ALEXANDRIA, Va. —The Northrop Grumman subsidiary SpaceLogistics announced the sale of three Mission Extension Pods (MEPs) to GEO operators Intelsat and Optus. The satellite life extension market may still be in its infancy, but the announcement meant SpaceLogistics successfully sold out of its second generation of propulsion augmentation devices.

President of SpaceLogistics, Tom Wilson stated, “This sale completes the launch manifest for our first tranche of MEPs and underscores the demand for our services.”

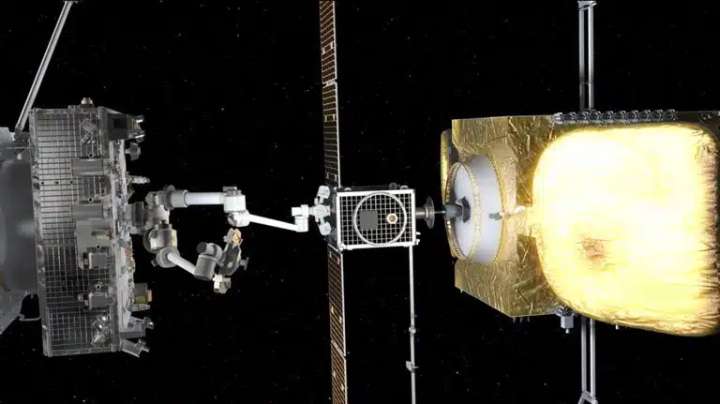

An artist’s rendering of the SpaceLogistics Mission Robotic Vehicle using robotic arms to attach a Mission Extension Pod that will augment propulsion systems and extend the service lives of commercial satellites. (Source: Northrop Grumman)

An artist’s rendering of the SpaceLogistics Mission Robotic Vehicle using robotic arms to attach a Mission Extension Pod that will augment propulsion systems and extend the service lives of commercial satellites. (Source: Northrop Grumman)

The life-extending jetpacks are scheduled for launch in 2024 on SpaceLogistics Mission Robotic Vehicle (MRV), a next-generation spacecraft outfitted with robotic arm capabilities and various sensors for rendezvous, proximity and docking. SpaceLogistics plans to install the Optus pod in 2025 and the two Intelsat pods in 2026. The pods will add six years of propulsion life to each satellite.

Some analysts have projected a multibillion-dollar market for in-space services, which includes life extension, debris removal, satellite repair, refueling, orbital transfer vehicles and in-space assembly and manufacturing. According to the latest State of the Satellite Industry Report, these services likely generated about $60 million in global revenues in 2022. However, they could become a more significant part of the space economy in the coming years, given government demand, potential returns on investment for operators and a growing global emphasis on sustainable orbits.

“This shows at least one company, Intelsat, which is the biggest GEO operator, thinks this is a valuable strategy for certain parts of their business model,” Brian Weeden Director of Program Planning for Secure World Foundation said of the SpaceLogistics sales.

While Optus and SES have demonstrated their interest in the services, the approach will not work for all GEO operators. Factors like the age of an operator’s fleet, existing capabilities, spectrum, service offerings and even openness to new technology adoption will play a role.

“In the future, you’re going to see different companies trying out different strategies,” Weeden continued. “Some will have an incentive to maximize the value of existing assets. Some are going to pivot to launching newer, more capable assets.”

Drivers of Early Adoption

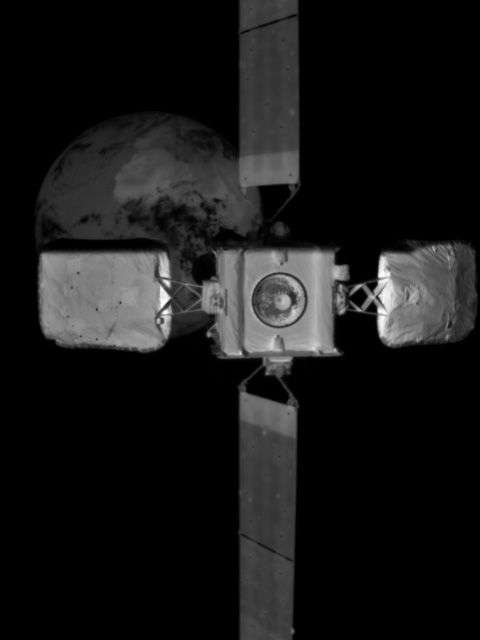

Intelsat’s June 20 announcement that it was purchasing a life extension pod marks the company’s second MEP order this year and its fourth order with SpaceLogistics. The companies made history in February 2020, with the first-ever in-orbit commercial spacecraft docking mission between SpaceLogistics’ first-generation Mission Extension Vehicle-1 (MEV-1) and the IS-901. They repeated the feat in 2021 when the MEV-2 docked with IS-10-02, adding five years of propulsion capabilities to the nearly 20-year-old satellite.

