ALEXANDRIA, Va. — Companies like SWISSto12, Astranis, Saturn Satellite Network, Terran Orbital, Maxar and a handful of other manufacturers have been disrupting the traditional view of spacecraft in geostationary orbit with smallsats that can be deployed on a fast timeline and at a fraction of the size, weight and cost of traditional GEOs.

It may be too early to call it a trend, but satellite operators are intrigued with small geostationary satellites and their potential to change how satcom services are provided from GEO.

SWISSto12 was selected by Intelsat to provide its small geostationary satellite for specialized service for media and network customers. (Source: SWISSto12)

SWISSto12 was selected by Intelsat to provide its small geostationary satellite for specialized service for media and network customers. (Source: SWISSto12)

The announcement earlier this month that Intelsat plans to deploy SWISSto12’s GEO smallsat to provide Ku-band fixed commercial satcom services was a landmark moment for the Renens-based manufacturer. The deal marked the first commercial sale of the HummingSat design, which was developed in partnership with the European Space Agency, and is up to 10 times smaller, lighter and less expensive than a traditional geostationary satellite.

In a statement to Constellations, Intelsat SVP of Space Systems Jean Luc Froeliger explained that the HummingSat “fills a gap in terms of satellite size” and “provides another tool in our deployment toolbox, together with Software Defined Satellites, C-band satellites and Mission Extension services.”

SWISSto12 CEO Dr. Emile de Rijk described the deal with Intelsat as an opportunity “to open a new chapter in the satellite communications industry.”

Will GEO Smallsats Replace GEO Giants?

The smallsat design offers advantages that would not be economically feasible using a large GEO satellite, which typically costs hundreds of millions of dollars to develop, manufacture and launch. With GEO smallsats from 400-1,700 kg, manufacturers have lowered launch costs and improved launch flexibility. Production timelines are also faster, taking around 18-24 months from design to delivery, compared to 7-10 years for traditional GEOs.

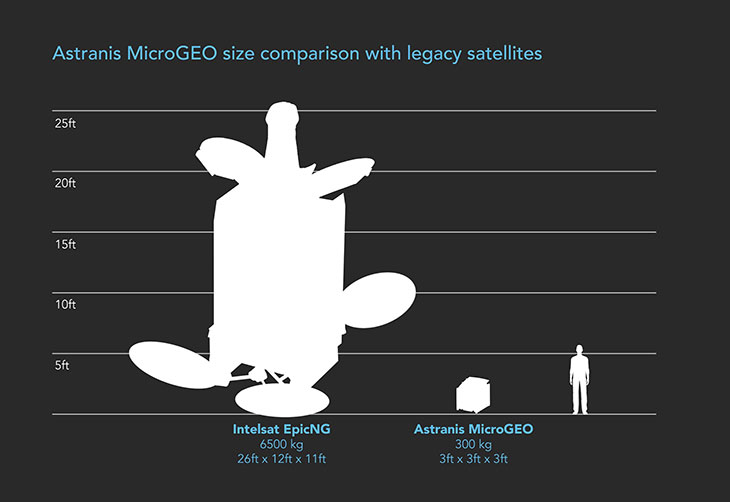

A size comparison shows the difference between Astranis’ MicroGEO satellite and a legacy GEO. (Source: Astranis)

A size comparison shows the difference between Astranis’ MicroGEO satellite and a legacy GEO. (Source: Astranis)

The lifespans of the Astranis and SWISSto12 GEOs are comparable to the 15-year service life of their large counterparts and the smallsats can offer a competitive replacement option for certain legacy GEOs that have reached end of life. However, owing to the limited space for power and transponders, small GEOs tend to compensate with narrower coverage areas or less dense beam power.

Depending on the operator’s use case, the tradeoff can be beneficial. For example, Astranis’ MicroGEO delivers as much power per beam, but has fewer than a traditional GEO satellite. That made it an ideal solution for Pacific Dataport’s (PDI) development project to deliver broadband to remote underserved markets in Alaska.

PDI Vice President of Government Affairs Shawn Williams explained in a recent Constellations podcast, “When you have a very targeted group of people and you don't have $500 million to spend on a satellite, this MicroGEO option is probably the most economical way to reach those people.”

With growing interest in the technology among satellite operators and end users, some manufacturers envision a future where smallsats replace GEO giants. Others in the industry see them playing a complementary role to legacy systems. Intelsat’s Froelinger suggested that small GEOs might replace legacy satellites but “on a case-by-case basis, depending on the demand forecast.”

In a statement to Constellations, Dr. de Rijk explained that operators are using small GEOs for different missions and business cases than they would use larger satellites, “which means HummingSats expand the span of missions and business cases that can be serviced out of GEO.”

Manufacturing Breakthroughs

Getting to the point of economic and practical feasibility for small commercial GEOs is largely a reflection of broader trends in the satellite industry. Affordable commercial launch services and software-defined payloads have made it possible, as well as advancements in manufacturing.

SWISSto12 - 3D PRINTING RADIO FREQUENCIES from SWISSto12

“Making small satellites in GEO commercially competitive is a technical challenge when you look at a figure of merit such as cost of capacity,” de Rijk said, adding that the cost of building a small satellite is not directly proportional to its size.

To keep the HummingSat compact, cost-effective and powerful, SWISSto12 has been printing 3D payloads. The company uses additive manufacturing to print complex RF systems. This process lessens the number of interconnects, resulting in reduced mass and enhanced performance. De Rijk described the unique manufacturing process as “an important enabler to the competitiveness of the HummingSat.”

Small GEO producers are also taking advantage of space-grade, commercial off-the-shelf components that have been available at a lower cost, due to the boom in LEO satellite manufacturing.

In addition to commercial satellite communications, several GEO smallsat producers have demonstrated interest in partnering with the military to deploy more resilient capabilities in geostationary orbit.

Explore More:

PDI Finds Business Model to Tackle ‘Underserved’ Markets with New MicroGEO

Podcast: MicroGEO Satellites, Software-Defined Radio and Getting the World Online

Podcast: Software-Defined MicroGEO, Integrated Ground and a Network for Rural Alaska

Intelsat’s CTO on C-Band Clearing Schedule, Satellite Transport and GEO v Non-GEO