ALEXANDRIA, Va. — The value of commercial satellite imagery has become undeniable, especially in the last year. Satellite operators have revealed images to the world that would have otherwise been classified, improving transparency in conflict zones and emergencies while facilitating greater intelligence sharing among international partners.

Nowhere is the value of this data clearer than the use of commercial synthetic aperture radar (SAR). In the early days of Russia’s invasion of Ukraine, Ukrainian authorities stressed the need for data on enemy troop movements at night. Electro-optical satellites could collect during the day when cloud cover and smoke were limited, only radar could deliver day or night, all-weather imagery.

A SAR image showing troops in Belgorod, Russia, approximately 80 km from the Ukrainian city of Kharkiv. (Source: Capella Space)

A SAR image showing troops in Belgorod, Russia, approximately 80 km from the Ukrainian city of Kharkiv. (Source: Capella Space)

“As we’ve seen in Ukraine, it’s been absolutely critical to show the world what’s happening on a daily basis,” Capella Space Founder and CEO Payam Banazadeh told Constellations. “It’s been absolutely critical for the U.S. to be able to share intelligence back to Ukraine and they’ve been able to do so by relying pretty heavily on commercial unclassified shareable data.”

That was not always the case. U.S. companies producing high-resolution radar imagery were under strict national security regulations for years. The industry started to flourish in the last 5-7 years, with American companies finally catching up with the commercial capabilities other nations have been developing for decades.

What is now a roughly $3.7 billion commercial SAR market took years of patience on the part of industry as well as an evolution in the approach to commercial remote sensing within the intelligence and national security communities and among policymakers.

Now, there are signs of accelerating usage and demand for commercial SAR, as well as tangible evidence of the benefits of shareable satellite radar imagery in a multinational operational context. When National Geospatial-Intelligence Agency (NGA) Director of Commercial and Business Operations David Gauthier announced plans to double purchases of commercial optical imagery early in the Ukraine conflict, he also announced that the agency had pushed commercial SAR capabilities into service “months earlier than planned” and at five-times the rate expected.

Civil and commercial SAR is being used in Turkey and Syria to assist with disaster recovery and assess the scale of the earthquake using change detection maps. ICEYE has begun providing near real-time SAR imagery to monitor flooding and other natural disasters. Ursa Space uses its constellation of SAR satellites to monitor oil inventories, providing transparency into the global energy market.

What Took So Long for Commercial SAR?

Over the next decade, commercial SAR will represent a $16.9 billion revenue opportunity and amount to nearly one-quarter of the total Earth observation market, according to NSR. Despite government and military demand for radar imagery, U.S. companies have only recently joined that global market.

At seven years old, Capella Space was the first American company to build and operate a synthetic aperture radar satellite. It’s Denali, launched in 2018, was the first U.S. commercial SAR satellite in orbit.

“When we started the company back in 2016, there was no commercial SAR in the U.S. It just didn’t exist,” explained Banazadeh.

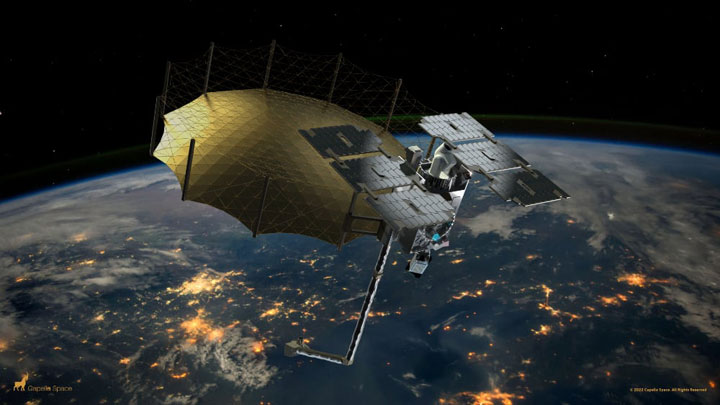

Capella’s next-generation Acadia SAR satellites provide high-quality imagery and rapid order-to-deliver speeds using automated tasking. The satellites are slated for launch in 2023 and will be equipped with optical communications terminals for inter-satellite links. (Source: Capella Space)

Capella’s next-generation Acadia SAR satellites provide high-quality imagery and rapid order-to-deliver speeds using automated tasking. The satellites are slated for launch in 2023 and will be equipped with optical communications terminals for inter-satellite links. (Source: Capella Space)

The U.S. military and intelligence community (IC) had robust programs of record for commercial Earth observation data, but not a single American company offered radar imagery. Only Canada, Germany, France and Italy had commercial SAR satellites.

Officials in the Pentagon, IC, White House and Congress had been talking about the need for commercial radar for years. But the intelligence community and DoD upheld stringent national security requirements and international obligations on the collection and distribution of high-resolution imagery and phase history data that made it difficult to impossible for a U.S. company to succeed in a competitive global market.

