ALEXANDRIA, Va. — By the end of 2022, there were approximately 1 billion 5G subscriptions globally and projections that number will reach 5 billion by the end of 2028. The inclusion of non-terrestrial networks (NTN) in the 5G standard was an acknowledgment that satellite is essential to delivering on the promise of ubiquitous high-speed, low-latency connectivity. But it’s not a foregone conclusion.

Satellite connectivity is helping 5G become a reality, but challenges remain. (Source: Pixabay)

Satellite connectivity is helping 5G become a reality, but challenges remain. (Source: Pixabay)

Providers have described seamless roaming between space and terrestrial networks and service that will make end users exclaim, “I can’t believe it’s not wireless!” In reality, that outcome is at the end of a long road and there are hurdles to overcome for satellite to help attain the promise of 5G as an integrated part of mainstream telecommunications networks.

Slow Terrestrial Rollout

Whoever said 5G was fast was not talking about the deployment. In a survey of telecommunications stakeholders, 64% said it would take another 1-3 years for 5G to become fully mainstream. Most major carriers offer low-band (600 to 700MHz) or mid-band (1.7 to 2.5 GHz) 5G in areas where the infrastructure has been deployed. High-band mmWave 5G (24GHz) is mostly found in major cities where carriers have invested in the dense infrastructure needed to support high speeds over short distances.

So far, the satellite industry has only seen a limited impact from 5G deployments in terms of revenues, according to NSR. The prioritization of 5G in densely populated areas has meant fewer opportunities for satellite, which is best used to support rural and remote connectivity. Pandemic-related delays lengthened the process for 3GPP to finalize Releases 17, which included satellite specifications, like New Radio (NR) for satellite direct-to-device access. There has also been a slow ramp-up of private 5G networks due to spectrum scarcity and a lack of affordable end user devices.

The slow terrestrial deployment of 5G has been one of the limiting factors impacting satellite’s role. (Source: iStock Photo)

The slow terrestrial deployment of 5G has been one of the limiting factors impacting satellite’s role. (Source: iStock Photo)

Aurora Insights, which tracks the deployment of 5G by monitoring spectrum use from space, noted in a recent report, “The challenges associated with mainstream 5G deployment should not be understated.” These include clearing spectrum, auctioning licenses, deploying dense infrastructure, testing networks and then building out the networks to attain sufficient signal power.

A slow initial rollout is not necessarily indicative of long-term prospects. Overall, the adoption rate of 5G has been faster than LTE.

Cost: Is Satellite 5G Worth the Investment?

An article published last month carried the dismal headline: “Operators’ 5G investments show no clear signs of paying off.” Despite spending tens of billions of dollars building infrastructure, most mobile network operators (MNOs) have been unable to increase the average revenue per user. Meanwhile, hyperscalers, internet companies and other players that are not investing in the infrastructure are reaping significant gains.

Some satellite operators view the MNO experience as a cautionary tale. During a recent webinar hosted by GVF, Intelsat’s Director of Product Management for Networks Gerry Collins warned that satellite operators need to be prepared to provide value-added services beyond pure connectivity or somebody else will “eat our lunch.”

“We’ve got to be open to those challenges that we’re going to invest a hell of a lot putting satellites up into space,” he said. “And we have to be sure that we’re going to be the ones that are getting to get the returns.”

Standardization: What’s Lost, What’s Gained?

Standardization around 5G specifications is creating a foundation for satellite to integrate into mainstream telecommunication networks. It has defined 5G New Radio access network for non-terrestrial terminals to communicate with base stations. It has established performance requirements, customer expectations and massive opportunities in satellite direct-to-handset, IoT and industrial IoT.

For an industry that has been historically “cursed” by low volume, the main advantages of standardization are enlarging the addressable market for satellite services and leveraging economies of scale, to access a larger, less expensive supply of components and chipsets.

Of course, there is a tradeoff. A purpose-built solution will always perform better for a specific use case than a more general solution designed to support several use cases. That axiom has largely defined the satellite industry for decades. But just as Carrier Ethernet, network function virtualization (NFV) and software-defined networks (SDN) helped push the telecommunications industry toward greater interoperability, similar developments in the satellite industry are challenging the notion that purpose-built is always better.

