A Falcon Heavy rocket lifts off. (Source: SpaceX)

A Falcon Heavy rocket lifts off. (Source: SpaceX)

LONDON — “Today, we are all dependent on SpaceX.”

This is how Marc Benhamou, head of Inmarsat’s satellite and launcher procurement division, now part of Viasat Inc., summarized the current market for medium- and heavy-lift rockets.

In a June 20 presentation here to the Seradata Space Conference, a conference in which insurance underwriters and brokers are heavily represented, Benhamou described a situation that has been true for several years. And when he referred to “dependency,” he meant not just satellite owners, but insurers as well.

It has been exacerbated since early 2022 by the removal of Russia’s Soyuz rocket from the commercial rotation following the Ukraine invasion.

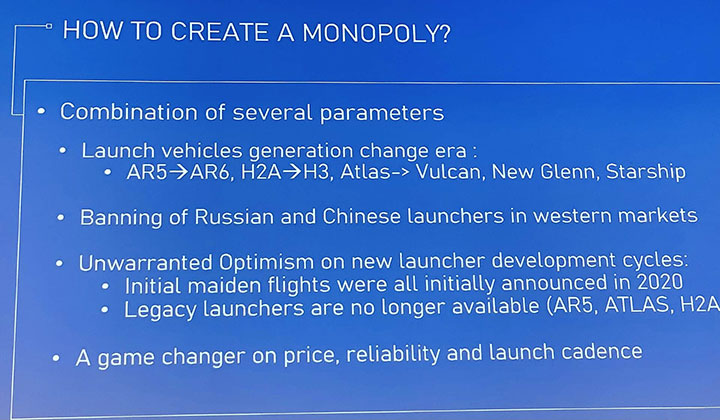

(Source: Viasat/Inmarsat)

(Source: Viasat/Inmarsat)

For satellite operators, it’s an uncomfortable situation to be hostage to a single supplier, even one as reliable, and who launches with such frequency, as SpaceX.

Viasat is one of those operators. With Europe’s Ariane 6 rocket unlikely to make its inaugural flight before early 2024, and then only in its lighter version, Viasat was obliged to pull its Viasat 3 Asia-Pacific satellite from the Arianespace manifest.

The second Viasat-3 is scheduled for launch later this year aboard a United Launch Alliance (ULA) Atlas 5 vehicle. Viasat would like to launch the final Viasat-3 model, likely to weigh 6,000 kilograms at launch, in 2024.

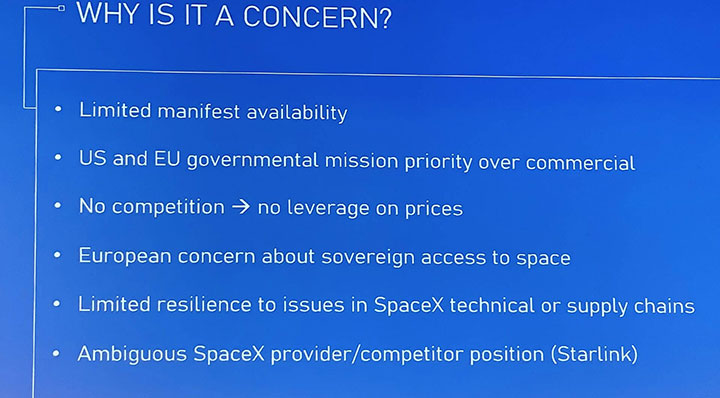

(Source: Viasat/Inmarsat)

(Source: Viasat/Inmarsat)

India’s GSLV Mark 3 has still not yet ramped its launch rate and is mainly devoted to Indian national satellites, and would be hard-pressed to lift a 6,000-kg payload to geostationary transfer orbit.

A new generation of medium- and heavy-lift rockets is on the way, but they are not yet qualified for flight. Japan’s H3, the Ariane 6, ULA’s Vulcan and Blue Origin’s New Glenn will provide relief from the all-roads-lead-to-SpaceX situation.

But when? And with Amazon’s Kuiper constellation of broadband satellites having made bloc purchases of Ariane 6, Vulcan and New Glenn launches, how much latitude will operators have?

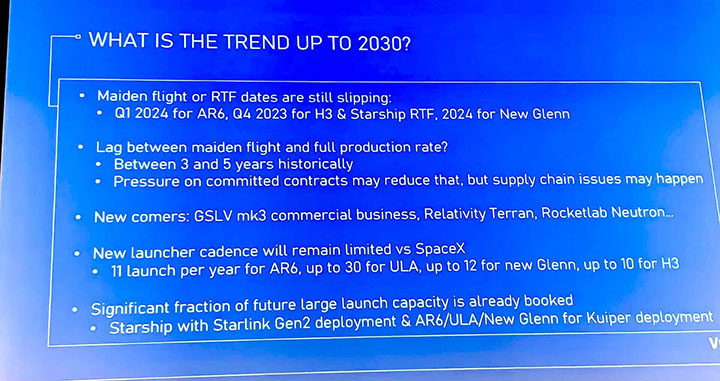

(Source: Viasat/Inmarsat)

(Source: Viasat/Inmarsat)

The answer: Very little until perhaps 2027 or 2028, when the pressure on these vehicles’ manifests will start to ease — assuming that these rockets are in service in 2024 and that Kuiper is on time.

Benhamou said Viasat continues to scout market possibilities for the third Viasat-3, but there appears to be no alternative.

Like most everyone else in the industry that looks at SpaceX, Benhamou’s remarks were a mix of trepidation and admiration.

“Rocket science is still rocket science,” Benhamou said of the delays encountered by Ariane 6, H3, Vulcan and New Glenn. “But on the other side, SpaceX is doing amazingly well. It poses a real question for other operators.

“[SpaceX] is the game-changer. Who would have thought we could see SpaceX launch 100 times per year,” Benhamou said. “We are all impressed. But if there is a launch failure at SpaceX that grounds them for several weeks, there would be a cascading impact on everyone.”

Commercial satellite fleet operators have gone for several decades with a launcher supply that gave them significant negotiating room. For the first time, they are now obliged to accept whatever price SpaceX charges.

“Having no competition gives them price leverage. SpaceX increased their prices significantly last year, and if tomorrow they do the same thing, no one will be able to push back on that.”

And not one of them is insured. Starlink satellites here are ready for launch on a Falcon 9. (Source: SpaceX)

And not one of them is insured. Starlink satellites here are ready for launch on a Falcon 9. (Source: SpaceX)

For satellite insurers, there are no premiums unless there are launches. A large portion of their current premium income is coming from SpaceX. But SpaceX’s main customer in the past year has been its own fleet of 4,000-plus Starlink satellites, which are not insured.

And what happens if SpaceX one day were to decide to refuse to launch a Starlink competitor? The UK and US governments put their thumbs on the scale to encourage SpaceX to launch the final OneWeb satellites, grounded because they had been booked on Russian Soyuz rockets. And what if Amazon’s Kuiper faces substantial service delays because one of the three new, untested rockets it has selected fails?

Insurers attending the conference were treated to multiple speaker graphics showing the sharp growth in the space sector. But the percentage of insured satellites is dropping, thanks in part to SpaceX Starlink.

Benhamou left his audience with what some might see as a nightmare scenario: A super-heavy-lift rocket that launches at high frequency, and at prices so low as to be difficult to believe.

“Starship is the elephant in the room,” Benhamou said.

Read more from Space Intel Report.