PARIS — Satellite fleet operator Intelsat has emerged from 21 months of Chapter 11 bankruptcy reorganization, selected a new board of directors and will have a new chief executive arriving on April 4.

A little over half its $15 billion in debt was wiped out during the Chapter 11 process, leaving $7 billion. The company has received $1.2 billion in cash for having completed, on time, the Phase One C-band clearing mandated by the U.S. Federal Communications Commission (FCC). It stands to receive another $3.7 billion if it completes the job by December 2023.

That’s a lot of activity and the question now is: What does the New Intelsat want to do?

Intelsat Chief Technical Officer Bruno Fromont declined to address many big-ticket strategy issues, saying they would be decided by the company’s board and management in due course.

But on the sidelines of the Satellite 2022 conference in Washington, Fromont discussed the Cband- clearing process, the challenge of launching seven C-band satellites in a short period, and the FCC’s apparent love affair with non-GEO-orbit satellite broadband.

Intelsat Chief Technology Officer Bruno Fromont. Credit: Intelsat

Intelsat Chief Technology Officer Bruno Fromont. Credit: Intelsat

Is everything up in the air now at Intelsat or is most of the previous strategy still considered valid?

We know where we are going. There will undoubtedly be some adjustments with the new CEO and the new board. But they are well aware of what we are trying to achieve. So far I have not sensed any real push-back or change in direction.

The new board is in place and we have already had several discussions with them. Everybody’s energised and wants to move forward.

PNG has another shot, in June. But if you cannot succeed with this, will it have much affect on your plans over the Americas?

The ITU in the past has let people claim force majeure for just about anything to justify a deadline extension.

We have many filings around the globe. Let me give you some context without wanting to put into jeopardy any future investment we may make at this position. This whole thing began with a force majeure event, the failure of Intelsat 29e [in April 2019].

But we have many filings, including at that location. This is a small piece of the Ka-band spectrum. It’s a nice-to-have for us. We have contracted for four SD satellites [software-defined] and one of them is going to be going there to replace 29e and do more.

Two-satellite Airbus OneSat satellite order from Intelsat. Credit: Airbus

Two-satellite Airbus OneSat satellite order from Intelsat. Credit: Airbus

This satellite is going to leverage Ku-band frequencies to the maximum and these frequencies are secured. It is also going to rely on Q- and V-band for the gateways and we have the possibility of using some Ka. We have other Ka filings at that location that have not expired and we are very confident that we can use those.

The team was looking at the [ITU] docket and seeing some of the extensions that people got, and we decided to take a shot. We didn’t spend much time discussing it with the [ITU Radio Regulations Board], which we would do in a normal circumstance.

As for the satellite coming in 2024, this doesn’t change anything. We have plenty of frequency for feeding the satellite with traffic.

You received your Phase One C-band-clearing payment of $1.2 billion. On Phase 2, you are under a fairly aggressive satellite construction and launch schedule being imposed on you by the FCC.

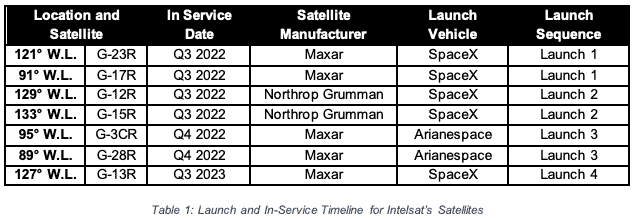

You told the FCC you were still on track to field seven satellites, five from Maxar, two from Northrop Grumman, on five launches — three from SpaceX, one from Arianespace, between Q3 this year and Q3 next year.

Maxar has had delays related to Covid-19. Are you still confident about that schedule?

This is an evolving situation. But yes, based on very recent conversations, the schedules seem fine. Everything looks OK for the launches [three of the four] by the end of this year.

The Ukrainian Antonov cargo aircraft usually used to transport satellites from the manufacturing to the launch sit is now out of service with the Russian invasion of Ukraine. What are your options?

Credit: Intelsat

Credit: Intelsat

Intelsat has ordered seven satellites and contracted for their launch on four rockets in 2022 and 2023 as part of its C-band-repurposing program overseen by the U.S. Federal Communications Commission (FCC). Intelsat has received $1.2 billion in accelerated-milestone payments and stands to receive an additional $3.7 billion if it completes its C-band transition by December 2023. The above timeline was Intelsat's schedule as of Dec. 31, 2021.

We and I guess our competitors have been working with SpaceX and Arianespace to make sure we can actually transport the satellites to the launch site. We are not talking about a big delay, but if you have to send satellites by boat it’s going to be another 10-12 days of delay.

We still have margin on the implementation side. Once we have the satellites launched we should have enough time to work with our customers. We are not worried about that.

One the ground segment side, we are working diligently to manage all the shipments to the different sites to get through to Phase Two.

So far we are good, but we are watching the launcher situation carefully. Everybody’s in the same boat right now.

