Satellite connectivity has a long history in telecommunications. The latest 3GPP specifications elevate the role of satellites in the 5G ecosystem.

Satellite connectivity has a long history in telecommunications. The latest 3GPP specifications elevate the role of satellites in the 5G ecosystem.

ALEXANDRIA, Va. — It’s difficult to understate the impact of 5G on the global telecommunications ecosystem and how the world views satellite connectivity.

One of the biggest turning points came with the most recent release of the 5G standard, which marked the most thorough integration of commercial space and terrestrial mobile communications networks to date.

This process has been ongoing for years under the auspices of 3GPP, the global consortium of telecommunications standards development organizations responsible for developing the technical specifications to achieve the promise of 5G—anytime, anywhere coverage, to any device, across any network.

While satellite has had a seat at the 3GPP table for some time, it was often viewed as an afterthought. The 3G and 4G standards supported cellular backhaul, some specialty services and satellite-based IP but little more. In 2017, working groups began formal research into the roles and benefits of satellite connectivity in the 5G ecosystem. This, in turn, prompted recommendations that the fifth generation of mobile broadband technology support non-terrestrial use cases, including high-altitude platform systems, drones and LEO and GEO satellites.

It wasn’t until Release 17 earlier this year that satellite was positioned as a critical component of the global 5G ecosystem. That release gave the satellite industry its first technical specifications for integrated, direct-to-device 5G over satellite.

Being included in the standard has elevated the importance of satellites while creating new opportunities and areas of cooperation between space and terrestrial service providers. These include extending the reach of terrestrial broadband coverage, providing mobile connectivity, creating resilient cellular backhaul and establishing stable, narrowband links to IoT devices, among others.

As President of the Satellite Industry Association Tom Stroup explained in a recent Constellations podcast, “We’ve seen a recognition that many of the things that are desired by 5G can only be achieved with the ubiquitous coverage that satellite networks provide.”

Evolving 5G Standards

The promise of 5G is a captivating vision for companies, customers and governments around the world who see a future where the most remote parts of the globe are connected, and traffic is handed off seamlessly in a hybrid network of terrestrial and non-terrestrial assets.

Realizing that vision at a practical level will require continued collaboration across industry participants to understand and address technical challenges as they arise. For example, 3GPP’s Release 16 did not account for issues affecting the mobility and orbital altitude of LEO and GEO satellites respectively.

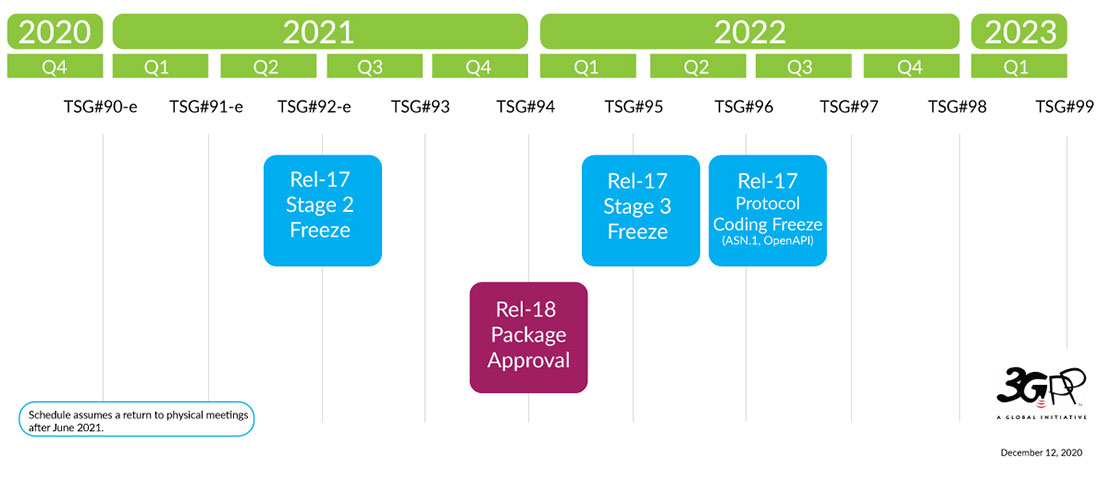

A timeline showing the dates for 3GPP’s Release 17, which included specifications for satellite 5G. (Source: 3GPP)

A timeline showing the dates for 3GPP’s Release 17, which included specifications for satellite 5G. (Source: 3GPP)

“GEOs’ altitude causes high path loss and a lengthy round-trip time; the mobility of LEOs introduces a very high Doppler offset on the radio link, and it also inevitably requires all devices to frequently change their serving nodes,” Martin Jarrold, VP of International Programme Development at GVF pointed out in a communication with Constellations. “Release 17 establishes basic mechanisms to manage these challenges.”

