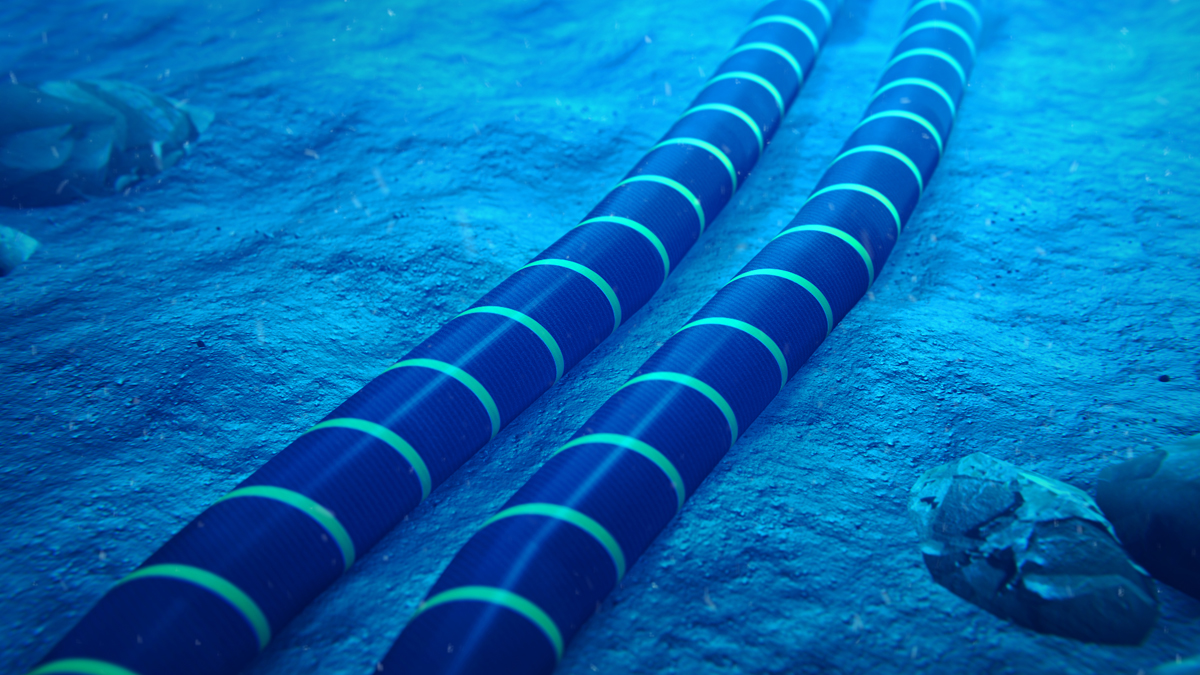

ALEXANDRIA, Va. — As much as 99% of all international data traffic is carried through the global network of submarine cables. Recent events have shown the fragility of this infrastructure and the impact of satellite backup when terrestrial connectivity fails.

Just last week, multiple undersea cables failed leaving dozens of West and Central African countries experiencing severe internet outages. Only a few weeks earlier, four undersea cables were cut in the Red Sea in what was believed to be an intentional disruption related to the ongoing conflict in Yemen. The incident affected approximately 25% of telecommunications traffic, primarily on networks in the Middle East.

These events underscored a trend that has been clear for some time. The world is not becoming a more stable place and as connectivity becomes increasingly critical for more organizations, any kind of communication outage is less and less tolerable.

To that end, a growing number of organizations and enterprises have turned to satellite as a necessary backup service. Services that were mostly used by governments, first responders or critical infrastructure providers are now seeing more widespread adoption.

Daniel Gorlovetsky, CEO of TLVTech, an Israeli software development solutions provider, said he partnered with a satellite service provider to ensure business continuity. “At TLVTech, we recognize the invaluable asset of satellite communications as a backbone to maintain connection resiliently, especially in scenarios where terrestrial networks falter due to natural or man-made disruptions,” he wrote to Constellations.

Gorlovetsky continued, “The growing complexities within the global ecosystem, coupled with an increased frequency of natural disasters and geopolitical instabilities, undoubtedly point to an escalating demand for emergency or occasional use satellite communication services.”

Irene Graham is the co-founder of Spylix, a Seattle-based cellphone monitoring company, who turned to satellite emergency services to avoid disruptions related to natural disasters and infrastructure damage. The backup capability has been important, she said, but not without its challenges. “We encountered delays in response times during critical situations, which significantly impacted our ability to maintain seamless communication during emergencies,” Graham said. She added that her experience “highlighted the need for service providers to improve their responsiveness and reliability.”

