Originally published by Northern Sky Research on November 16, 2023. Read the original article here.

On October 13th Qatar Airways announced a collaboration agreement with Starlink for the roll out of a complimentary high-speed, low-latency Internet service. Other airlines had previously partnered with SpaceX including JSX, Hawaiian Airlines and airBaltic. However, the new agreement is significant not only because Qatar Airways is the largest airline to partner with SpaceX so far, but also because it ranks among world’s top and is considered world’s best for business-class travel. Thus, the success level can mark an inflection point for the expectations and prospects of non-GEO, low-latency in-flight entertainment and connectivity (IFEC).

Global network meets global user

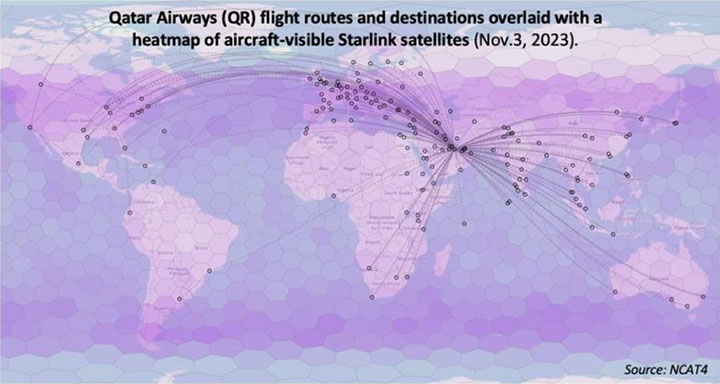

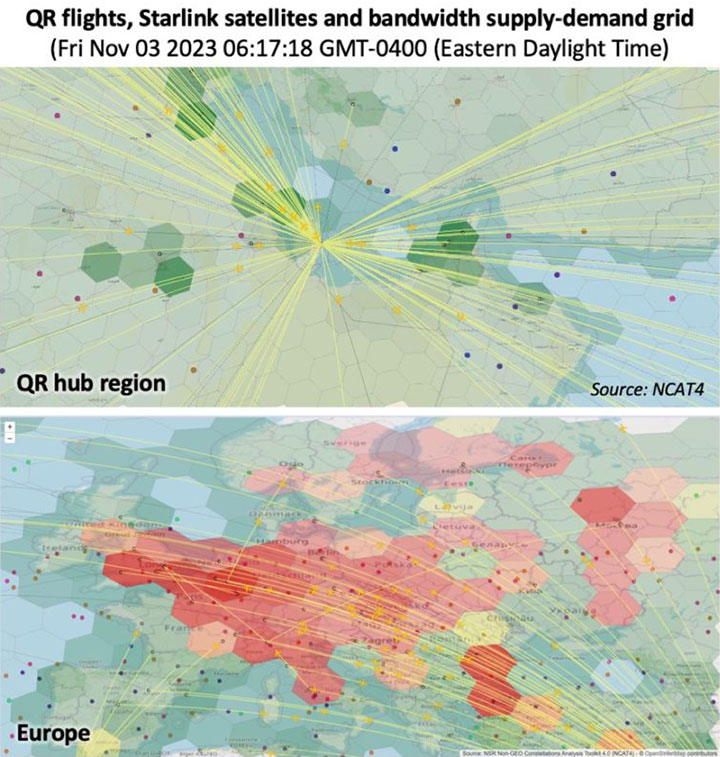

Overlapping Starlink’s network of ~4,700 operating satellites with Qatar Airways’ flight routes connecting over 160 destinations present a good case for analysis. This article leverages NSR’s Non-GEO Constellations Analysis Toolkit 4.0 (NCAT4) to measure Starlink’s ability to meet the capacity demand and service quality of a global airline known for prioritizing the passenger experience.

Before digging into the Qatar Airways case (hereafter referred to as QR, its IATA code), it is worth noting that a wave of airlines partnering with LEO players should not be surprising because LEO broadband constellations have no choice but to aggressively target aero and other mobility markets. The reasons include:

- Thousands of satellites orbiting at low altitudes produce high levels of frequency-reuse ‘spotbeam’ HTS capacity, but LEO satellites’ limited visibility of the Earth’s surface constraints addressability for the produced bandwidth.