Years of talk are finally translating into quicker action, according to Banazadeh, who recently announced the creation of Capella Federal, a subsidiary to support the needs of U.S. government, defense and intelligence customers at scale.

“Faster is still a relative term when it comes to government,” he said. “It’s not going to be overnight, but it is relatively faster than before.”

After launching its constellation in 2020, Capella became the first U.S. SAR provider to sign a Cooperative Research and Development Agreement with the NGA. Last year, Capella was one of five commercial SAR providers to receive a National Reconnaissance Office (NRO) contract under the agency's Broad Agency Announcement (BAA) Framework for Strategic Commercial Enhancements to purchase commercial SAR capabilities and evaluate the potential for expanded contracts. Airbus, U.S., ICEYE, U.S., PredaSAR and Umbra Space also received NRO contracts.

A Brief History

While the 1980s saw the beginning of the U.S. commercial space industry with a focus on commercial launch, the 1992 Land Remote Sensing Policy Act set the stage for commercial satellite imaging. Over the next 15 years, the number of licensed U.S. commercial remote sensing operators grew from zero to 25—and are currently well over 100.

Despite the growth in commercial Earth observation, the sale of commercial SAR imagery remained so restricted that even U.S. companies that were approved for licenses could not close the business case.

Other countries did not have a similar experience. By 1995, Canada had already become the first country to commercialize SAR imagery with the RADARSAT-1. Around that time, lawmakers raised concerns about U.S. competitiveness in commercial SAR, warning that other countries’ commercial capabilities would leave the U.S. government with “no effective control” over the technology. However, the DoD and IC continued to oppose commercial licenses to U.S. providers over issues of national security and international obligations.

As other nations advanced their capabilities, U.S. regulations eased from better than 5-meter resolution commercial imagery in the 1990s to 3 meters in 2000 and 1 meter in 2009. At that time, the NGA issued its first commercial SAR contracts. The five-year $85 million contracts went to three U.S. companies who, in turn, provided data from Canadian, German and Italian satellite operators and developers.

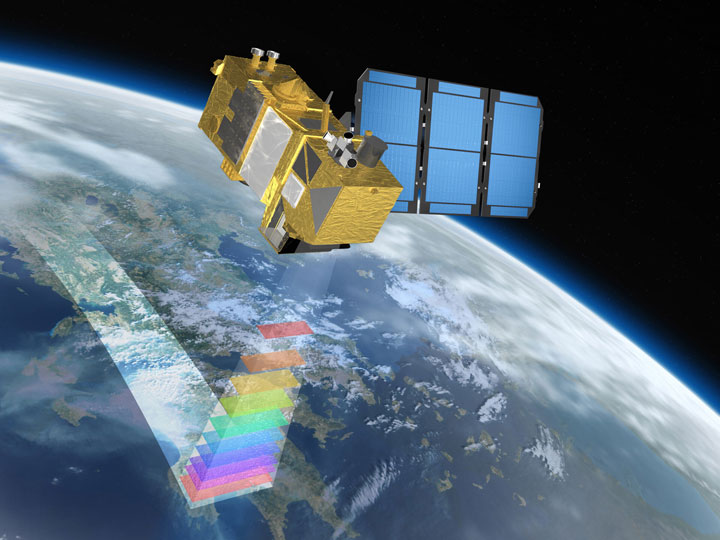

The ESA launched its first satellite in its Sentinel mission in 2014 and began providing free 5-meter resolution radar imagery. The Sentinel satellites were built being built by France’s Astrium Space and Italy’s Thales Alenia Space. (Source: ESA)

The ESA launched its first satellite in its Sentinel mission in 2014 and began providing free 5-meter resolution radar imagery. The Sentinel satellites were built being built by France’s Astrium Space and Italy’s Thales Alenia Space. (Source: ESA)

As anticipated, European and Canadian capabilities continued to improve, along with the availability of the data. In 2014, the European Space Agency launched the Sentinel-1 mission and began providing free SAR data for scientific, research or commercial purposes down to 5-meter resolution. The Sentinel mission has expanded and continues operations today.

In the years that followed, the U.S. began taking more significant steps to improve the intelligence community’s collaboration with commercial GEOINT providers. This included the 2017 establishment of the IC Commercial Space Council, which provides a central point to better assess, integrate and use commercial resources with classified DoD and IC assets.

In 2019, the NRO announced its first-ever contract with a U.S. commercial SAR firm, Capella Space, to study and evaluate the ability of a commercial provider to integrate commercial SAR into the national security enterprise. This was followed shortly after by and NGA Cooperative Research and Development Agreement to provide timely, persistent imagery, analytics and contextual information to agency researchers.

Restrictions were further eased in 2020 when the Department of Commerce released a new rule to streamline the licensing of commercial SAR satellites. The rule acknowledged that international systems provided imagery with finer resolution than what was permitted under U.S. regulations and established parity for U.S. operators. This meant that remote sensing systems with capabilities already commercially available overseas would be subject to less stringent U.S. controls and DoD would maintain its ability to assess the national security impacts of commercial projects.

