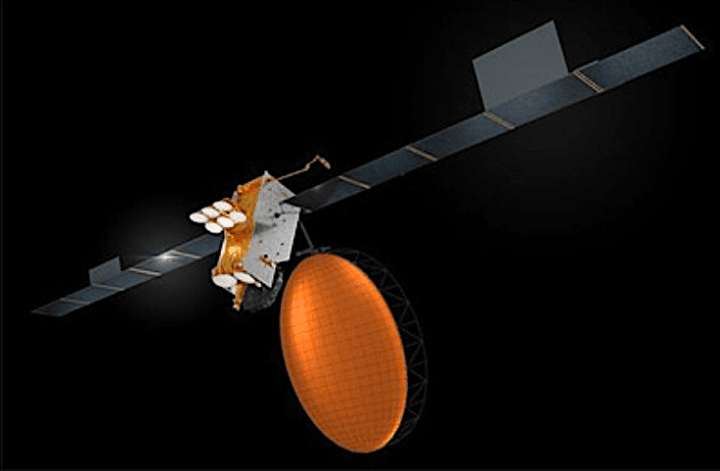

Inmarsat is bolstering its L-band capacity with two Inmarsat I6 satellites. Shown here is I6 F1. (Source: Inmarsat)

Inmarsat is bolstering its L-band capacity with two Inmarsat I6 satellites. Shown here is I6 F1. (Source: Inmarsat)

PARIS — Mobile satellite services provider Inmarsat has begun trials of a direct-to-device service using Inmarsat’s L-band from geostationary orbit with mobile network operators and user device builders with the near-term ambition of providing commercial two-way texting, device tracking and emergency communications.

London-based Inmarsat has expanded its memorandum of understanding with Taiwanese chipmaker MediaTek, with applications including connected cars and narrowband Internet of Things in addition to the smartphone market, the two companies said.

Inmarsat also has an agreement with UK-based ruggedized smartphone maker Bullitt Group, which has begun commercializing phones with both L- and S-band chips for satellite connectivity.

Bullitt’s initial service in Europe is using S-band satellite capacity from EchoStar Corp. The L-band Inmarsat service is scheduled to be introduced later this year.

Inmarsat and its ostensible future owner, Viasat Inc., have said they see direct-to-device as feasible from geostationary orbit. But Inmarsat — like its fellow mobile satellite providers Globalstar, working with Apple; and Iridium, working with Qualcomm — is determined not to set expectations too high for whatever service arrives.

This is in sharp contrast two AST SpaceMobile and Lynk Global, two startups that are licensing existing terrestrial-mobile spectrum to offer mobile network operators full-territory coverage as part of these operators’ customer plans.

AST SpaceMobile and Lynk both plan large constellations in low Earth orbit and have promised a quick ramp up from texting to full broadband performance from unmodified smartphones.

Iridium in particular has been vocal in its skepticism about the credibility of these promises, saying that the technology is challenging and that the regulatory environment will be even more so.

Inmarsat Chief Strategy Officer Fredrik Gustavsson. (Source: Inmarsat)

Inmarsat Chief Strategy Officer Fredrik Gustavsson. (Source: Inmarsat)

Inmarsat Chief Strategy Officer Fredrik Gustavsson outlined how Inmarsat views the market.

Do you think this is an enormous market in the near term?

The announcement we made wit MediaTek is for the narrowband IoT market, which we are able to serve today with our existing assets in the L-band. We have the satellites and we have the spectrum. So unlike some of the other companies who are making significant investments in this, for us this is leveraging our existing assets to address new growth markets.

With Release 17 of the 3GPP [standards making body] started, we think that is really the trigger for why this is relevant.

There are different views as to how big this market is. The three main use cases we see at the moment is around hand-held devices, direct to device with messaging; industrial IoT also; and connected cars. Those are the three main use cases we see at at the moment.

Here is where we would open up new growth markets. They are not served today because of lack of coverage from terrestrial. And this would be a way of expanding and avoiding the capex of extending new terrestrial networks, and using satellites instead.

This is something that is possible deliver, technically, today, unlike some of the more broadband applications.

So you see narrowband as the market, and not just a jumping off point toward the goal of broadband directly from satellite to smartphones?

This market is valid on its own, and will remain valid in the future. We know there is demand for broadband video services as well, but that market from a technical perspective is today not possible to serve. That could also be a market for us, but at the moment our announcement with MediaTek is around the narrowband. That will remain a relevant market even though there could be further growth in a broadband market as well.

What can you say about the trials being done with MediaTek and mobile operators?

We started this testing with MediaTek back in 2020. They were successful. We are timing this now because we have number of trials going on with both major network operators and device manufacturers. So far they have been encouraging. We are confident that we are on a path for a solution that will be viable technically and commercially.

Bullitt Chief Product Officer Jonathan Nattrass showing the company’s L- and S-band satellite-connected phone at Mobile World Congress 2023. (Source: YouTube)

Bullitt Chief Product Officer Jonathan Nattrass showing the company’s L- and S-band satellite-connected phone at Mobile World Congress 2023. (Source: YouTube)

Bullitt has talked about adding North America and other geographies later this year, using an EchoStar S-band satellite over Europe and then your L-band spectrum in other regions.

I can’t speak for Bullitt and their specific timing and I don’t want to give any specific timelines on when we expect these partnerships to be announced. But we have good momentum at the moment.

This is a geostationary orbit play at least for now, correct?

Yes.

What would be the division of responsibility between Inmarsat, MediaTek and the mobile network operators that would incorporate your capacity into their subscription offerings?

The core deliverable for us centers on the L-band connectivity. It’s the chipset for MediaTek and then the model with the MNOs or the OEMs [original equipment manufacturers] could look different in different circumstances. We have seen so far in the commercial model that it can evolve. Apple is now offering this free service and we don’t know how the MNOs will offer this on their networks.

We will work with them in a wholesale model where we would not be directly involved with how they charge their end customers.

And the same approach with automobile manufacturers and other prospective industrial IoT markets?

We are working jointly to have these discussions with MediaTek and bringing in the MNOs and OEMs.

Are these MNOs in different regions of the world?

Yes, this is a global offering. That is one of the strengths of our network and our spectrum rights. So we could work with a global network operator or we could do regional bespoke deals as well.

Read more from Space Intel Report.