ALEXANDRIA, Va. — Commercial in-flight connectivity (IFC) is taking off, creating a major opportunity for satellite operators and antenna manufacturers in the multibillion-dollar commercial aviation industry. But there are lingering issues around meeting passenger expectations and closing the business model.

In-flight connectivity is expanding with the availability of low-SWaP antennas and a more on-orbit capacity. (Source: Pixabay)

In-flight connectivity is expanding with the availability of low-SWaP antennas and a more on-orbit capacity. (Source: Pixabay)

Passenger expectations of in-cabin Wi-Fi and other forms of connectivity have increased coming out of the COVID-19 pandemic. According to Euroconsult, the number of commercial aircraft providing IFC services for passengers and crew will double over the next decade from just under 10,000 to more than 21,000 by 2031.

Around 120 commercial airlines offer in-flight connectivity to passengers today, with total bandwidth capacity consumption of around 24 gigabytes per second. In addition to supporting communications and entertainment for passengers, satellite IFC also enables improved services and applications for flight operations, safety, maintenance and flight crew support.

The market is dominated by a small handful of satellite operators, including Viasat, whose proposed acquisition of Inmarsat is driven in large part by Inmarsat’s established presence in the IFC market. Other players include Intelsat, through its subsidiary Gogo Commercial Aviation and partner Panasonic Avionics, and SES and Hughes, which power Thales Group’s solution. Starlink plans to roll out an aviation product by mid-2023. OneWeb recently validated its high-speed LEO IFC system and hopes to certify it by mid-2023.

According to recent surveys, more passengers expect to stay connected when they fly, including having the option to browse the internet, check email, send large files, listen to music, shop online and stream video. These expectations have evolved during the COVID pandemic. Inmarsat’s 2022 passenger survey showed a 40% increase in the number of passengers who think Wi-Fi is an important part of flying, compared to the previous year.

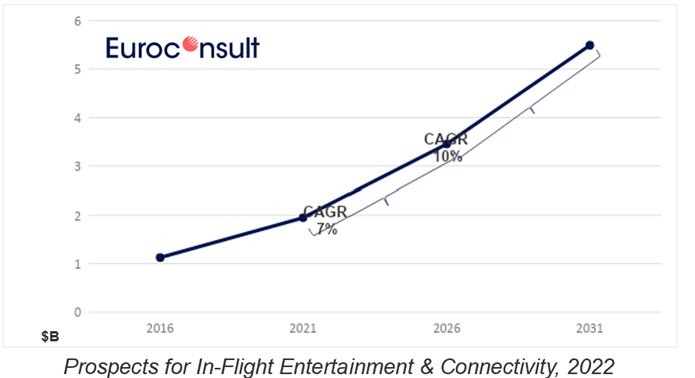

Euroconsult projects the in-flight connectivity market will double over the next decade. Image shows IFC service revenues. (Source: Euroconsult)

Euroconsult projects the in-flight connectivity market will double over the next decade. Image shows IFC service revenues. (Source: Euroconsult)

Many full-service carriers pursuing IFC are looking for the largest data pipeline and fastest speeds to deliver in-flight broadband that is similar to passengers’ at-home internet experience. Depending on latitude, the number of passenger devices and interference from nearby aircraft, in-flight Wi-Fi speeds currently vary between 10-100 Mbps per plane. Some promising solutions are emerging with download speeds up to 260 Mbps.

Deployment Costs vs. Free Wi-Fi

Within the satellite mobility market, commercial aircraft terminals will be the single largest driver of market value, growing at an estimated 12% CAGR. That growth will be fueled by higher bandwidth requirements per plane, passenger expectations of terrestrial-quality connectivity, as well as the high costs of terminal equipment and outfitting an aircraft with satellite broadband connectivity.

The average high-throughput Ku-band flat panel antenna for commercial aircraft is a roughly $100,000 investment, not including installation or the cost of grounding an aircraft. Starlink recently announced its IFC antennas would cost $150,000 with monthly service costs of up to $25,000. Even with increased availability of bandwidth from LEO constellations and high-throughput satellites, antenna costs are unlikely to drop over time, according to Euroconsult.

ThinKom’s Ka2517 IFC antenna deployed on an aircraft. ThinKom works closely with Gogo, a leading in-flight internet provider and subsidiary of Intelsat.