- Addressability limitations are compounded, but the fact that rural settlements -targets of fixed-broadband and wireless backhaul via satellite – are collectively scattered across a rather small portion of the Earth surface.

Due to these reasons, and while other industry observers initially downplayed Starlink for mobility (labeled as “built for residential broadband”), the NCAT white paper in early 2022 stressed that LEO operators would “absolutely need to target fixed-data and mobility markets simultaneously to maximize addressability and fleet-wide fill rates”.

LEO constellations also count with inherent technical advantages for IFC that go beyond reducing link latency and extending connectivity to high latitudes. Densified LEO networks like Starlink provide the aircraft antenna with choice to connect to several (often many) satellites, each with different look angles. This characteristic can support the elimination or mitigation of common IFC challenges such as excessive antenna weight and drag, “skew-angle” spectral-power limitations and tail shadowing.

IFEC supply & demand simulation through NCAT

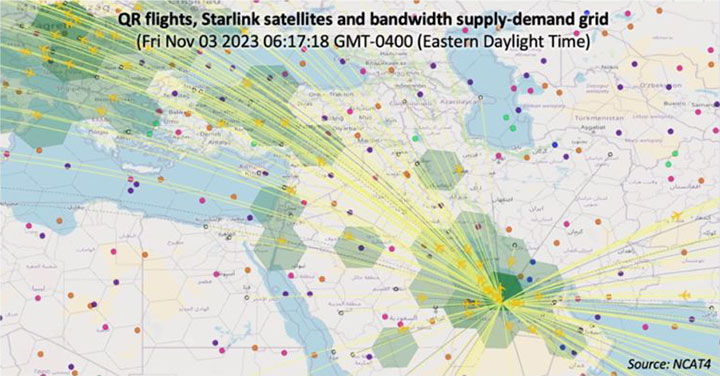

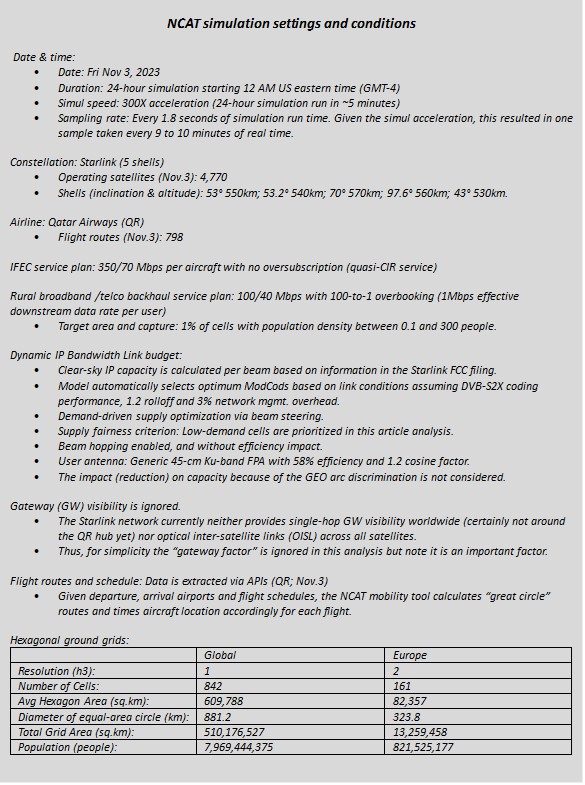

NCAT4 allows users to conduct global, regional, and country-level analysis of non-GEO constellations’ metrics and performance. The NCAT database is updated quarterly with constellation and satellite data derived from FCC/ITU filings. Orbital readings for operating satellites and commercial flight routes are updated daily via APIs (tens of thousands of records refreshed every day). These datasets allow the NCAT mobility tool to calculate and propagate the location of satellites and airplanes with great precision. Toolkit users can thus assess constellations’ performance dynamically, based on flight schedules, visible satellites, and definable time spans.

