Viasat will not replace the Viasat-3 Americas satellite, but will use third-party capacity and its newly acquired Inmarsat assets to compensate for the 90% loss of capacity on the satellite. (Source: Viasat)

Viasat will not replace the Viasat-3 Americas satellite, but will use third-party capacity and its newly acquired Inmarsat assets to compensate for the 90% loss of capacity on the satellite. (Source: Viasat)

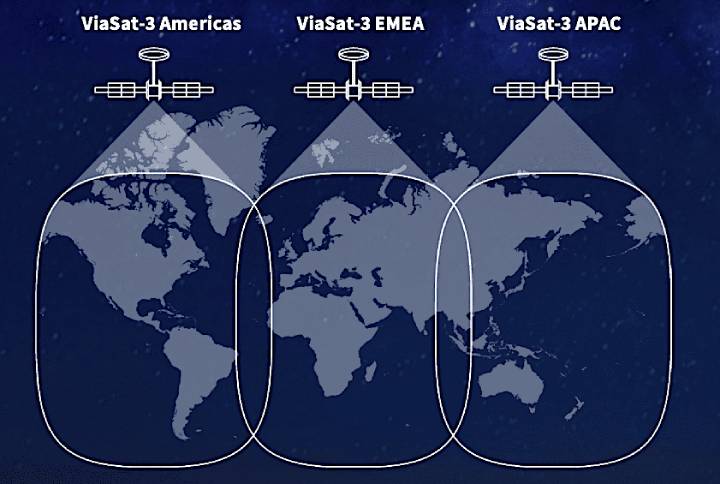

SINGAPORE — The Viasat-3 Americas satellite has definitively lost more than 90% of its expected terabit-per-second of throughput but Viasat Inc. has concluded that capacity it has leased from third parties, plus fleet additions from its Inmarsat acquisition, will mean the satellite will not be replaced.

In an Oct. 12 note to investors, the company said it would be filing a claim for the loss by the end of the year, but did not say whether it would be for the full $420 million in coverage given that some minor portion of the capacity can be salvaged and will be put to use.

Viasat also said the I6 F2 satellite, which was launched only just after the May Inmarsat acquisition and failed before entering service, would be the subject of an insurance claim, also to be submitted by year’s end. It is insured for $348 million and the clear suggestion is that this will be a total loss.

Viasat said this satellite, built by Airbus Defence and Space and carrying a large L- and Ka-band payload, would be replaced.

The Oct. 12 statement said a company reassessment of its Inmarsat-enlarged fleet and of how it could make use of the two Viasat-3 satellites yet to launch — one planned over Europe, the Middle East and Africa, the other over the Asia-Pacific — has resulted in better-than-expected news for Viasat’s positive cash flow, which is now expected to return sustainably in H1 2025 rather than H2, as previously estimate.

In addition, the expected synergies from absorbing London-based Inmarsat will result in $80 million in annual operating expense savings and $110 million in annual capex savings starting in fiscal-year 2025. Earlier assessments were that this would phase in over three years.

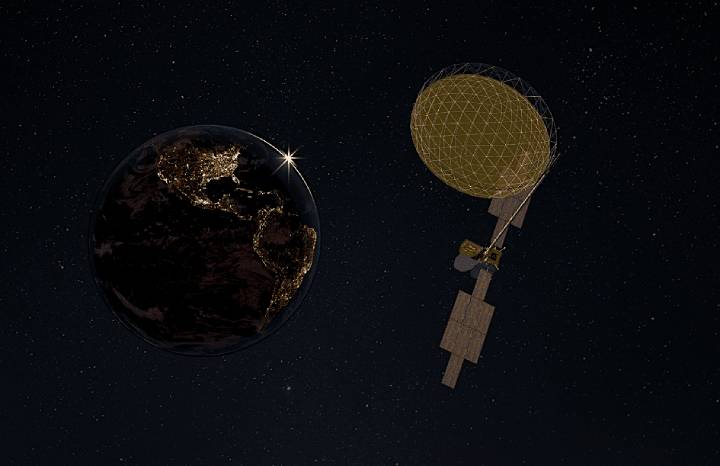

The Viasat-3 Americas satellite as its 18-meter-diameter antenna was supposed to deploy. (Credit: Viasat)

The Viasat-3 Americas satellite as its 18-meter-diameter antenna was supposed to deploy. (Credit: Viasat)

None of these figures include the up to $768 million in insurance claims, a sum that by itself will all but certainly cause the global commercial space-insurance market to report a substantial loss for the year. Space insurance premiums are expect to total between $550 million to $600 million, according to insurance officials.

The update did not specify when the second Viasat-3, intended over EMEA, would be launched. Unlike the third, this one includes the same 18-meter-diameter deployable mesh antenna, built by Northrop Grumman Astro Space, which has remained stuck in a partially deployed position despite delisted several months fo efforts to shake it free.

Viasat Chairman Mark D. Dankberg told the World Satellite Business Week conference in Paris on Sept. 13 that the company had “a pretty good understanding of what the cause was. The antenna provider does expect that that will be remedied on the second satellite. The third flight is a different antenna, unrelated to that.”

Among the over unknowns is whether the two other Viasat-3 models will be placed in different orbital slots in geostationary orbit to help compensate for the loss of the Viasat-3 Americas, which was expected to buttress Viasat’s in-flight-connectivity business.

Read more from Space Intel Report.