Constellations spoke with Jordan Noone, Co-Founder and General Partner of Embedded Ventures, a VC-firm that invests in space technology. Noone brings a unique perspective to identifying start-ups. His background includes co-founding Relativity Space, a unicorn of space start-ups, where he saw upfront and personal how venture funding works and doesn’t.

That led him and his partner at Embedded, Jenna Bryant, to build a different type of VC firm, one focused on space technologies that are ‘beyond launch.’ Noone knows about launch too, having worked on the SpaceX Falcon 9 out of college before going on to co-found Relativity at the ripe age of 22. With a commercial rocket going up almost every day, soon, as he sees it, launch will be boring and where do you go from there?

What’s exciting to Noone is what comes after launch. That includes some defense, commercial, and revisiting opportunities that were too expensive, need reinvigoration, or are now enabled by the rapid drop in launch costs. “There's enough investment happening today in the rocket sector that we don't need to add to that,” said Noone. “You see mainstream investors moving into rockets, but you don't see mainstream investors moving beyond rockets.”

His firm’s thesis is dual use space technology beyond launch; technology that has applications in both the commercial and the government sectors, because as he sees it, it’s almost impossible to not work with both given the government’s significant presence in space. “You can't lack a government relationship, whether it's contractual growth, the regulatory side, or you're working with your government or a foreign government as you grow your company.”

An area Noone feels particularly strong about is national security, which he credits for the freedoms and liberties that have allowed him to pursue and build his career. “The national security community is now viewed sometimes awkwardly as taboo by the investment sector,” he says. He sees that as unfortunate and something that is going to be very damaging for the country if that perspective continues to grow. “People have forgotten that Silicon Valley was built on national security innovation during the Cold War. That’s something we as investors have an obligation to help build up. That's what we need to inspire if we're going to see both technological success but also national security success.”

A founder’s perspective

Noone’s experience as an engineer pitching Relativity to VCs is part of the origin story: “You’d want to tell them about this new kind of company that had never existed before, with technology that had never been applied at the scale that we wanted to develop, and they weren’t even interested in hearing it. They're like, ‘oh, that doesn't match our thesis.’ It was confusing.”

Where most investors focus on spreadsheets and looking at returns, Noone sees a bigger picture. He believes there’s a way to incentivize national security innovation and encourage investment so that with the right sort of influence from the US government it could turn into a commercially viable ecosystem.

He cites NASA’s investment in launch as an example, which ended up tipping the entire commercial rocket launch industry into self-sufficiency. “That's really where we see the role of government in these sectors, is tipping them to long term commercial success,” he adds.

The biggest challenge as he sees it, one setting the stage for the entire century, is whether national security innovation can be incentivized through capitalism more than the competition.

“We're competing on a world stage where our competition has direct control of their innovation, Noone says. “In these other countries, every company is a dual use tech company.”

Innovating with government

To bridge that gap, Embedded Ventures is now working with the US Space Force SpaceWERX through a Cooperative Research & Development Agreement, or CRADA, a non-financial arrangement to “have that open door relationship where we can talk to them and tell them what we're seeing.”

Even with a variety of government entities focused on innovation, Noone asks what if these programs miss the mark, funding stops, or appropriation ends prematurely? “Do we have time for a couple cycles of practicing on innovation? Those cycles can take 10 to 15 years to reset after issues. I would say no, we don't have 10 years to practice getting innovation into national security. We have to hit the mark and not take that risk,” he continued.

The intent of the CRADA, as Noone explains it, is bringing together how the moves that the government makes influence private capital, and how the moves that private capital makes influence the government. “They work hand in hand but unfortunately in a way that is often chicken or the egg,” he added.

Commercial investors look to place their bets on the right company to hit their pot of gold. That can mean waiting on a contract that gives them a glimmer of what could be a moonshot payoff in five years. But it’s a catch-22, “No one's going to appropriate a bucket of money until there's enough commercial traction success. And no one's funding those companies until there's money in signs of indication. So the balance between those is very slow and the CRADA opens the door between them.”

It’s complicated

But shaping and encouraging innovation in the space ecosystem is more complicated than in other technologies. Wanting venture capital to play a bigger role in funding space innovation is trickier than in say cloud computing. The challenge in the space sector, Noone says, is that it touches on so many more areas at once, “whether it's hardware, software, regulatory, or the economic side of it. And everything is extreme.”

For investors, it takes a keen understanding of not just the technology but also the right human talent to combine all those ingredients.

“You're looking for even higher top performers, the actual needs of the company, the bets you're making. If a mistake is made in a space company that isn’t caught, or the talent isn’t there to catch it, that can implode a company, affecting investor confidence and compromising all that work and billions of dollars because of a mistake,” he said.

So where is Noone placing his bets? What are his moonshots in the next five to seven years?

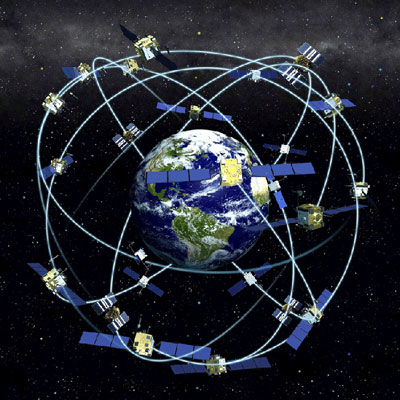

He counts among them lunar, space manufacturing, next generation telecom, the future of GPS, and more. Essentially, areas both old and new.

“Is GPS going to be a government owned system forever?” Noone asked. “There are trillions of dollars of value locked up in what could be commercial innovation. Who's going to commercialize a GPS ecosystem for that same pot of gold?”

As for lunar, Noone sees it for both economic and national security reasons. “I think national security will end up being the driver there.” Although the US is chasing lunar innovation, Noone believes it will become more and more relevant. “Which country is going to be the first to point something down at us from the moon? That'll be a big scare for us, and something that wakes up the greater community as to what other people are trying to do in space,” he said, suggesting the US is not going to fall shy of a competition on innovation.

Overall, Noone sees lots of opportunities beyond launch. Some are rapidly being commercialized or attempted, like GPS and next generation PNT (pointing, navigation & timing) and “really cool stuff in space research, space manufacturing, and space tourism.” And, he added, “a ton of activities happening in space that are going to happen at a scale never before seen.”

Click here to listen to the full interview.