read more from Space Intel Report.