Originally published by Northern Sky Research on December 21, 2023. Read the original article here.

The commercial space station market is seeing huge investments lately that raised quite a lot of interest in orbital space travel. Sierra Space recently raised USD290 million to support the development of its Dream Chaser vehicle and Orbital Reef space station, and Axiom Space has received a USD350 million investment to develop its own space station.

These are not easy to close and some players struggle to secure enough capital to support their activities and maintain their schedules. Indeed, earlier this year, Northrop Grumman cancelled its plans to develop its own commercial space station and instead joined the Starlab space station, led by Voyager Space, and Axiom Space’s Ax-3 mission might be delayed to avoid clashing with another launch. These issues bring up the question: What is the future of the orbital space travel and tourism market amidst commercial space station delays?

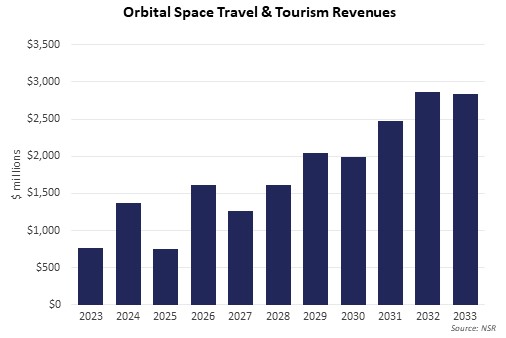

NSR’s Space Travel & Tourism Markets, 5th Edition report forecasts more than 450 passengers to fly to orbit from 2023 to 2033, generating more than USD19.5 billion in cumulative revenue during the same period. Government agencies drive the majority of the orbital travel activity by paying for commercial launch for their astronauts. At the same time, commercial launch service providers (LSPs) are developing crew capabilities to support government programs as well as NASA’s plans for deorbiting the ISS and also fly private astronauts.

Exorbitant orbital travel prices limit the opportunity

Currently, SpaceX, Roscosmos, and the Chinese are the only options for people to reach orbit, with SpaceX leading in terms of the commercial opportunity. It is government demand that dominates this market with their deep pocket that can sustain the high associated with orbital space travel costs.

NSR has estimated the average ticket to orbit cost is USD63 million, which indeed limits the commercial market adoption. The prices for this market have been set by the high costs associated with launch, reduced somewhat via SpaceX’s development of Crew Dragon, through subsidy and support from NASA’s Commercial Crew Program (CCM). NSR expects further price reduction to take place as Boeing’s Starliner, Sierra Space’s Dream Chaser and Blue Origin’s New Glenn vehicles launch before 2030 and increase the supply of vehicles that can reach orbit. These prices might drop again after 2030, if the ISS is retired and commercial space stations start competing head-on to take its place.

Commercial launchers and space stations delays impact

NSR forecasts at least one commercial space station to be operational by 2030. Even if it is delayed and private missions are limited, the government sector has the ambition and the drive to support the remaining LSPs. For example, NASA continues to support the development of Boeing’s Starliner regardless of the consistent delays the program has experienced since it was started. The rationale is for NASA to have several vehicles to reach orbit and meet its ambitious human space flight program goals, which set its sights on going back to the Moon and then set foot on Mars in less than 10 years. And for that, it needs several launchers to get there.

NSR’s first 7 of its 10-year forecast expects more than 200 passengers to be served generating almost USD11.5 billion in cumulative revenue, which will be split amongst a few players. Therefore, in this case, the orbital space travel ticket prices would remain fairly fixed, given the lack of competition and the expectation that space agencies will also be in line to get their astronauts up to orbit.

The Bottom Line

The orbital space travel market is mainly driven by government support and programs, as commercial players vying to launch astronauts require huge amounts of funding to attract more price-sensitive private astronauts. Some commercial players might not secure enough funding and hence their space stations might be delayed or cancelled, which would limit the number of private astronauts that will be served and keep space travel ticket prices almost fixed.

Fortunately, this market will keep going as governments are likely to move on with their space travel plans to orbit and beyond, by supporting the operational LSPs for their astronauts’ travel to space, while we wait for commercial space stations to eventually host astronauts in their orbital facilities.

Originally published by Northern Sky Research on December 21, 2023. Read the original article here.