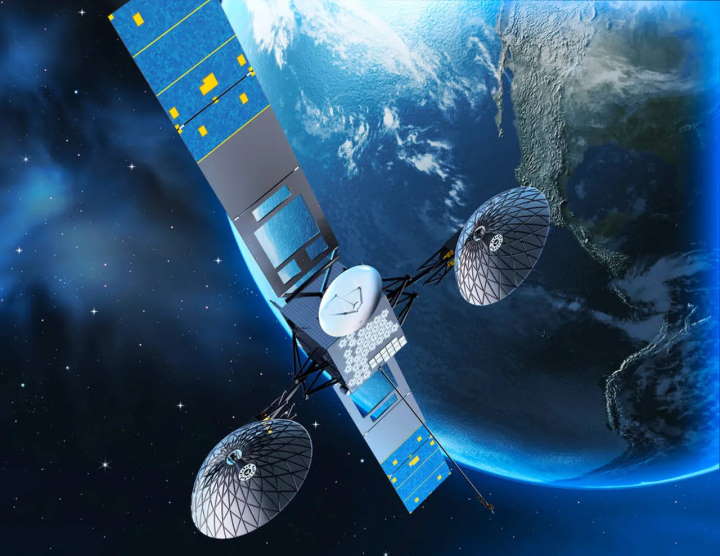

There is growing acceptance within the satellite industry of the benefits of standardization. (Source: NASA)

There is growing acceptance within the satellite industry of the benefits of standardization. (Source: NASA)

“You may not get the same quality,” Space Bridge Systems Engineering Manager Amir Kashanizadeh said of the difference between proprietary and standardized satcom solutions. “But in the end, I think the market will not allow us to ignore 3GPP. And 5 to 10 years from now, anyone who ignores this standardization will be eliminated from the market.”

Spectrum Use and Allocation

Nothing made the value of spectrum clearer than the FCC’s record-breaking 2021 auction of a slice of the C-band for $81 billion. The wireless industry is hungry for mid-band and mmWave spectrum. While there are opportunities for satellite to offload traffic from congested mobile networks, it doesn’t alleviate the challenges around spectrum allocation and sharing.

It remains an “ongoing point…of friction” between the two industries, Satellite Industry Association Tom Stroup explained in a Constellations podcast. As mobile services occupy higher frequencies previously reserved for satellite use, the likelihood of interference increases. Regulators are struggling to understand the risks and allocate scarce resources between two growing industries.

“The issue is not going away,” Stroup continued. “It's an area that is going to continue to be a challenge for policymakers as well as for both of our industries.”

Interference between satellite and terrestrial networks and spectrum allocation will present ongoing challenge. (Source: iStock Photo)

Interference between satellite and terrestrial networks and spectrum allocation will present ongoing challenge. (Source: iStock Photo)

New opportunities in two-way satellite direct-to-handset or sat-to-cell service are also creating challenges around spectrum allocation. Satellite operators, like SpaceX and AST SpaceMobile, have requested FCC licenses to share spectrum with cellular partners inside the U.S. So far, the FCC has only granted a license to Lynk Global to provide sat-to-cell on terrestrial GSM and LTE services.

Big Opportunities

Over the next decade, the implementation of 5G will represent a $162 billion opportunity for satcom, according to NSR.

The mobility market, including in-flight connectivity, maritime and rail, is expected to experience a roughly 10% CAGR over the next decade, according to Euroconsult. Satellite IoT and machine-to-machine connectivity in various industries will comprise a roughly $6 billion market by 2031. Satellite direct-to-handset connectivity is catching on quickly with companies like Iridium, Globalstar, AST SpaceMobile, Lynk Global and SpaceX striking deals with smartphone manufacturers and mobile carriers.

Satellite is positioned to play a significant role in the future of telecommunications. But the future is not here, yet. Technical and business challenges exist and they are being met by service providers seeking to realize the vision of satellite 5G and beyond.

Explore More:

How Satellite Became a Part of 5G

Podcast: Satellites Integrated with Telcos, 5G and a Converging World

Podcast: NFV, SDN and Enabling Dynamic Satellite Ground Networks

To work with Telcos, Satellite Needs to Revamp Its Reputation: WTA Report