(Source: Skylo Technologies)

(Source: Skylo Technologies)

LA PLATA, Maryland — Satellite direct-to-device (D2D) service provider Skylo Technologies, ostensibly neutral with respect to the GEO vs LEO argument, said it’s not clear that LEO is the superior architecture, at least not yet.

Skylo’s service is debuting in Europe and North America using already licensed mobile satellite service spectrum from geostationary satellites owned by Viasat Inc. as part of Viasat’s acquisition of Inmarsat; and from Ligado, which has rights to some of that spectrum.

Setting aside the argument over whether satellite D2D will ever be a major market or will remain limited to emergency messaging, such as Apple’s service using the Globalstar LEO satellites, the question is whether licensed satellite spectrum is better than hitchhiking onto spectrum already licensed to mobile network operators (MNOs) to extend MNO geographic coverage.

Skylo Chief Executive Parth Trivedi acknowledged that the strategy of using MNO spectrum adopted by companies such as Lynk Global and AST SpaceMobile has its advantage. Skylo expects to work with all comers.

But for its first deployments, Skylo wanted spectrum already licensed for mobile satellite use.

Skylo CEO Parth Trivedi. (Source: Mobile World Congress)

Skylo CEO Parth Trivedi. (Source: Mobile World Congress)

“Going after spectrum that doesn’t exist or isn’t licensed and authorized is a huge challenge,” Trivedi said during the Dec. 12-13 “Future of Wireless, AI and Convergence” webinar organized by New Street Research and BCG. “On top of that, launching new satellites is an additional capital-intensive challenge that we weren’t too excited about.”

Skylo has built its own Radio Access Network using the 3GPP technical standards. It is partnering with Qualcomm, Samsung, Mediatek and Sony. Deutsche Telekom has begun commercializing Android phones using the Skylo service and the Viasat/Inmarsat satellite spectrum. The company has also in various stages of negotiations and trials with Telefonica and Canada’s Telus Mobility.

Trivedi said the D2D business model will be developed in many forms, including one he likened to “an insurance-type offering.”

“Everyone is familiar with paying $13-$14 a month to insure their hardware. So for perhaps $5 a month you can ensure connectivity across the board,” Trivedi said. “Another model is where the OEMs want to provide a satellite SOS service to their customers and in some cases may include that as part of the car or device when it’s sold.”

This is the Apple/Globalstar model so far with the latest iPhones, which have equipped to communicate with the Globalstar satellites.

In addition to providing the service, Skylo also certifies the chipset hardware designed for satellite D2D. “We certify their hardware onto our network and we certify the devices on our network. That’s an important role we play. We take the entire ecosystem along with us.”

Skylo then operates the D2D network, with a global Network Operations Center, and installs its radio access network base stations at the Earth stations of its satellite partners.

Trivedi repeatedly stressed in his remarks the importance of having the entire mobile connectivity ecosystem adopt 3GPP standards to accelerate innovation. Whether Apple and Globalstar, mobile satellite operator Iridium or other players will agree to that remains to be seen.

Skylo Technologies investors. (Source: Skylo)

Skylo Technologies investors. (Source: Skylo)

Trivedi said Skylo IP added to the 3GPP standard improves the link budget so that users do not need to extend their arms to find a satellite signal, offering the same texting experience as with terrestrial cellular signals.

Skylo’s technology is equally applicable whatever the satellites’ orbit. The company began with Viasat/Inmarsat/Ligado because “these companies have the most formidable spectrum holdings across the board,” Trivedi said. “We need that capability to scale.”

GEO-orbit satellites also provide much higher power and large reflectors that can close the link with a small, unmodified smartphone. “When you’ve got a small ear on the ground you need a loud mouth in space.”

Viasat has said it is considering a LEO network to complement its current satellite architecture and Trivedi acknowledged that LEO has advantages, starting with the number of satellites that a user phone can talk to.

Much will depend on the cellular protocols that will be used ad more LEO D2D constellations enter service, and how network operators weigh the on-board power advantage against available spectrum and the battery life of users’ smartphones.

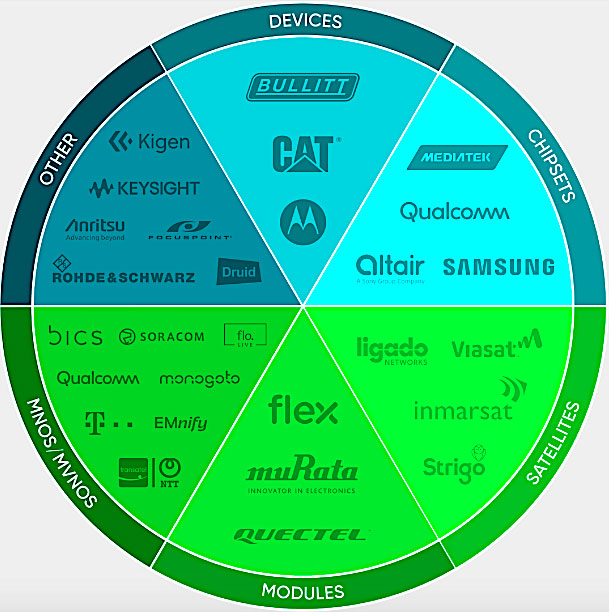

Skylo partners. (Source: Skylo)

Skylo partners. (Source: Skylo)

Of the two standards released by 3GPP in 2022, narrowband (NB) NTN and NR NTN, “narrowband has a lot more success,” Trivedi said. “When you have limited output power on your phone, spreading that over a wider bandwidth you lose fidelity. Your power density goes down and your ability to close the link suffers.”

Skylo, he said, is working on additional NB NTN services, and that extending NB NTN to the LEO constellations will be a next step.

That raises the LEO v GEO question: “If we are running the same type of channel bandwidth across these constellations, what is the huge incremental benefit that we’re getting from LEO?” Trivedi asked.

“You are getting more capacity and more overall diversity. But in terms of consumer expectations around what they can do on their phone once LEOs come out, I think those expectations are a bit inflated right now. I don’t think you are going to find that launching a bunch of LEOs is going to unlock Netflix-type services direct to device.”

That’s another point of debate in the industry. Lynk and AST SpaceMobile say that when they get their full constellations up, consumers will get 4G/5G-level connectivity. Others, including LEO satellite operators SpaceX, working with T-Mobile; Iridium; and Apple/Globalstar are much more reserved, and say it will take years before that happens.