A massive population and an emerging middle class with increasing purchasing power makes India a desirable market for the satellite industry—especially for a new generation of satellite operators offering consumers connectivity from LEO constellations. But new regulations implemented by India’s government could put a wrench in the growth plans of satellite companies looking to expand their footprint on the subcontinent.

In May, the Indian Department of Telecommunications (DoT) implemented 29 new regulations impacting companies in the space and satellite industry. According to Vivek Prasad, a principal analyst for Analysys Mason in Kolkata, India, the new regulations were intended to, “tighten the operational, security and indigenization conditions under the country’s Global Mobile Personal Communications by Satellite (GMPCS) framework.”

“The regulations placed by the DoT seem to be focused on three aspects,” said Grace Khanuja, a satellite industry management and strategy consultant at Novaspace. “The first is enhanced security, especially considering recent geopolitical events and concerns about spoofing and cross-border communications. The next involves sovereignty and the desire to maintain and preserve telecom data under Indian jurisdiction.

“Finally, the DoT is looking to incentivize local manufacturing and integration of national systems like Navigation with Indian Constellation (NavIC) as part of its ‘Make in India’ program.”

These new regulations could have significant ramifications for satellite operators that see India—with its massive population and relative lack of connectivity—as a vital avenue for future expansion .

Catering to the Under-Connected

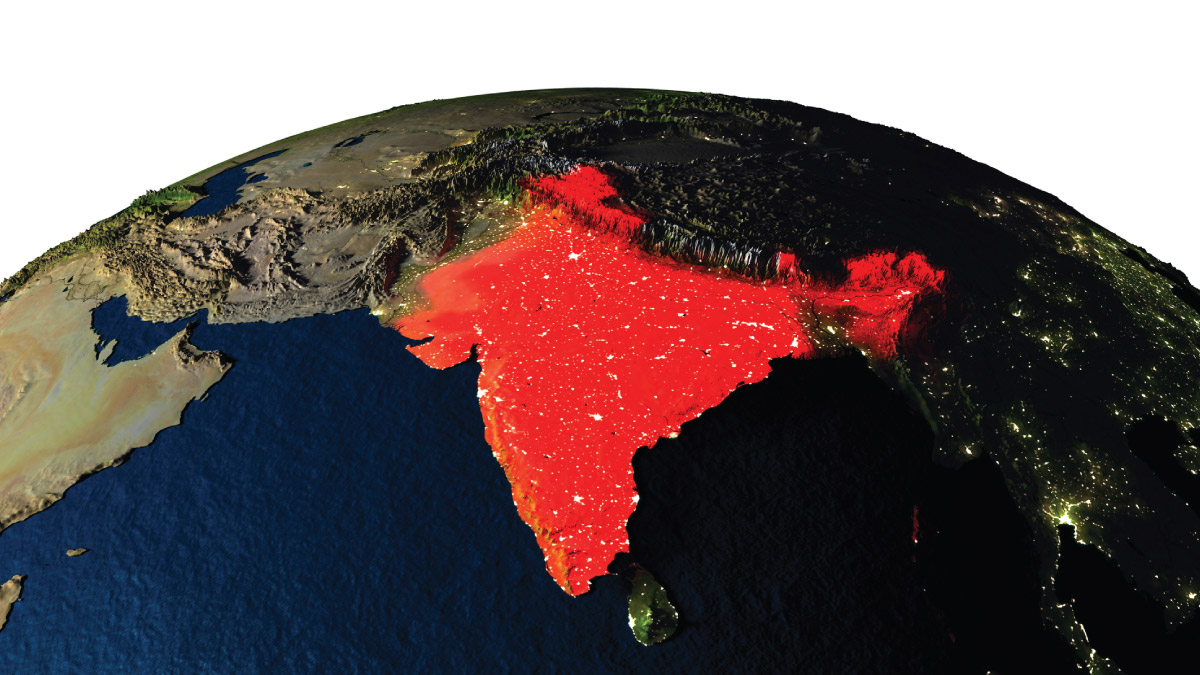

India is the world’s most populous nation, with a total population of approximately 1.46 billion people in 2025, as estimated by the UN. The country also features a growing economy, with the percentage of families considered middle class rising from 14 percent in 2005 to 31 percent in 2021. This economic growth is largely tied to policy changes implemented in the 1990s that opened the country to new, higher-paying jobs in finance, technology and other sectors.

As Prasad explains, satellite operators see tremendous opportunity in the Indian market not just because of its population, but because of what many within the country don’t yet have and increasing competition in other parts of Asia.

“India offers one of the largest opportunities as approximately 40% of the total population is still unconnected or under-connected.” —Vivek Prasad, Analysys Mason

“In terms of addressable market, India offers one of the largest opportunities as approximately 40% of the total population is still unconnected or under-connected ,” Prasad said. “Also, competition from Chinese constellations in other emerging economies in the region with access via Silk Road Initiatives makes India a key target market for sustained subscribers and revenue growth.”

