Originally published by Analysys Mason on June 6, 2025. Read the original article here.

"Satellite operators and vendors in Europe must balance new revenue opportunities against funding and agility challenges, which have slowed the pace of space infrastructure developments in the past."

European space infrastructure activities are accelerating, driven by shifting geopolitics, a diversifying market landscape and increasing demand among governments in Europe for sovereign solutions.1 These trends dominated conversations at the Smallsat Europe conference in Amsterdam in May 2025, with further discussions focusing on satellite constellations, as well as new launch and propulsion options.

Europe has a diverse industrial base, which provides local vendors with the confidence required to independently develop manufacturing, launch and in-orbit services. However, there are some challenges that should not be overlooked: vendors have found it difficult to obtain funding, project timelines have overrun and Europe’s ability to iterate has traditionally been slow.

Analysys Mason therefore advises that investors and vendors exercise a mixture of caution and excitement about European space infrastructure developments. Expect competition and the pace of the market to increase as more players announce their intentions to enter and engage in this area but consider that the path to space – and to revenue – will remain somewhat circuitous.

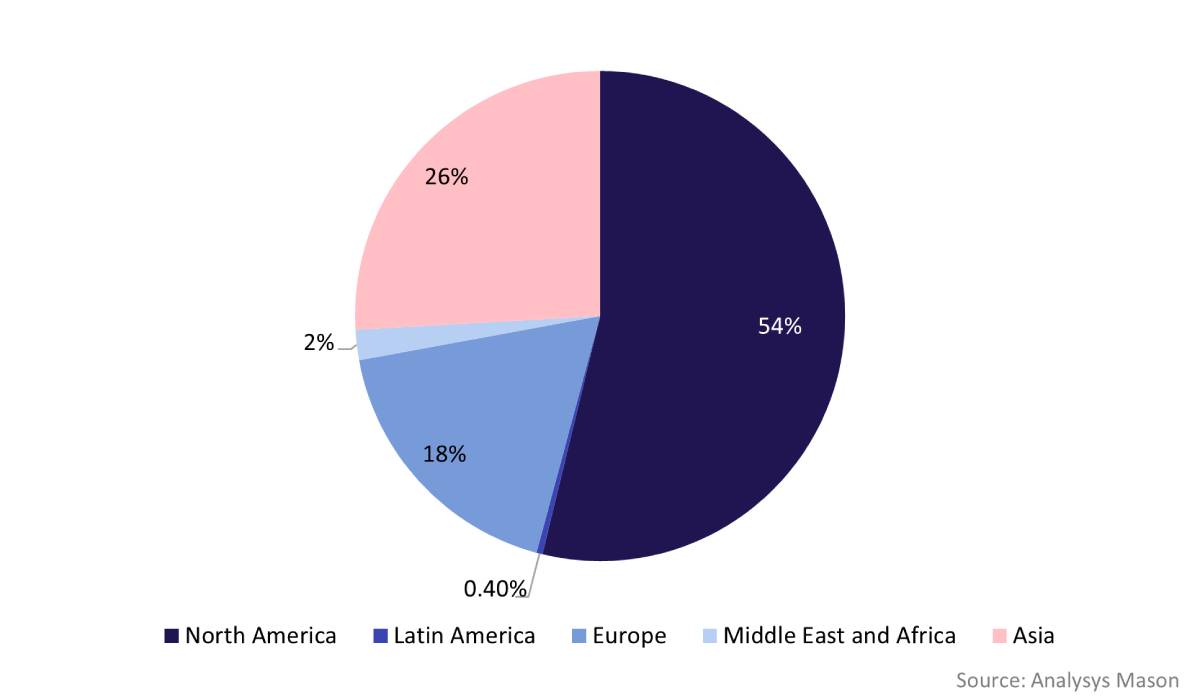

European space infrastructure represents 18% of the global revenue opportunity and will generate USD137 billion by 2033

Figure 1: Satellite manufacturing, launch and in-orbit service revenue share, by region, 2023–2033

Analysys Mason’s Space Infrastructure research programme includes detailed forecasts that show that European revenue from satellite manufacturing, launch and in-orbit services will exceed USD137 billion by 2033. This represents 18% of the global revenue opportunity, driven by government projects and satellite constellations. IRIS2 is an example of both a government infrastructure project and a satellite constellation. This project was in development for years, but final funding and the structure of the project materialised only after the new US administration was in place. Policy changes in the USA are putting satellite supply chains under pressure, which has affected the pricing of, and customer access to, such solutions worldwide. Although this pressure has not been the sole driver of satellite market activities in Europe, these US-led developments have spurred European governments to seek out sovereign solutions to become more self-reliant. In addition, to combat a monopoly in the launch market and to support national capabilities, several European launch providers (such as Latitude in France and PLD Space in Spain) have announced investment and support from their respective governments in recent years.

Satellite constellations are the cause and driver of European space infrastructure activity. Satellite operators are demanding satellite fleets for their own data and secured connections, and the rest of the market is responding to the requirements of scale. Numerous satellite manufacturing facilities have been opened and expanded in the last 5 years (including Aerospacelab, Argotec and Alba Orbital), and more platforms are being announced at conferences such as Smallsat Europe. At the same time, manufacturers with little to no space flight heritage are increasingly engaging with the satellite market, either to support traditional supply chains or to compete in the growing revenue opportunity.

One of the trends highlighted at Smallsat Europe was the prevalence of satellite propulsion suppliers. Globally, there is a move toward increased satellite manoeuvrability, supporting new approaches via alternative fuels, new form factors or in-orbit services. The conference featured no fewer than 12 booths from propulsion hardware vendors, many able to claim flight heritage through the recent launch of their technology. While it is not surprising to see technology vendors at a conference, it is indicative of this European surge to see so many new space technology vendors reaching commercial deployment.

Funding and a lack of agility in Europe have often slowed market progress, or resulted in less adaptable satellite programmes

As large as the revenue opportunity is, challenges remain. Funding is difficult to procure because a significant proportion of European players’ venture capital comes from non-European sources. Public funding is available, but the delivery of this funding is slowed by logistics or by European geo-return policies.

Collaboration is often cited as one of Europe’s greatest strengths, but there are benefits to a more agile and focused approach. For example, IRIS2 will not be deployed until 2030. While the technologies and services proposed for the constellation are robust, significant market movement will take place before then, challenging the programme’s global competitiveness. These movements within the market include the diversifying supply chain of vendors and manufacturers in Europe, which grants players access to a variety of technologies and approaches but can also leave customers requiring more time and effort to find the right path for them.

Success in the European space infrastructure market will involve embracing new opportunities while planning clear, reliable and value-driven paths

In the near term, the number of announcements and activities in the European space infrastructure market will increase and it will be the players that present strong and clear paths forward, and have realistic expectations of revenue growth and challenges, that will survive in the long term.

1 Sovereign solutions refer to infrastructure and services demanded by government institutions, with the connotation of independent, nationally focused solutions.

Originally published by Analysys Mason on June 6, 2025. Read the original article here.