Policies in Today’s Buy vs. Build Climate

Major acquisition changes have been underway since the creation of the Space Force in favor of a “buy what we can, build what we must” model. This has begun filtering into the intelligence community through the NRO which is responsible for the acquisition of commercial satellite imagery.

In recent years, Congress has attempted to add commercial space requirements to the National Defense Authorization Act (NDAA). The 2023 House Armed Services NDAA report included language calling on the NRO to expand its commercial SAR acquisition program “beyond its pilot program status.” The committee urged the agency to continue pursuing commercial SAR GEOINT to meet the demands of the IC and military.

U.S. lawmakers have attempted to include commercial space requirements in recent legislation. In 2023, the U.S military space budget was $28.5 billion, a 30% increase over the previous year. (Source: MotionStudios)

U.S. lawmakers have attempted to include commercial space requirements in recent legislation. In 2023, the U.S military space budget was $28.5 billion, a 30% increase over the previous year. (Source: MotionStudios)

The Senate Armed Services Committee’s 2020 NDAA went further in attempting to mandate commercial remote sensing imagery by the NRO and NGA. Though never enacted, the measure would have required the organizations to consider commercial alternatives as part of their analysis for future acquisition of space systems.

As a former space national security official explained to Constellations, the shift to favor commercial imagery is complex and it will move at the pace of government. Intelligence and military agencies need to balance requests for new commercial capabilities against existing exquisite capabilities. Even if a commercial system has the same essential requirements as a classified system, the government is expected to maximize the use of its assets before procuring more capabilities. The military and IC must also deliver an honest assessment of whether commercial systems can fulfill additional requirements in an appropriate, secure and cost-effective way.

Moving forward, U.S. lawmakers are expected to give extra scrutiny to space-based procurements in the wake of significant spending increases. The total DoD space budget was $28.5 billion in 2023, a 30% year-on-year increase, including an estimated 9% boost for classified space programs.

Information Sharing Among Governments and Industry

Ultimately, the need for “national technical means” and classified information within the intelligence community is different from the DoD, which is proving to be a voracious consumer of commercial satellite data. The essential difference boils down to the ability to share information more easily across agencies, combatant commands or among partners and allies.

U.S. officials and international partners continue to express frustration in trying to share information within the highly classified U.S. space portfolio. This is where commercial SAR has been a game-changer. Unlike NRO or NGA assets, the data that comes off a commercial radar satellite can be translated into a shareable product for allies and partners. This is especially important in contingency planning, wargames and capacity building, as well as international disaster response and humanitarian missions.

French and U.S. soldiers train together during a Combined Joint Task Force exercise in Djibouti, March 13, 2022. Commercial SAR data is more easily shared among coalitions and allies than data gathered on classified intelligence satellites. (Source: U.S. Army National Guard/Staff Sgt. Jeff Clements)

French and U.S. soldiers train together during a Combined Joint Task Force exercise in Djibouti, March 13, 2022. Commercial SAR data is more easily shared among coalitions and allies than data gathered on classified intelligence satellites. (Source: U.S. Army National Guard/Staff Sgt. Jeff Clements)

“Not a single event happens in the 21st century where you’re the only country that is impacted,” Banazadeh said. “The shareability of data has a completely different value in this day and age than it did 30 years ago.”

The unique quality of open, shareable data that commercial operators bring the table benefits warfighters and international coalitions as much as civil and commercial customers.

As the advantages of near real-time SAR data become increasingly apparent, companies are expanding their services beyond military and government customers. On Wednesday, Capella announced the creation of its Analytics Partner Program to bring AI-powered geoanalytics to partners serving commercial markets, such as manufacturing, energy, insurance and finance.

“Long-term access to timely, accurate, all-weather information is game-changing for so many industries and presents a growing market opportunity for our partners,” Banazadeh said in a press release.

Capella currently has seven satellites deployed out of its 30-satellite constellation and has raised over $250 million in venture capital since its founding, including a $60 million round in January. The company plans to launch its next-generation Acadia satellites this year with increased radar bandwidth and power to deliver higher resolution, higher quality imagery to its government customers.

After years in a challenging regulatory environment, commercial SAR has become a competitive market poised for expansion. Operators like Capella, ICEYE, Umbra, PredaSAR and others are building out constellations that will increase revisit rates and bring a level of persistent monitoring and resiliency that would otherwise be unattainable with the limited number of exquisite national security satellites on orbit today.

Explore More:

DoD’s Increasing Demand for Data Fusion in Space

US Space Systems Command Calls for Greater Info-Sharing Among Allies

Why DIA Wants More Commercial SDA Partners

Podcast: SDA’s Spiral Development and Being a Constructive Disruptor