Unlike a regulatory body or legal authority, 3GPP operates as a system-level engineering collaboration uniting seven telecommunications standard development organizations and diverse members throughout the telecom supply chain. Specifications are proposed, tested, adopted and evolved in a consensus-based and technology-driven process.

Jorge Garcia Hospital of Hispasat is a co-chair of the Global Satellite Operators Association (GSOA) Working Group on Standardization, which is an active participant in developing 3GPP standards. In an interview with Constellations, he emphasized the importance of stakeholders providing input.

“All of them are collaborating at the same time and in the same rooms in these 3GPP working groups,” Garcia said, noting participation from satellite operators, chipset vendors, UE vendors, information and communications technology producers, application services providers, software developers and more. “This is the great thing, that we are creating a standard and collaborating among the members that need to create the technology.”

That said, deploying the technology has been a challenge for everyone involved. It has taken years for 5G services to reach roughly 25% of the population via terrestrial networks and it could take another five years to be deployed fully.

The satellite industry has faced unique challenges and longer timelines associated with developing and deploying on-orbit infrastructure. Moreover, the technical specifications for satellite networks are still relatively new. It wasn’t until Release 16 (2020) that 3GPP began studying and specifying New Radio (NR) access technology standards to support wider signal bandwidth and improve integration with satcom systems. This prompted further exploration and development of the NR air interface and 5G waveforms, which were specified in greater detail in Release 17.

“Bringing a totally new technology to the satellite ecosystem is a challenge,” Garcia emphasized. “You cannot think that this will be done tomorrow.”

However, the work is well underway. Virtually every major satellite operator and numerous satcom vendors are actively building Release 17 specifications into their networks. Currently, most 5G-from-satellite capabilities are still undergoing testing. Industry insiders anticipate 5G capable satellite systems will be available by 2023 and 2024.

Joining the Telecom Market

While the satellite industry takes strides to facilitate the 5G rollout, it is also playing catchup with trends that have defined the modern telecommunications industry. Since 1998, 3GPP has been working to establish and improve standards and interoperability among broadband and mobile devices, operators and networks. This has helped build a $2.7 trillion global telecommunications market, only a fraction of which is held by satellite communications.

Robert Bell, executive director of the World Teleport Association, noted that the integration of non-terrestrial networks in the 5G standard “reflects a late but necessary awakening of the satellite industry to the absolute reliance of the terrestrial telecom business on standards.”

It also marks an opportunity for satellite service providers to rebalance their focus from providing proprietary solutions to a niche market to providing more integrated solutions for a mass market.

Using a standard architecture for all communications has powerful advantages in terms of cost-savings and interoperability, Bell continued. “It would be hard to imagine a greater folly for satcom operators not to adopt such a standard…”

The 5G standards present opportunities for satellite service providers to integrate into the larger telecom market. (Image: NIST/NCCOE)

The 5G standards present opportunities for satellite service providers to integrate into the larger telecom market. (Image: NIST/NCCOE)

Building 5G into networks opens a series of opportunities for satellite service providers. These range from backhaul and traffic unloading to mobile edge computing and connectivity services to mobile users on land, sea and air.

Jarrold added that the standardized ecosystem also gives end-users the flexibility to integrate satcom, “enabling true heterogeneous networks with roaming between satellite and terrestrial, providing better services over satellite, and attracting new customers that satcom does not currently serve.”

Interoperability and Software-Defined Solutions

One of the biggest advantages of standardization is it makes it easier to work with satellite operators and vendors. Mobile network operators can provide smoother end-to-end service management when their space-based partners are operating on the same standard. Moreover, satcom networks built to 5G specifications will have the benefit of working across telecom vendors and mobile network operators, as well as connecting to a variety of devices.

“In the end, what 5G allows you to do is to reach the mass market, because of the interoperability,” Garcia explained.

The benefit of reaching a mass market applies both to the pool of potential customers and greater access to materials to build the networks. In adopting 5G specifications, satellite operators and vendors can tap into a more developed, high-volume supply chain for commercial chipsets, modems and software, saving development time and costs.

The trend in the satellite industry toward standardized software solutions in place of proprietary hardware has been and remains critical to the expanding role of space in 5G. Virtual network components, software-defined payloads and the like are not only more cost-effective in the long run, they are better suited to the variable needs of telecommunications.

The transition to open ecosystems, like 5G, that are based highly on software-defined solutions has improved the delivery of flexible, scalable and easily adaptable space-based services, making it easier to deploy new capabilities and adopt new standards. As the 5G standard continues to evolve, space network managers can look forward to software updates, instead of deploying entirely new platforms.