But satellite demand in India is driven by more than just a lack of connectivity. A rising appetite for digital tools and services, combined with the presence of large, underserved regions, is further accelerating it.

“India offers a massive user base, which could provide a major growth spurt for LEO operators, given they can find a ‘sweet spot’ price of entry,” Khanuja said. “Demand for satellite services in India is heavy considering the fast-growing use of digital tools as a result of ‘Digital India’ initiatives, and coverage gaps in rural regions and mountainous areas lacking high-quality broadband.”

Khanuja explained that these factors, the presence of local telecom and satellite companies with which to partner and India’s “strategic foothold within the Asian region and growing economic status in the world economy” combine to make the subcontinent a focus for many satellite operators looking for rapid growth and expansion.

But if there is so much need for the connectivity satellite can deliver, why is India making it harder for foreign satellite operators to do business in the country?

The Emergence of New Security Concerns

New regulations in India are most likely the result of national security and sovereignty concerns due to geopolitical affairs in the region, said Davis Mathew Kuriakose, an independent satellite specialist with knowledge of the region’s satellite industry.

“The directive came on the heels of heightened tensions with Pakistan in early 2025,” Kuriakose said. “Indian authorities were wary that unrestricted satellite internet could allow communications beyond government reach—for example, to militants or hostile elements in border areas who might use satellite links to bypass surveillance.”

Those tensions and the resulting concerns across the Indian government gave rise to new regulations, seemingly intended to give the DoT more control over the satellite networks operating in India and the data traveling across them.

“These regulations…seek to maintain data sovereignty while increasing data security for India and its citizens.” —Davis Mathew Kuriakose, Independent Satellite Specialist

“These regulations increase government oversight and control over satellite communications within India’s borders. They seek to maintain data sovereignty while increasing data security for India and its citizens,” Kuriakose said. “These new rules also mandate fail-safes to keep the expansion of satellite services in check.”

Regardless of why the regulations were put in place, they threaten to temper the aspirations of many satellite operators looking to expand operations in India.

More Rules Mean Higher Cost of Entry

As a result of new regulations, satellite companies looking to expand into India may find themselves facing higher barriers to entry to begin offering services to the country’s population.

Satellite companies looking to expand into India may find themselves facing higher barriers to entry to begin offering services to the country’s population.

“[These regulations will require] higher commitments and larger capital expenditures to build out India-based infrastructure, including local data centers and points-of-presence for satellite traffic, and to localize 20% of the ground segment within five years of launch,” said Khanuja.

But the regulations will do more than add cost; they’ll also add complexity and require operational changes for satellite operators.

“There will be operational complexities stemming from expected real-time tracking of mobile terminals, and leveraging NavIC for positioning, which will require specialized hardware integration,” Khanuja said. “They’ll also face limitations in global backhauling, considering the regulatory restrictions on connecting terminals to foreign gateways. This would add complexity to how companies like Starlink have built their global architecture, which relies on centralized inter-satellite links, shared global gateways and a unified backend.”

According to Khanuja, the new regulations could, “warrant a fragmented infrastructure for the country that could delay deployment and raise costs.”

If there is one silver lining for LEO satellite operators looking to enter the Indian market, it’s the fact that these regulations aren’t just for them—they impact every satellite company that operates in India.

“These regulations are not limited to new entrants; they apply to all foreign and domestic GMPCS license holders,” Prasad said. “This includes existing players, such as the strategic partnership between Eutelsat OneWeb and Bharti Airtel, and Orbit Connect India, the partnership between JIO and SES. It also includes new players, such as Starlink and Kuiper.”

While all satellite operators face these new regulations and requirements, there are ways they can lessen the impact and expedite their expansion into India.

“Companies should continue to partner and collaborate with local telcos who can help ensure compliance with these regulations in the long and short term, which is what companies like Eutelsat OneWeb, SES and Starlink are already doing,” Kuriakose said. “They should also advocate for phased or delayed implementations for the more highly complex technical requirements, such as real-time tracking frequency and NavIC integration deadlines.”

American companies could also turn to their own government for assistance. When asked what role the U.S. government could play in helping to open the Indian market for American satellite companies, experts agreed that trade discussions between the nations could be impactful.

“I see strategic value in the U.S. and Indian governments having bilateral discussions focused on balancing market access for American satellite operators, technological reciprocity, and India’s security needs,” Prasad said.

[The U.S. government could utilize] direct diplomatic dialogue to advocate for reasonable regulatory frameworks and include satellite broadband as a priority agenda item in bilateral trade negotiations and economic summits,” Kuriakose said. “The U.S. can propose space and satellite technology transfer, support India’s ‘Make-In-India’ initiative and suggest joint infrastructure development to encourage India to consider regulatory requests from the U.S.”

Explore More:

Europe’s Space Industry: Elon Musk 2.0 Is a Clear Opportunity for Us To Confront the Threat From Musk 1.0

Power Plays: The Push for European Space Sovereignty

The Viability of Space Sovereignty Depends on the Partnership Path