SpaceWERX at SXSW

SpaceWERX at SXSW

Even in the best economy, entrepreneurship is a risky business, especially if you’re dealing with space. The past two quarters of market uncertainty have made it even more challenging for space startups to secure investments. Venture capital firms have been reluctant to deploy funds and when they do, they are tending to take larger equity stakes.

Given the current investment climate, the companies in the best position to weather the tight equity market will be post-revenue, with existing customers, or with a product or service that meets the needs of existing markets. The other companies in a position to thrive will be the ones who have or are seeking to build relationships with the government.

More government space spending, more funding opportunities

“When you’re operating in space, you can’t be lacking a government relationship,” Jordan Noone, co-founder of Embedded Ventures, said of the space sector in a recent Constellations podcast. “Whether its contractual growth, the regulatory side, you’re working with your government or foreign governments significantly as you grow your company.”

Noone has been on both sides of the funding equation, first, as the co-founder of the space unicorn Relativity Space and now with Embedded Ventures. Embedded Ventures is one of a class of space VCs focused on early-stage investments in dual-use companies with cutting-edge technologies for both government and private sector customers.

Over the past five years, the U.S. Department of Defense has started offering more opportunities for dual-use startups to develop and find a market for solutions with national security applications. This is particularly true of the U.S. Air Force and Space Force, which are focused increasingly on a buy versus build model.

In addition to greater openness to small businesses, DoD spending on space is set to increase by as much as 43% in FY 2023, according to Velos budget tracker. The latest version of the National Defense Authorization Act (NDAA) passed by the Senate has $28.8 billion for space across the services, excluding NASA.

In a recent webinar offering advice to startups, Eagle Point Funding director of business development Yoav Sadan strongly encouraged non-dilutive federal funding through programs like AFWERX and SpaceWERX. Without losing equity or transferring IP, companies can secure 12-24 months of engineering runway, earn credibility with other investors and build a market fit for their product. “You’re essentially getting funding to develop a product that the agency can either later help you commercialize or they can use themselves,” Sadan noted.

The following programs were developed to help the military identify commercial opportunities for national security solutions. Each has a record of providing awards to space startups and entrepreneurs on an accelerated schedule.

Defense Innovation Unit & National Security Innovation Capital

Included in the FY23 NDAA is a significant increase for the Defense Innovation Unit (DIU), which fosters the development and adoption of commercial technology for the military and typically issues contracts within 90 days. DIU was allocated $81 million for FY 2023—twice its initial budget request. That budget includes a significant increase in National Security Innovation Capital (NSIC) to $15 million. NSIC was created in 2021 as, essentially, a DoD venture capital fund. The funding is non-dilutive and aims at accelerating product development in dual-use startups while stimulating further private capital investment.

SBIR and SBTT

The space budget increase will also support DoD’s long-standing investment programs, the Small Business Initiative Research (SBIR) and Small Business Technology Transfer (SBTT), which are funded as a percentage of an agency budget. The two programs have resulted in over $14 billion in small business R&D investments over the last two decades and generated a 22:1 return on investment.