NB IoT, Direct-to-Device and the Future of Satellite 5G

Recent headlines have reflected enthusiasm around satellite direct-to-cell services, like the Globalstar-Apple agreement or AST and Lynk Global’s cell towers in space. While the technology represents a breakthrough, even the developers admit they are still years away from supporting direct-to-cell talk and video communications.

The immediate applications envisioned for satellites under Release 17 include broader use of satellite 5G backhaul from fixed cell sites and mobile platforms, such as ships and planes. Satellite will also play a role in hybrid multiplay with terrestrial broadband as well as edge caching of multimedia content to offload terrestrial networks. Both of these applications will be important given the continued growth of video streaming and multicasting.

However, one of the most promising and potentially the most significant area of commercial satellite 5G will be in direct-to-IoT services. As the number of IoT devices exceeds 12 billion, satellite industry experts see an exciting area for direct-to-device 5G at volume.

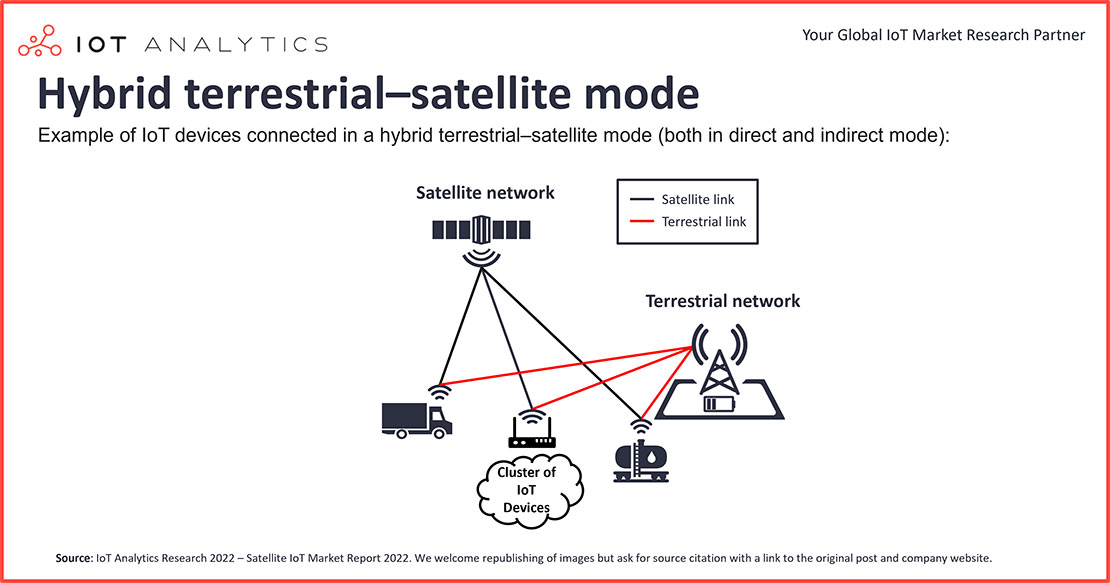

This IoT Analytics graphic shows how terrestrial and satellite IoT networks can interact. Switching from terrestrial to satellite connectivity requires two different RF chipsets embedded in the end-user device or satellite terminal. (Source: IoT Analytics)

This IoT Analytics graphic shows how terrestrial and satellite IoT networks can interact. Switching from terrestrial to satellite connectivity requires two different RF chipsets embedded in the end-user device or satellite terminal. (Source: IoT Analytics)

The narrowband (NB) IoT standard was developed earlier as part of the 5G standard set to support low-power wide area networks. The standard was developed to allow sensors and IoT monitoring devices to connect to terrestrial networks where available or switch automatically to satellite, without specialized hardware.

Satellites have a longstanding, important role in machine-to-machine communications, Jarrold noted. However, “IoT has introduced a new and greater satellite device connectivity imperative.” Satellites are uniquely positioned to cover wide swaths of the Earth, with GEOs reaching up to one-third of the globe and LEOs covering up to 8%. From that vantage point, satellite can offer shared uplink connectivity and data collection on myriad, widely dispersed IoT devices from farms and mines to shipping vessels and aircraft.

With an expanding set of capabilities and new opportunities emerging as a result of the 5G standards, satellite is well-placed to support global connectivity solutions into the future. “We will not take the market of terrestrial. Terrestrial will not take our market,” said Garcia. “It’s a total collaboration for the same purpose, and it’s connecting everything, connecting everybody, connecting everywhere.”

Explore More:

Podcast: Satellite Networks, Mobile Network Operators and Cell Service from Space

5G Outlook and Update with Tom Stroup, President of the Satellite Industry Association

Satellite Moving Closer to Telcos with Ground Virtualization, 5G

Podcast: 5G, Satellites and Connectivity Anywhere