Credit: Google Finance

Credit: Google Finance

PARIS — Seraphim Space Investment Trust has stayed the course so far in a down market, re-investing in companies whose public stock has declined and finding deals among privately held startups.

But a down market is a down market and Seraphim’s performance in it, while not bad, reflect the broad declines in tech startups generally, space startups in particular, and especially startups that have made public-stock introductions.

Seraphim Chief Executive Mark Boggett in March explained the trust’s investment philosophy and why short-term market fluctuations are not a worry for the long-term investor: Read more

It’s one thing to say you don’t mind rain, it’s another to be caught in a rainstorm. Seraphim, whose initial stock offering occurred in June 2021, told investors it was targeting a portfolio net asset value appreciation of better than 20%. As of March 31, it was 6%.

Credit: Seraphim Space Investment Trust

Credit: Seraphim Space Investment Trust

Seraphim’s portfolio is 67% Series B-round investments or later, with 47% Series D or later. It is comprised of 23 companies. Ten of them make up 68.3% of the net asset value.

In a May 12 investor presentation, Boggett said many companies in the portfolio are “soonicorns,” with their enormous potential value waiting to be discovered by the markets. The portfolio is 38% UK, 22% U.S. and 34% EU.

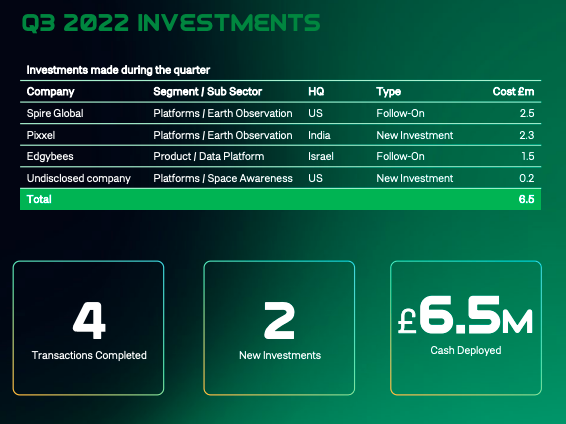

The remaining companies include two new investments in companies based in Israel and India.

Damn the torpedoes: Seraphim has used the occasionally sharp declines in the market value of space-technology startups as a buying opportunity. Credit: Seraphim Space Investment Trust.

Damn the torpedoes: Seraphim has used the occasionally sharp declines in the market value of space-technology startups as a buying opportunity. Credit: Seraphim Space Investment Trust.

Edgybees of Israel, a recent investment, in a company using satellite and drone video to create an Artificial Intelligence-powered augmented reality platform. Seraphim invested $2 million as part of an $8 million internal funding round.

Pixxel of India is developing a 5-cm-resolution hyperspectral sensor fitted onto small satellites. Seraphim invested $3 million as part of a $25-million Series A funding round.

Seraphim also invested a further $2.5 million in share purchases of Spire Global, whose enterprise value had fallen to where it was in 2017, when Seraphim made its first investment.

Boggett said Seraphim’s performance in the quarter was affected by the dramatic fall in shares of Arqit Quantum of Britain, developing a quantum encryption platform. Partly offsetting the Arqit decline was the increase in value in D-Orbit, a satellite last-mile-delivery platform. D-Orbit is privately held.

Boggett said the reaction of the public markets has not been mirrored by private investors in startups, whose enthusiasm for the space sector remains intact. He referred to a company in which Seraphim did extensive due diligence recently that suddenly registered a spike in demand, which caused the company to withdraw the transaction.

“We hope to get this back into the pipeline in the next quarter,” Boggett said.

Read more from Space Intel Report.