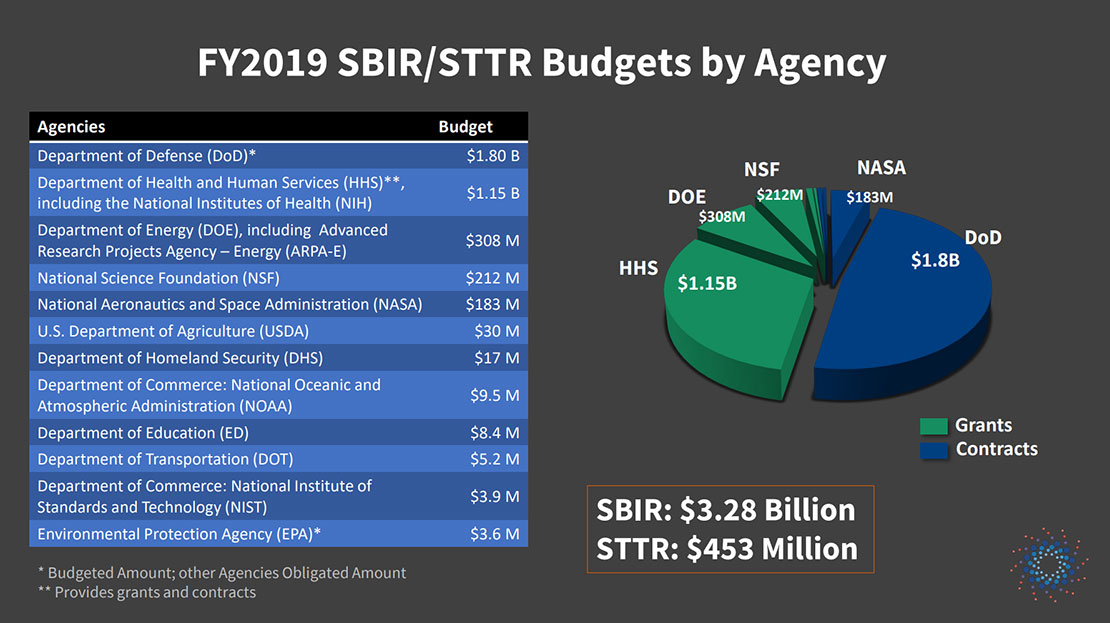

FY2019 SBIN/STTR Budgets by Agency. Credit: SBA Overview of SBIR/STTR Programs, March 2020

FY2019 SBIN/STTR Budgets by Agency. Credit: SBA Overview of SBIR/STTR Programs, March 2020

Twelve different agencies run SBIR/SBTT programs. SBIR funding is significantly more than STTR, which requires a partnership with a research institution. The Department of Defense outpaces every other department in funding for small business R&D. In 2021, DoD granted 3,365 SBIR awards worth $1.73 billion, roughly 40% more financial support than the next biggest agency, Health and Human Services.

Both SBIR and SBTT have three phases of funding for feasibility, prototyping, preparation for commercialization. Matching private investments are strongly encouraged or required by the second and third phases.

AFWERX and SpaceWERX

More recently, the Air Force and Space Force (through the Air Force Research Laboratory) adapted the SBIR model to the creation of AFWERX in 2017 and SpaceWERX in 2021. Both follow the same three-phase process but also offer a handful of more flexible, early-stage investment initiatives. For example, both offer “Open Topic” solicitations for entrepreneurs to present dual-use technologies that fall outside of specific requests for proposals. The Air Force also hosts annual “Pitch Days” where companies can get contracts up to $150,000 the same day they submit a proposal.

SpaceWERX, the innovation funding initiative for Space Force, is in an active phase of budget growth and looking for new companies to work with on various solutions for on-orbit manufacturing and propulsion to space domain awareness and remote sensing. SpaceWERX has several “challenges” and an “accelerator” program to connect entrepreneurs with DoD end-users.

In addition to establishing new investment programs and opportunities, the Department of Defense also signaled an intent to make it easier for innovators to work with the government. In February, it released a series of policy recommendations to increase competition within the space and defense industrial base and lower the barrier to entry for small businesses.

‘Chicken and egg’: Investment Begets Investment

An investment from DoD or other agencies can provide a lifeline and path to long-term success for space startups. But in many cases, the government, like a private investor, wants to see that a startup has additional support before engaging.

Noone noted it tends to work in a way that’s “chicken and egg, in an unfortunate way.” The government contract tends to open doors to private capital but the government assesses private investment when considering a company for an R&D grant or SBIR contract. Contracts beget contracts and investments beget investments.

It’s all a matter of lowering the risk of failure, explained Chris Mather, a senior consultant at Parallax Advanced Research, an Ohio-based innovation collaborative that builds strategic partnerships between government, industry and academia.

“If a VC supports a company, that financial support raises the odds of that entrepreneur solution being successful in the marketplace,” Mather said in a recent Constellations podcast. “If they've given the stamp of approval and they've been willing to invest, it really is a validation of the company and the technology.”

That has been key to the success of commercial launch sector not only in the United States, but in other parts of the world. France’s Arianespace began as a joint venture between Airbus and Safran but grew into a world leader in commercial and government launch services through the support of European governments. U.S. commercial launch giant SpaceX started with relatively modest personal and private equity investments and literally took off after securing major contracts with NASA. SpaceX’s most recent funding round in May 2022 brought in $1.5 billion.

“That’s an example that I think is not highlighted enough in U.S. government circles, where it shows the power of tipping an industry into long-term commercial success,” Noone said of NASA’s investment in commercial launch. “And there are other areas in space, there are other areas in national security right now that could turn into a commercially viable ecosystem with the right sort of influence from the U.S. government.”

Explore More:

Podcast: Investing in Dual-Use Technologies and Working with Space Force

Venture Capital Meets National Security

Podcast: Raising the Odds of Successful Entrepreneurship