The Nusantara-3/Satria-1 satellite. (Source: Thales Alenia Space)

The Nusantara-3/Satria-1 satellite. (Source: Thales Alenia Space)

SINGAPORE — Indonesia has perhaps the world’s most extensive satellite broadband deployment program and is finding out that even before it’s deployed, it’s not enough.

It never is, when it comes to broadband. But Indonesia’s extensive deployment, with two high-throughput satellites launching this year, goes as far as any nation in pushing connectivity into unserved regions.

The 20-Gbps Nusantara 1 satellite this year will be reinforced by the government-sponsored Nusantara 3, also known as Satria-1, a Thales Alenia Space-built satellite designed to provide 150-plus Gbps through 116 beams and 11 gateway Earth stations.

Nusantara-3/Satria-1, the centerpiece of Indonesia’s Bakti broadband deployment program, is scheduled for launch the week of June 17 aboard a SpaceX Falcon 9 rocket.

Agus Budi Tjahjono, commercial director at PT Pasifik Satelit Nusantara (PSN), Indonesia’s domestic satellite fleet operator, said the Boeing Satellite Systems-built Nusantara-5, sometimes referred to as Satria’s Hot Backup Satellite, is son track for launch at the end of the year. Its throughput is expected to be more than 160 Gbps.

“With all three satellites we will have approximately 330 Gbps over Indonesia,” Tjahjono said here June 6 at the Avia Satellite Industry Forum. “We may be the biggest capacity provider in Asia starting at the end of this year.”

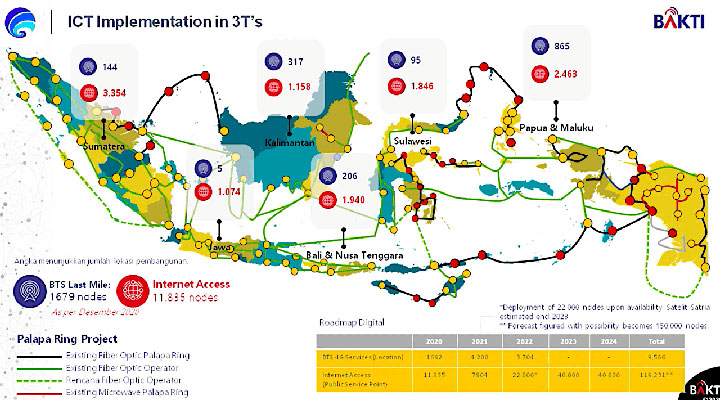

(Source: Bakti)

(Source: Bakti)

The Bakti project has included early use of multiple third-party satellites while waiting for the new spacecraft to launch. Satria-1, whose financing was not easy, in particular has seen multiple delays.

Imran Malik, senior vice president of global sales at fleet operator SES, which has been among the operators providing broadband capacity to Indonesia, said Indonesia is an example of what a developing country can do, especially one whose geography makes it difficult to deploy fiber.

“This is one of the most ambitious USO [universal service obligations] programs not only in Asia, but anywhere in the world,” Malik said here June 7 at the Euroconsult Asia Satellite Business Week conference, part of the Asia Tech x Singapore/SatelliteAsia conference and exhibition.

“This program was launched in 2018 and Indonesia decided to lease capacity on all the HTS satellites available and then waiting for Satria,” Malik said. “The throughput is now too low, so the question is how to increase it. Bakti has some other issues at the moment but it’s still one of the best programs anywhere in the world.”

Indonesia is now discovering that 330 Gbps is not enough. It is likely to scale back its ambitious plans of deploying 150,000 government sites, including schools.

“The plan [for Nusantara-3/Satria-1] is 150,000,” Tjahjono said. “I think only 1 mbps per site is too little, so some locations would be served by GSM or terrestrial or fiber optic. I think the number might be reduced to around 50,000.”

Nusantara 3 is a public-private partnership, with PSN as the satellite operator, that is run by the Ministry of Industry, Communications and Innovation.

Tjahjono discussed the deployment plans and how PSN expects to fend off the competition from global satellite players including SpaceX Starlink — already in Indonesia through a partnership with Indonesian telco PT Telkom.

Agus Budi Tjahjono. (Source: PSN)

Agus Budi Tjahjono. (Source: PSN)

What is your current commercial offer?

We do end-to-end services, not just transponder leasing. We also do cellular backhauling with about 10,000 sites across Indonesia, including 5,000 community Wi-Fi sites, to villages through 90-centimeter dishes. We sell through kiosks and whoever wants comes to pay for a voucher.

The villagers sometimes will walk 2 kilometers for cellular coverage, for which they pay 70 cents per gigabyte. they are buying gigabytes.

We have a lack of capacity and that is why we need Nusantara-5. It will be able to deploy more community Wi-Fi all over Indonesia. They will need more speed and are willing to pay for it.

Will you be competing with cellular in some of these villages?

In the rural areas, cellular has poor connectivity. They say they have a 4G signal, but it’s not really 4G. We can give a very-high-speed internet. But we cannot compete with their price point.

There are 12,000 villages in Indonesia that are not covered by a cellular signal. And the speed is very slow even in villages that have coverage.

Your director, Adi Rahman Adiwoso, has repeatedly said PSN can win against the low-orbit constellations, the NGSOs, by offering better total service, at lower cost. Is that still PSN’s view?

Indonesia has 270 million people, and 28% of them are undeserved. We want to be a winner in our country even with the NGSOs. We believe we can compete and the key is vertical integration. We have an end-to-end service, we are not just selling the bandwidth. We have local technical team to do the installation and the operations.

PT Telkom is deploying Starlink in Indonesia for B2B applications. (Source: PT Telkom)

PT Telkom is deploying Starlink in Indonesia for B2B applications. (Source: PT Telkom)

PT Telkom’s agreement with Starlink is just for B2B service, correct?

The regulation is just for B2B. We see they are quick with enterprise. PT Telkom has another reseller, a local ISP, so they are selling to the end user — not the consumer but to corporations, oil and gas companies, using our Nusantara 1 satellite.

How does the PT Telkom/Starlink pricing compare to what you will be providing with the two new satellites?

We can compete with their pricing. They also need stable electricity to have an antenna at the user sites. Indonesia in some locations does not have good electricity. That’s why the key is a local technician to do the operations and maintenance. When we see electricity is not good, we install solar panels.

PT Telkom and Starlink could do the same thing.

Yes, but they don’t have a local operation.

Have you seen any change in pricing in the past six moths from PT and Starlink?

Yes, there have been price decreases and we have to respond. Their price point is $200-$250 [per mbps] and we expect they will go lower. It’s the total cost of the service, not just the satellite, also the gateway and hub and the remote terminal and the installations and operations and the power system.

We want to provide connectivity without [becoming a] commodity. There is so much competition, even now. People can pay a very low price for cellular and this is challenging for all of us. We can charge a premium but we have to keep up the speed and good service.

Read more from Space Intel Report.