Originally published by Space Intel Report on May 29, 2025. Read the original article here.

Gregg Burgess. (Source: General Atomics)

Gregg Burgess. (Source: General Atomics)

AMSTERDAM — Satellite laser communications providers Cailabs, General Atomics, Odysseus Space and Tesat said enough real-world testing has been done to prove the technology but that compatibility between manufacturers and the sector’s ability to ramp production remain challenges.

These issues have slowed development of the US Space Development Agency (SDA) missile-warning and targeting network, which has put a premium on using multiple vendors. All SDA satellites have laser links for inter-satellite communications with others in the LEO network. Some manufacturers have been unable to keep pace.

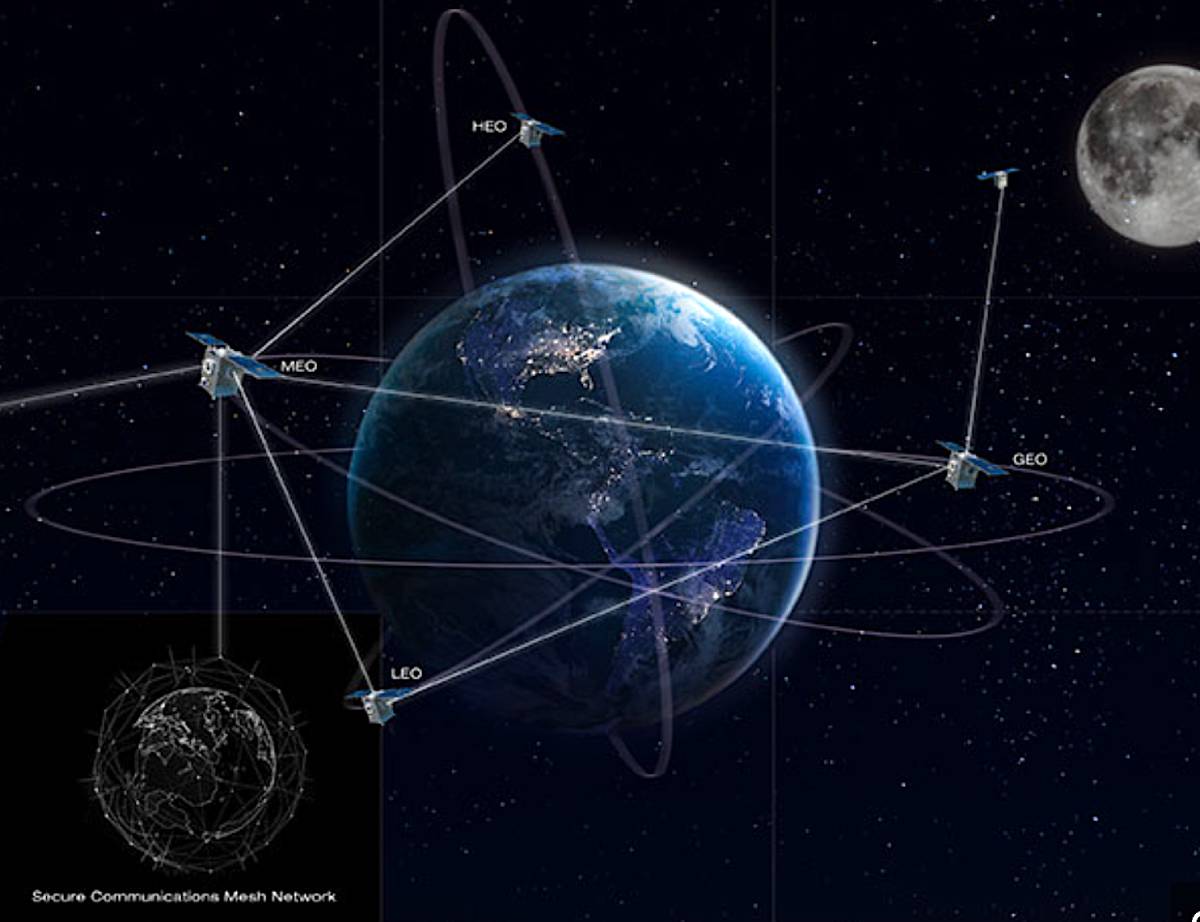

Addressing the SmallSat Europe conference and exhibition here May 27-28, organized by Satnews Events, these companies made clear that LEO-to-LEO, space-to-Earth and LEO-MEO-GEO connections have different requirements. Success with one application does automatically qualify the hardware for another.

What is clear is that demand is picking up, even for space-to-ground links, which until recently was considered an untested frontier technology.

Cailabs of France, a manufacturer of optical ground stations, had produced what it said were successful results in 2024 tests with the French Defense Ministry, but the ministry withheld permission to publish details.

The same sort of testing then was done with Cailabs customer Kepler Communications of Canada, which confirmed that the Cailabs technology, which mitigates interference as the laser signal traverses the atmosphere, was fit for purpose. The testing was done with satellite laser terminals built by Germany-based Tesat Spacecom.

Jean-François Morizur. (Source: Cailabs)

Jean-François Morizur. (Source: Cailabs)

Cailabs Chief Executive Jean-François Morizur said he now considers the Cailabs ground station to have reached TRL 9, which means proven for commercial use. The company has 10 stations under contract.

“Interference was the main challenge,” Morizur said. “Interoperability, except for pointing and acquisition – these have now been solved. I’m not saying it was not complex. Going through the atmosphere is the one thing that creates value and it’s also on the critical path.”