The NCAT frontend web application utilizes the mentioned server-provided datasets to run (two steps):

- Clear-sky IP throughput characterization per satellite beam for the selected constellation shell/s (IP throughput tool). Characterization is performed by the NCAT server on each shell, beam and antenna look angle.

- Supply and demand calculations for satellite in-flight connectivity (IFC) based on beam efficiency and user-selected commercial airlines and airport/s.

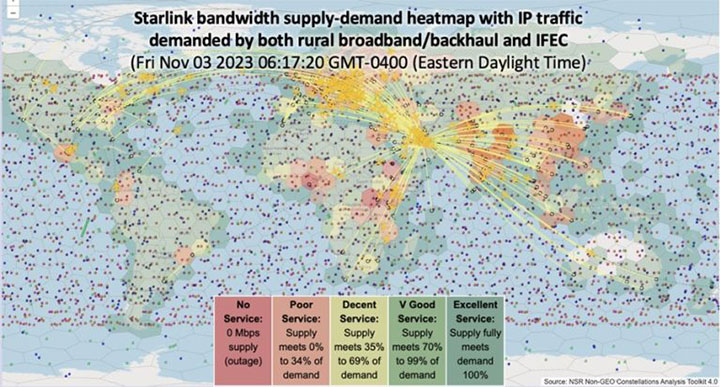

Driven by user-defined inputs and selectors, NCAT calculates constellations’ ability to meet bandwidth demands. Calculations are performed at the maximum possible sampling rate based on settings, angle and distance between aircraft and satellite. Results dynamically drive a supply-demand “heat map” analysis mapped on hexagonal ground grids.

The conditions and NCAT assessment results described below focus on the hypothetical case of Starlink’s current satellite constellation servicing the entire QR fleet.

Scenario 1: Qatar Airways (QR)

Scenario 1: Qatar Airways (QR)

The first assessment conducted for QR assumed IFC in isolation of any other source of bandwidth demand. This assessment clearly indicated that the Starlink network has no problem in meeting the bandwidth demand of all QR flights, based on the listed assumptions. Assuming 350 Mbps (downstream) per aircraft, the amount of capacity that the Starlink network can currently provide exceeds QR’s bandwidth demand, independently of the number of flying airplanes, the boundaries of any ground cell, and time of the day. Even around QR’s Doha hub (Hamad International Airport) satellite bandwidth supply exceeds demand. Simulation assumes 350 Mbps of downstream capacity constantly demanded by each flying aircraft. Note that the PR mentioned “gate-to-gate” connectivity, but NCAT currently simulates demand for flying airplanes.

Scenario 2: QR combined with rural broadband /backhaul

Scenario 2: QR combined with rural broadband /backhaul

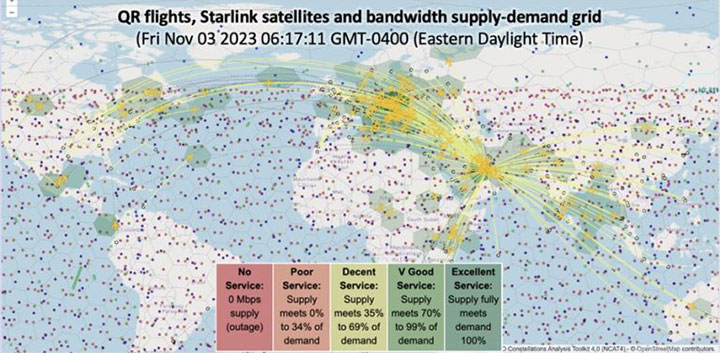

Simulation results differ considerably when assessing the performance for IFC in combination with global demand by fixed and wireless broadband terminals in rural areas. As can be seen in the global map, QR’s flight routes over Europe and other regions can experience bandwidth bottlenecks. Simulation assumes that Starlink has access to all markets and attempts to deliver an effective data rate of 1 Mbps for 1% of the global rural broadband/backhaul market.

