Starlink satellite trails over Brazil. Credit: Egon Filter

Starlink satellite trails over Brazil. Credit: Egon Filter

WASHINGTON — Searching for usable spectrum in lower bandwidths can best be summed up by Yogi Bera’s famous quote: “Nobody goes there anymore. It's too crowded.”

Demand for spectrum has continued to grow at a rapid pace with satellite and other allocated services vying for valuable bandwidth. Terrestrial service providers are scrambling to buy up lower bandwidths to feed an increasingly spectrum-hungry customer base. This has left satcom providers seeking higher ground and moving to develop commercial operational capabilities in the Q band (33-50 GHz) and V band (40-75 GHz).

The satellite industry is accustomed to sharing spectrum among operators and some fixed terrestrial services, but the explosive demand for connectivity has led to greater and more frequent tensions.

Fights over licensing, allocation and use are becoming the norm and are putting satellite and terrestrial service providers in competition for limited bandwidth. The battle for the 12 GHz band between SpaceX and OneWeb against Dish’s alliance of mobile and fixed 5G providers is typical—and ongoing. Conflict over the use of the 24 GHz band pit NASA and NOAA against fixed wireless internet providers. The fight over reallocating C band was largely resolved through a multibillion-dollar auction, but certainly not without hurt feelings. In the Ka band, which was seen as an oasis only a few years ago, there are now growing concerns from satellite operators that regulators could repurpose spectrum in the 28 GHz band for 5G.

Crowding in the lower frequencies has generated a “migration” into higher bands, like Q/V, explained Satellite Industry Association President Tom Stroup.

“There’s almost a natural inclination to look for bands that are either not used or potentially underutilized,” Stroup said. “In the world of spectrum use and spectrum management, that typically means moving to higher frequencies.”

Benefits of Operating in Q/V

For decades, operating communications satellites in higher frequencies was considered difficult if not impossible. But the potential benefits were too significant to ignore.

The ability to provide commercial satellite communications in the Q/V bands meets two fundamental needs for today’s GEO and non-geostationary-satellite orbit (NGSO) satellite operators: available bands of spectrum and significantly higher rates of data throughput. Depending on the configuration, Q/V band operators can potentially utilize more than twice the available bandwidth available in Ka.

Incorporating Q/V capabilities into communication satellites can free up spectrum for subscribers in lower Ka-band downlink frequencies, explained EVP of New Satellite Systems Development at Kacific Bob Perpall. Kacific is currently considering a Ka/Q/V-band hybrid system and is expected to select a satellite manufacturer in the coming months.

“Q/V provides alternative gateway frequencies, both the forward uplink as well as the return downlink, which otherwise takes away from using your Ka-band array resources. These can be allocated to the subscribers, which means more frequency reuse is possible.” Perpall said. “It means there’s more bandwidth available for subscribers, so you’re getting a bigger throughput by using Q/V.”

When feeder links and subscriber links operate at entirely different frequencies, it helps reduce incidents of self-interference. It also allows providers to install multiple gateways at shared sites without worrying about interference.

Operators using Q/V may also look forward to deploying less ground infrastructure than is used for Ka-band satellites. With more available bandwidth and ability for reuse, operators need fewer gateways and fewer diversity sites, which translates into less associated hub equipment.

“It allows you to reduce your footprint in terms of hardware deployed in locations,” Perpall noted.

However, because of the physical challenges of operating in the millimeter frequencies, antennas, amplifiers, transmitters and other equipment must be built to a higher standard, which translates inevitably into higher initial costs.

Operating Challenges

Many of the same challenges of operating in other Extremely High Frequencies apply to those who move into the Q/V band, not the least of which is developing specialized equipment. The 4.0 – 7.5 mm wavelength requires an unobstructed line of sight between transmitter and receiver and sufficient power to propagate through the atmosphere. At the Q/V operating frequency, attenuation and atmospheric effects are particularly severe, and the effects of rain, clouds and atmospheric gas can impair the availability and quality of service.

