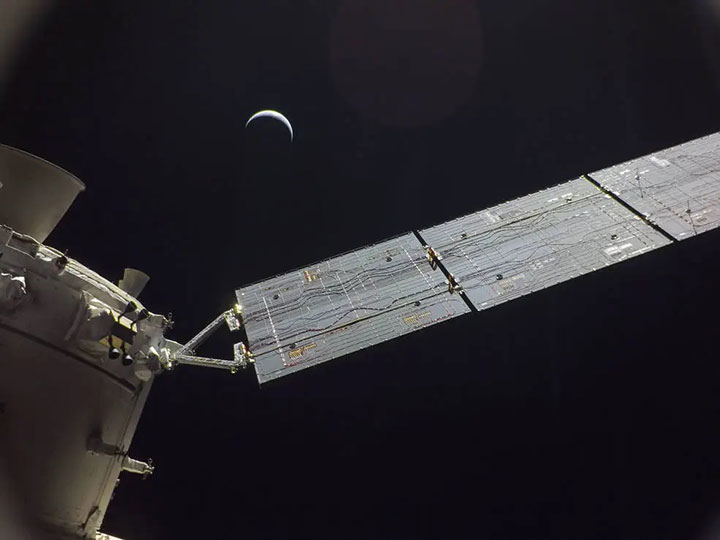

The Orion spacecraft for the Artemis I lunar return mission takes a photo of itself with the moon as a backdrop. (Source: NASA)

The Orion spacecraft for the Artemis I lunar return mission takes a photo of itself with the moon as a backdrop. (Source: NASA)

ALEXANDRIA, Va. — The investment climate over the last 18 months has been difficult, to say the least. After the enthusiasm of 2021, venture capital flows into the space sector dropped by more than half the following year. Yet, despite the challenges, some investors remain eager to take a risk on space technology companies that can turn a truly out-of-this-world vision into a reality on the ground.

Those are the kinds of companies that appeal to Type One Ventures, an early-stage, space and deep tech venture capital fund founded in 2019 and headquartered outside Los Angeles, Calif.

Type One’s fundamental mission is to invest in the technological evolution that will define humanity over the next 100 years—which is not to say it’s waiting for the next century for returns. “We have a vision for 50-100 years. We’re investing in 10-year lifecycles,” explained Type One Ventures Founding Partner Tarek Waked. The fund typically looks for returns in the traditional 3-5-year timeframe.

The VC has made its mission clear from its very first investments in Orbit Fab, the designer and builder of “gas stations in space,” and the in-space manufacturer Made in Space. Orbit Fab recently closed a $28.5 million Series A funding round and has secured several DoD contracts, a contract with Astroscale to refuel its satellite life extension spacecraft. Made in Space was acquired in 2020 by space infrastructure provider Redwire, which currently has a $187 billion market valuation and multiple government and commercial contracts.

In addition to space technology, Type One has diverse investments in robotics, biotechnology and health care, AI, nanotechnology and advancements in mobility and transportation.

A Big Vision with a Practical Roadmap

When looking for the right match in the space sector, Type One tends to focus on startups that are inspired to advance humankind through technology and have a stepwise approach to achieving it.

“What I like to see in a company is a big vision that moves the needle in some way, shape or form but has bitesize ways to achieve that mission,” Waked explained. “What gets me excited is seeing founders think far ahead but also understanding what are the things they’re going to need to do.”

Type One’s investment in Gravitics typifies its approach. In November 2022, Waked and his team led a $20 million seed funding round for the Seattle, Wash.-based company building LEGO-style space station modules. The company has a big vision of building and designing the infrastructure to support human life in space. It is also pursuing that mission against the backdrop of the 2030 decommissioning of the International Space Station, early fundraising success by private commercial station providers, like Axiom Space, and a growing number of emerging national space agencies seeking an on-orbit presence.

In assessing this off-world market, Waked saw Gravitics filling a need within the supply chain to meet the demand for space station capabilities expressed by commercial players and funded by government initiatives.

“We’re looking for things that are required in the industry—the ‘needs to have,’” Waked explained, which could mean proven technology for existing markets or markets that will likely take shape in the future.