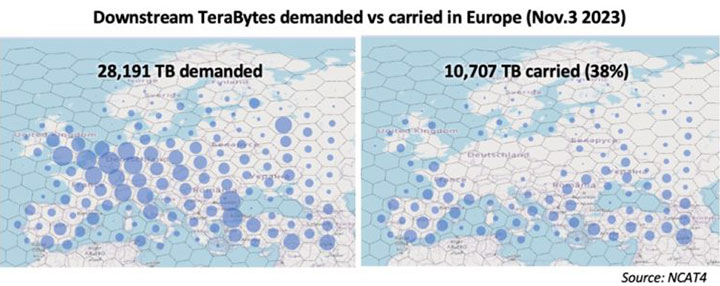

By using the NCAT downloadable data with simulation results for all cells, it is seen that for the 24-hour simulation, bandwidth demand in several cells across Europe suffer from network congestion. Starlink satellites have steerable beams, so, under IP traffic congestion, the specific cells that experience service degradation or outages are managed by the orchestration system. In the NCAT simulation settings, low-demand cells are prioritized over high-demand cells.

Supply and demand adjustment variables

Supply and demand adjustment variables

In LEO broadband constellations, congestion instances can be specific, both in terms of location (ground cells) and time of the day. Spectrum is a scarce resource, so independently of the number of satellites launched and spectrum bands used, satellite networks need to implement bandwidth management strategies to administrate IP traffic congestion.

Traditional satellite network operators and service providers focused on enterprise users often differentiate themselves based on how well they manage bandwidth to meet customer expectations. This will be no expectation for LEO broadband, even in the context of an ever-increasing number of orbiting satellites. SpaceX tends to favor a rather “net-neutrality ISP model” to both residential and B2B markets, but the throw-bandwidth-at-the-problem approach has limitations due to the mentioned LEO addressability constraints relative to MEO and GEO systems. Starlink’s latest fair-access policy indeed recognizes the need to manage bandwidth congestion through rate limiting, based on subscription plans and market segments.

Looking forward, as both country authorizations and network size continue to grow, Starlink will have more room for differentiated services as it targets residential and B2B users. It is possible that Starlink will put more emphasis on traffic prioritization and QoS. Being Ku-band on the user end, at some point in the network maturing process Starlink should be able to handle strict SLAs, including CIR-denominated IFEC services like those offered by Intelsat Gogo and Anuvu. However, Starlink’s strength will likely hinge on the opportunity to maximize QoE (quality of experience) across different target markets. This is because traffic prioritization achieves optimum perceived results (tradeoffs) when under the simultaneous presence of high-volume, best-effort (i.e., residential) and low-volume, high-profit (IFEC, defense, etc.) IP traffic patterns. A key player mastering such approach over GEO satellites is ViaSat.

Local pricing is another adjustment variable to maximize network reward and user satisfaction when in the presence of spots of network congestion. NSR anticipated in early 2021 that we could see a more pronounced departure from region- or even country-level pricing for satellite capacity, as ultra-local supply/demand dynamics and pricing power could modulate pricing. During 2023, SpaceX indeed modified Starlink subscription prices based on service availability in specific locations.

The Bottom Line

Despite LEOs’ virtues (and need) to target mobility markets, it is a fact that aero connectivity is characterized by high switching costs and complex, sophisticated ecosystems; so, market shifts take years. QR itself mentioned in the PR that it initially seeks to add Starlink “onboard specific aircraft and routes”. However, the announcement is sure to be followed by more involving airlines, non-GEO satellite operators and specialized IFC service providers.

As calculated and visualized through NCAT tools, even mega-constellations face constraints to meet the bandwidth demands of high-end business segments like aero, when under other sources of bandwidth demand. Growing the number of satellites may alleviate but not solve bottlenecks, so it is possible that SpaceX will sophisticate Starlink’s bandwidth management and QoS to meet high-end user expectations.

Originally published by Northern Sky Research on November 16, 2023. Read the original article here.