Some of these issues can be addressed at the gateway by switching to a nearby diversity site when disruptions reach a certain threshold—which is done today by operators in the Ka band.

There’s also a need to account for a larger dynamic range, particularly in the tropics. According to Perpall, Q/V will need at least as much uplink power control (UPC) dynamic range as Ka band. Though it’s not clear if commercial operators will have enough power to achieve it.

“One of my biggest concerns about Q/V is that maybe we won’t have the luxury of a large dynamic UPC range,” Perpall said. Based on propagation loss models, variations in Q/V could be three times what they are in Ka, which might result in more frequent switching from primary to diverse site. This could limit the forward uplink capacity gained by using Q/V band.

One way to address the issue is by limiting the bandwidth transmitted up. But that would mean sacrificing some of the anticipated gains of 50 GHz of transmission.

V-Band ‘Land Grab’

With the challenges and opportunities, companies have been snatching up licenses in the V band at a rapid pace over the last five years. In the U.S. FCC’s last V-band offering in November 2021, nine companies submitted applications seeking approval for more than 38,000 NGSO communication satellites.

Some analysts have described the rush as a “land grab,” with companies staking claims they may be unable to use. Others see it as a step toward developing capabilities that will improve spectrum sharing and reduce interference among satcom and terrestrial providers.

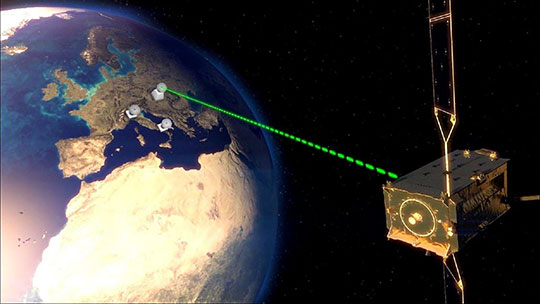

Alphasat’s TDP 5 measures the impact of cloud coverage on its signal

Alphasat’s TDP 5 measures the impact of cloud coverage on its signal

It remains to be seen how much of the licensed V band can be developed. Currently, most companies with operational approval are at the development stage. Only a few have deployed test satellites. Airbus and Thales was one of the first to deploy a Q/V band transponder on the Aldo Paraboni Payload in 2014 as part of a mission to explore the feasibility of commercial Q/V-band use. Eutelsat also tested Q/V-band communications on its Eutelsat 65 West A satellite.

Boeing is scheduled to deploy its first V-band test satellite in September. The Varuna Technology Demonstration Mission (TDM) will be the first demonstration of Boeing’s proposed constellation of 147 NGSO V-band satellites recently approved by the FCC. It will also mark an important milestone in the company utilizing its licensed bandwidth. Viasat, Inmarsat, OneWeb, Iridium and SpaceX have also been approved to deploy NGSO constellations using Q/V bands.

Stroup noted there is “nothing surprising” about the fact that so few companies have become operational in the V band. “There’s generally a multiyear process from a band being made available to getting equipment available and the deployment,” he emphasized. “It’s not just the deployment of the satellite, it’s the deployment of the receivers and the earth stations for it.”

However, regulators have a clock ticking for companies to use their spectrum before they lose it. International Telecommunication Union (ITU) anti-warehousing rules require NGSO operators to field their first satellite seven years after applying for the spectrum. Two years after that, they must deploy 10% of their constellations. By five years, they need to deploy 50% and the entire constellation must be in orbit seven years after fielding their first satellite.

The new milestones were put in place in November 2019, before anyone could have anticipated the supply chain shocks caused by the COVID-19 pandemic and Russia’s invasion of Ukraine. According to reports, companies are now filing petitions with the ITU requesting extensions to meet the deployment deadlines. Currently, the ITU’s Radio Regulations Board only has the authority to grant deadline extensions on a case-by-case basis for operators who can prove delays were related to circumstances beyond their control.

Explore More:

Podcast: NGSO Constellations Everywhere, Déjà Vu all Over Again

Podcast: New Space, Smallsats and Regulatory Implications