ThinKom’s Ka2517 IFC antenna deployed on an aircraft. ThinKom works closely with Gogo, a leading in-flight internet provider and subsidiary of Intelsat.

Given the high cost of equipment, installation and recurring service charges, most airlines charge passengers between $7-$40 for the duration of a flight, with tiered pricing for faster speeds. Amid disappointing uptake and passenger complaints of high cost, poor service, a growing number of carriers have started offering free in-flight Wi-Fi or including it as a loyalty benefit for priority or first-class passengers. Air New Zealand, the U.S. carrier JetBlue, Australia’s Qantas and mainland China’s Hainan Airlines offer free Wi-Fi for all passengers on certain domestic flights.

Delta announced earlier this month that it would begin offering free IFC on more than 700 of its aircraft equipped with Viasat’s Ka-band IFC solution. The service will start this year and be available on regional and international flights by the end of 2024.

Intelsat and Japan Airlines subsidiary J-AIR announced plans to roll out free IFC service on its Embraer E190 aircraft. The service will use Intelsat’s 2Ku system and utilize capacity from Sky Perfect JSAT’s JCSAT-1C high-throughput satellites.

Connectivity expectations have also led to more deals for satellite operators and antenna manufacturers to outfit new commercial aircraft with connectivity capabilities.

Southwest Airlines announced last year that it had chosen Viasat to install in-flight Wi-Fi equipment on new deliveries of the carrier’s Boeing 737 MAX aircraft. Inmarsat won a major contract with Emirates earlier this month to outfit its incoming fleet of Airbus A350s with advanced high-speed in-flight broadband. Safran, one of the largest aircraft equipment manufacturers and a key supplier of connectivity solutions to Airbus, selected ThinKom’s Ka-band commercial IFC terminal for both retrofit and linefit installation. SpaceX is also reported in talks with carriers about outfitting new aircraft with the Starlink Aero Terminal.

Closing the Business Case

The satellite industry has come a long way since the early 2000s when Boeing’s billion-dollar Connexion failed to close the business case for satellite-enabled IFC. Increased passenger uptake, low-SWaP, flat panel antennas and more on-orbit capacity have made the case more compelling. The continued deployment of high throughput Ka-band satellites also promises to increase available bandwidth, potentially lowering usage costs.

There are still questions about the business case for broadband IFC, both for airlines and satellite IFC equipment suppliers. A recent OneWeb survey found a majority of passengers (59%) rated current in-flight connectivity offerings as “very poor” to “moderate,” with roughly the same number dismissing the current service as unreliable. Most IFC services are unavailable at certain latitudes, such as Polar routes, which can ultimately harm a carrier’s reputation with its passengers.

Customer expectations for terrestrial-quality service remain a challenge for IFC providers. (Source: Pixabay)

Customer expectations for terrestrial-quality service remain a challenge for IFC providers. (Source: Pixabay)

According to Job Heimerikx, CEO and Founding Partner of AirFi, a low-band IFC provider, sometimes less is more. Rather than join the broadband race, AirFi partnered with Iridium and Skytrack on a “minimally invasive” windowpane-mounted antenna that can support a 22-88 Kbps link for texting, payment validation, flight update reporting and crew communications.

“Of course, everybody wants the best and the maximum. But are they willing to pay for it is a different question,” Heimerikx told Constellations. “The real business case for connectivity can be found in simple operational functions.”

Heimerikx noted that providing a reliable, low-band service was preferable for customers, such as low-cost carriers, that currently hold 32% of market share and are the fastest-growing segment in commercial aviation. In most cases, Ku and Ka-band systems are too expensive and require modifications to the aircraft fuselage, which is impractical for carriers that lease aircraft.

Still, there are strong positive signals that carriers that provide broadband IFC will see continued passenger uptake. A representative from Viasat reported that one of its customers, Qantas, had reached pre-COVID levels of IFC capacity usage, even though it was only filling two-thirds of the seats. This suggests that as providers increase capacity and service availability, passengers will continue to consume more bandwidth.

Explore More:

Podcast: Future of Satellite Connectivity and Other Key 2023 Space Trends

Podcast: The Intersection of LEO and 5G, Phased Array Antennas and Low-Power Connectivity

The Road to Interoperability: Transformation Beyond Teleports