Cailabs’ production facility is sized to build up to 10 optical ground stations per year and this year’s production is already booked. The company is adding capacity to build up to 50 stations per year.

(Source: Cailabs)

(Source: Cailabs)

“There is a very strong demand signal,” Morizur said. “It’s happening very fast. We are seeing validation after validation. It’s working and we have the statistics to show it. Our focus now is, how do we scale this and how do we make sure the supply chain holds up to that? Cost is not really a challenge as our stations are cheaper than most RF [radio-frequency] gateways.”

The enthusiasm around space lasers has inevitably led to irrational enthusiasm among some prospective customers.

“You see crazy numbers from some of the players, with too many zeroes,” Morizur said. “From other players, we hear they only need one. So there are extreme cases.”

European governments have begun a multi-year effort to increase their defense spending, spurred by Russia in the East and its invasion of Ukraine, and by the Trump administration in Washington, which has put into question the US commitment to the NATO alliance.

“Secure ISR military links will be here soon considering the demand,” Morizur said, referring to intelligence, surveillance and reconnaissance missions. “The data we get from Ukraine shows that optical is desperately needed, no question about it.”

One of the many advantages of optical communications is that they are more difficult to intercept or jam. Radio-frequency jamming in and around Ukraine has been rampant.

Jordan Vannitsen. (Source: Odysseus Space)

Jordan Vannitsen. (Source: Odysseus Space)

Cailabs’ decision to boost production is welcome news for Luxembourg-based Odysseus Space, a startup whose business model is lasercom as a service. Customers purchase subscriptions and then receive data without having to purchase their own ground stations.

Thidl requires lots of laser terminals in orbit on commercially available satellites, and a network of ground stations as well.

Odysseus Chief Executive Jordan Vannitsen said his company will deliver its first flight-model terminal this year, with an SDA-standard-compatible ground terminal ready in 2026 in Spain. From there it will build out its network.

Odysseus customers are more interested in data volume than in immediate downlinks.

“Customers only want a lot of data every day,” Vannitsen said. “They don’t need it at millisecond speed, they just want to get the data down every day. When we go to an Earth observation company, they say they can get about 80% of their data today. But in a couple of years it will be 30% with the increase in their payload capabilities, so we are helping them get all of their data.”

Vannitsen agreed that space lasercom is still figuring out how to scale production and overcome supply-chain issues, and to assure interoperability among terminal manufacturers. “These are the challenges so we can really scale” production of ground and space-based terminals.

Odysseus recently announced an agreement with Contec of South Korea, a bnuilder of satellite ground stations, to deploy a network of optical stations in Europe starting in 2026.

The SDA has done more than any other single customer to stimulate the lasercom ecosystem. SpaceX’s Starlink has deployed more laser terminals than anyone else, but it uses proprietary SpaceX technology and is not compatible with the SDA technical standard.

SDA has not clearly communicated its progress in demonstrating that its lasercom providers, all of which passed interoperability testing at the US Naval Research Laboratory, have communicated with each other in space.

(Source: General Atomics)

(Source: General Atomics)

Gregg Burgess, space systems vice president at General Atomics Electromagnetics, said terminals can be declared interoperable in the lab but still have issues in orbit.

“Most of the technology has been worked out and there are many successful examples of communications between satellites using the same company’s terminal,” Burgess said. “The real breakthrough will be in getting companies to work together. Very recently we had encouraging results with a ground-based General Atomics terminal speaking to a Tesat terminal in space.

“We are continuing to work that with our colleagues. It’s the greatest challenge in the future.”

General Atomics is working on US Space Force’s Enterprise Space Terminal program, which is focused on links between satellites in different orbits — MEO to LEO, MEO to GEO, GEO to LEO and higher orbits. General Atomics, CACI and Viasat recently won Phase 2 contracts for the program.

Demonstrating real interoperability between two vendors’ terminals remains to be demonstrated, Burgess said.

“We’re just starting to get that sorted out in the ecosystem. I would expect a year from now we will have progress to report across the industry, and some results with Tesat here in the next couple of months. But there is a lot more testing to do.”

What about the SDA standard, which the agency has set as a sine qua non for its multiple lasercom providers?

“There is a little bit of variation that can occur and when you actually meet the environment of space-to-space or space-to-ground communications, there are a lot of things that make it challenging,” Burgess said.

“In particular the challenge of pointing, acquisition and tracking. The technical implementation may be different among different vendors. So while they build to the same standards that alone is not necessarily going to make it work.

“Following the standards does not necessarily get to technical success.”

Daniel Troendle. (Source: Tesat-Spacecom)

Daniel Troendle. (Source: Tesat-Spacecom)

Germany-based Tesat, which is building a production facility in the United States, has some 60 terminals in orbit now, including hardware built for SDA contractors and Kepler. it has been deleted as provider for Kepler’s data-relay network and for Telesat Canada’s Lightspeed broadband constellation.

Daniel Troendle, Tesat head of sales for Europe, the Middle East and Africa, said the company’s current production rate is one terminal a day, and it is building a new factory to increase that to 10 terminals per day, with the goal of 1,000 per year.

Troendle said the industry does not need to settle on one identical standard, and that like cellular networks different standards can be built to operate seamlessly with others. “We need flexibility in the standards because they evolve,” he said.

Originally published by Space Intel Report on May 29, 2025. Read the original article here.