Disaster Recovery Business Always Surges After a Disaster

For the most part, the entities and organizations that need resilient communication services already use satellite today. That doesn’t mean the market is saturated, though. Following the Red Sea incident, Intelsat reported higher demand for satellite capacity, even after operators had rerouted undersea data traffic. Intelsat VP of Media and Networks for EMEA Rhys Morgan told Capacity that the company was able to implement short-term services for customers affected by the cuts, including customers seeking a secure pathway for mission critical or highly sensitive communications.

“Theres always a surge in the disaster recovery business after a disaster,” noted Robert Bell, Executive Director of the World Teleport Association. Suddenly the ability to connect becomes life and death for a business and they see the value of redundancy. However, once the disaster is over, many customers are quick to forget and may struggle to justify the added cost.

Today’s customers for satellite backup generally fall into two categories of services. In one, the customer or organization contracts for satellite services that they use throughout the year—for example, to offload regular network traffic or for secure communications. They use a certain amount per period and often pay to surge capacity when disaster strikes. Others have satellite strictly for emergencies. These tend to be short-term, more expensive contracts.

Historically, this model for providing emergency or backup satellite has created a “never-ending tension between customers and suppliers,” explained Bell. “Suppliers can’t afford to have a bunch of capacity sitting idle, waiting for the next bad thing to happen. And customers generally don’t like the idea of paying for something they’re not using.”

The situation is improving gradually, though, thanks to the increase in on-orbit capacity and growing competition among constellations, particularly in low Earth orbit. In the next few years, planned deployments of new software-defined, high throughput satellites are expected to triple on-orbit capacity in GEO. Pending the successful deployment of several commercial mega-constellations, LEO capacity could reach 180 Tbps by 2026. Greater capacity on orbit combined with the digitization of ground systems are expected to further reduce the cost of satellite bandwidth, which has been on a steep decline in recent years.

“With cheaper capacity bandwidth, more enterprises or organizations could be willing to pay for backup capacity in the future,” said Dimitri Buchs, Managing Consultant at Euroconsult. He cautioned that those opportunities may be relatively limited, since most service needs are already likely being met.

“I don’t think it’s going to become a booming market,” he added. “It’s more opportunistic. And if capacity prices continue to decrease, it might lead some smaller companies with lower financial capabilities to start using satellite.”

Advantages of Digitization and Cloud

Some may argue that there is nothing new under the sun when it comes to disaster recovery or emergency satellite backup services. But just as new technologies on orbit are improving bandwidth availability and cost, the digitization of the ground segment is beginning to make satellite services easier to deploy and more valuable in emergency use scenarios.

A new model that could support faster emergency satellite backup deployments was demonstrated this week at Satellite 2024 by Kratos and Amazon Web Services (AWS) Kratos. Rather than installing racks of hardware at the gateway, a satellite operator or network manager can “spin up” virtual modems and other virtual network functions using the cloud and generic server equipment. The end user only needs to request the service for the link to be established between the satellite, the gateway and a small edge device on site. “It’s basically showing, when you need that backup because your terrestrial link goes down, you fire up the instance in AWS and you establish the link on the satellite as backup,” said Thomas Muller, Director of Commercial Satcom Solutions at Kratos.

Shifting from hardware-centric to virtual capabilities is also expected to improve pricing options toward the “pay-per-use” model used in other industries.

According to Buchs, “Digitalization, particularly through the cloud and cloud-native technologies provides really a significant advantage for emergency and occasional use cases.”

Beyond flexibility and scalability, Buchs cited the advantage of digital architectures for remote management and monitoring of satellite and ground systems. This can be critical in an emergency situation where access to affected areas may be limited or dangerous. “Emergency responders remotely configure, monitor as well and troubleshoot satellite and ground systems from anywhere with internet connection. And this ensures continuous operation and timely response.”

Finally, when satellite connectivity is enabled through the cloud and other software, it’s possible to collect real-time analytics, which Buchs said can be collected, analyzed and disseminated to positively feed real-time emergency response management decisions.

Explore More:

Podcast: SSC on Standardization, Reconfiguring the Ground Segment and Meeting Gbps Demand

Podcast: Mainstreaming Satellite, Embracing MEF Standards and Enabling Service Delivery in Minutes

Can LEO Broadband Truly Succeed in Developing Countries?

US to Spend $42B on Broadband Equity: Will Satellite Be Included?