Bringing Space to Earth Markets

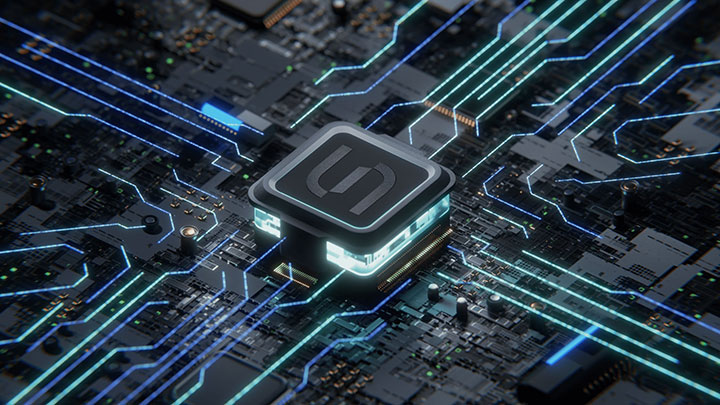

Type One is also interested in the potential for manufacturing materials in space to serve existing markets on Earth and build a stepping stone to a more developed space-to-space market. In 2021, it joined World Fund in a $10.2 million seed round for Space Forge, a startup from Cardiff, Wales, that is designing a space platform to fabricate high-value materials that can be used in semiconductors, fiber optic cables and pharmaceuticals.

The work being done by Space Forge will “impact positively an existing trend terrestrially,” Waked said, referring to the expanding market for highly efficient microprocessors. Terrestrial demand is being fueled by the growth of the electric vehicle market, advanced computing and geopolitical tensions that have prompted government initiatives around sovereign chip manufacturing. “We’re trying to onshore semiconductor production,” said Waked. “Well, we can above-shore that as well and…have a technological edge by manufacturing semiconductors in space.”

Space Forge closed Europe’s largest ever seed round for a space tech company in December 2021. The company’s business model is built around manufacturing materials in space and returning them to Earth without the use of an ablative capsule. (Source: Space Forge)

Space Forge closed Europe’s largest ever seed round for a space tech company in December 2021. The company’s business model is built around manufacturing materials in space and returning them to Earth without the use of an ablative capsule. (Source: Space Forge)

Space Forge recently expanded their U.K. operations to the United States and has seen interest from U.S. government and commercial customers. Despite losing its first satellite, ForgeStar-0, in the Virgin Orbit launch failure earlier this year, the company is preparing to launch the ForgeStar-1A on the Transporter-10 mission in early 2024.

Type One also joined a $12 million seed round for Lunar Outpost, which focuses on advanced technologies with Earth and space applications. The company is building and launching a lunar rover and has tens of millions of dollars in existing contracts for terrestrial applications of their lunar-class tech.

Hubble Network is another investment with the near-term terrestrial vision of connecting any Bluetooth device to its LEO constellation using proprietary antenna technology.

Space Investment on the Rebound

Despite the challenges of high interest rates and inflation impacting labor and material, the global space industry grew at 8% CAGR in 2022 and total private equity investment in space topped $232 billion over the last decade.

Analysts are also tracking a rebound in space investments during the first half of 2023, particularly for companies seeking early-stage funding. Even with tight capital, the number of seed deals increased 55% over the recent 18-month downturn, according to Seraphim Capital.

Government space budgets have also lent a hand in stabilizing the industry. Global funding for space exploration hit $26 billion in 2023, according to Euroconsult. Global military space budgets exceeded $54 billion in 2022, growing 20% from the previous year and led by U.S. spending.

Waked acknowledged the macroeconomic situation has impacted investors and led to slower capital flows. “We’re seeing that that pick up a bit,” he added. The slowdown did not stop the VC from pursuing its long-term vision, as demonstrated in its investments during the period.

Looking ahead, Type One plans to continue directing funds at pre-seed, seed and Series A space and deep tech startups. It will also continue to participate opportunistically in growth rounds, particularly as its companies seek follow-on investment.

One piece of encouragement Waked had for founders pitching his VC is not to water down their big vision. “Something that I see folks doing is trying to say what they think an investor is going to want to hear and bringing it back to the point of ‘show me the practical stuff.’ That’s what people think investors want to hear.” While that is what some investors want to hear, ultimately, it’s the humanity-shaping concepts that motivate Waked and his team.

Explore More:

Podcast: Space Investors, the Emergence of ChatGPT and the First Open-Source War

Which Satellite Markets Need a Reality Check?

Report: Commercial Partnerships, Lunar Initiatives Driving Space Exploration Budgets

Podcast: Building in Sustainability, Cislunar Infrastructure and Furthering Exploration