Credit: Airbus

Credit: Airbus

Could the Airbus Supper Guppy be used, or is too expensive?

I don’t think it’s a question of price, it’s a question of qualification. The plane has capabilities, no question, to transport big pieces. Can it transport fully assembled satellites? I know they were working on this at Airbus.

Intelsat used to send teams to embed with the manufacturers during satellite construction. Is that still the case?

Yes, we still do that, everywhere.

So you have people who will speak truth to you about the status of the manufacturing. Particularly for Maxar, that’s a lot of satellites to produce in a short period of time.

Yes. And we have long-standing relationships with Maxar.

In fact, you saved them from bankruptcy.

We meet with them on a regular basis. They are not hiding things from us. They are very transparent. We put our heads together to solve any issues, like with the momentum wheels. But it seems like they have a plan to get everything back on track.

The Honeywell momentum-wheel issue was an industry-wide alert last year, not just at Maxar.

Correct.

Under the C-band Phase Two rules, can the FCC grant an extension beyond December 2023 if you prove that you have a satellite and a launch service contract and it’s just a matter of a few weeks? Is that at least a possibility?

One-half of a SpaceX Falcon 9 fairing returns to Earth for reuse. Credit: SpaceX

One-half of a SpaceX Falcon 9 fairing returns to Earth for reuse. Credit: SpaceX

Yes, that’s how it works with the FCC. They want to see proof of good faith, including milestone contracts and also the launcher contract. That’s something we deliver to them on a regular basis.

SpaceX has a busy manifest this year. You have two launches with them — four satellites. Is it safe to assume that SpaceX will prioritize commercial launches over its own Starlink constellation, which has a large appetite for launches?

I think so. I think Elon [Musk, SpaceX’s founder] is taking commercial slots ahead of his own launches. That has been his policy so far.

So to be clear: The FCC can extend a deadline once they are satisfied you have checked all the credibility boxes?

Yes, that’s right.

Intelsat and SES have talked about accelerating work on C-band clearing to further monetize the spectrum not with the FCC, but with individual mobile network operators. SES recently concluded a deal with Verizon on this. Is Intelsat pursuing the same thing? You’re using just as much C-band as SES.

I can’t really comment on this. What I can do is recall that we created that opportunity. I was involved in this and I know it intimately. You can be sure that if there is an opportunity, we have our eyes on it. First we need to get through the court ruling on the dispute between SES and us [SES is seeking compensation for what it alleges is Intelsat’s illegally breaking of their 50-50 Chand proceeds-sharing agreement]. That’s all I can say.

Intelsat has been talking about its own MEO-orbit constellation. How should we think of that now?

We have a pretty clear strategy internally even if we see no real need to be public about it. I have seen hundreds of business cases on my desk and I know where and how to create a sustainable business proposition — not just technically, but one that also generates revenue.

So yes, we have a clear view on the GEOLEO/MEO standings and what makes sense. We have been working on this quite a bit over the past couple of years. When we are ready to pull the trigger we will announce it. We do have some convictions regarding the respective merits of each architecture.

'GEO will always beat non-GEO on cost per bit'

We have said we consider non-GEO as a nice complement to a GEO backbone. I am convinced that GEOs will always beat non-GEOs from a cost-per-bit perspective. There is not even a question in my mind. It makes people pause when they think about that.

When you go for a non-GEO, you need to know why. You need to understand you are not doing this for the economics — otherwise, you’re wrong. It’s maybe for latency, coverage and perhaps accessing smaller terminals down the road.

We need to partition the business attributes of these different architectures. We are working diligently and we are looking at all the options. We are members of the HAPS Alliance [for high-altitude platforms]. And yes, we have a strong opinion on some of this stuff.

Credit: US Chamber of Commerce

Credit: US Chamber of Commerce

How can this be explained?

To keep pace with space innovation is very hard. Put yourself if the shoes of a regulator. It’s hard to keep track of what’s possible and what’s real and what the benefits are for the consumer.

It’s also hard to draw the lines between where they should regulate or leave people to go wild, and accept even weird projects.

The timing and the pacing is difficult. Every four years there is an ITU meeting where LEOs are a topic and you have multiple startups coming into the picture.

It’s difficult for them to have an opinion. Just a few years ago the FCC thought space was dying. Now, with a new administration, they think it’s the coolest thing ever.

So it ebbs and flows. People don’t have the technical teams or commercial skills to put their heads around all this. They are trying to get informed and do the best they can.

There is, it’s true, a dichotomy now between the scrutiny they give to a GEO market and then they OK a constellation of 10,000 satellites that may not make any sense but they are excited about it.

If you step back, there are cycles. They have not heard everyone’s story yet and there will be a reversion to the mean. Their policy will evolve. That’s my hope. It’s not easy to decide: How far do you go with regulations versus letting people in the commercial world improve and innovate?

Read more from Space Intel Report.