An image of Intelsat 10-02 taken by MEV-2’s infrared wide field of view camera before docking, April 2021. (Source: Northrop Grumman)

An image of Intelsat 10-02 taken by MEV-2’s infrared wide field of view camera before docking, April 2021. (Source: Northrop Grumman)

As an early adopter, Intelsat has repeatedly emphasized the significance of life extension technology for sustainability, reliable service and fueling the development of a new class of commercial capabilities.

“This commitment continues to build our unique self-insurance capabilities in space and is another step towards unlocking the potential of future in-orbit service applications,” said Intelsat Chief Technology Officer Bruno Fromont of the recent deal with SpaceLogistics.

Uncertain market conditions have also been a factor in driving some GEO operators’ interest in life extension. Orders for new GEO satellites have trended down in recent years alongside the rise of LEO constellations and high throughput satellites. The price of bandwidth has dropped steadily along with certain satellite service revenues.

Beyond questions about future demand, there is also a desire to optimize existing investments. Propulsion-based mission extension services help GEO operators address one of the biggest end-of-life predicaments: retire a functioning, revenue-generating satellite or risk running out of fuel and getting stranded in orbit. Even though there are plenty of cases of satellite payloads operating well beyond their scheduled life, space is not the place to “ride it til the wheels fall off.” It is difficult to predict fuel levels or when a catastrophic failure might turn an operational satellite into space junk. The 3,000-odd dead satellites stuck in orbit attest to that.

More In-Orbit Services and Servicers

A growing number of governments and commercial space actors have been developing various in-orbit services—beyond life extension missions. SpaceNews recently reported three of the emerging in-orbit servicing ventures raised $119 million in the first half of 2023 from private investors.

In addition to its work with SpaceLogistics, Intelsat has also partnered with Swiss-based ClearSpace, a European provider of in-orbit services. The two companies started their collaboration in 2022 but have not revealed the extent of their work together.

Astroscale, a leader in on-orbit services, entered the GEO life extension market in 2020 with its acquisition of Effective Space Solutions. The company is focused on government and commercial operators and is slated to launch its first Life Extension in-Orbit (LEXI) servicer by 2026. Astroscale was also the first company to team up with Orbit Fab, developers of Gas Stations in Space, for in-orbit refueling services for its LEXI spacecraft.

An artist’s concept of Astroscale’s Life Extension in-Orbit (LEXI) servicer. LEXI servicers are designed to be refueled and will assist commercial and government customers with attitude control, momentum management, inclination correction, GEO relocation and retirement to graveyard orbit.

An artist’s concept of Astroscale’s Life Extension in-Orbit (LEXI) servicer. LEXI servicers are designed to be refueled and will assist commercial and government customers with attitude control, momentum management, inclination correction, GEO relocation and retirement to graveyard orbit.

Starfish, a startup based in the Seattle area, is also optimistic about future demand for life extension services in GEO and deorbiting services in LEO. The company recently raised $14 million and launched its Otter Pup demonstration mission earlier this month. The mission hit a potentially critical snag with operators working to save Otter Pup after excessive rotation following an emergency deployment.

Governments continue to lead broader in-space servicing projects, such as those undertaken by the European Union and the UK Space Agency. The Italian Space Agency (ASI) recently contracted with a consortium of space companies, led by Thales Alenia for an in-orbit servicing demonstration. The demo will test the ability to refuel an orbiting satellite in LEO and is scheduled to launch in 2026.

JAXA and Astroscale Japan are collaborating on satellite refueling under the agency’s Space Innovation through Partnership and Co-creation (J-SPARC) program. The partnership is part of Japan’s broader approach to sustainable orbits through space debris removal, refueling, repairing and reusing spacecraft.

The U.S. Defense Advanced Research Projects Agency (DARPA) has been funding the Robotic Servicing of Geosynchronous Satellites (RSGS) program for several years to develop capabilities that can be joined to privately developed service vehicles to make “house calls in space.” This included an early attempt to support commercial satellite refueling and life extension for SES, which was ultimately canceled for financial reasons. More recently, RSGS has been working with SpaceLogistics on a next-gen robotic arm system for in-space repairs that will be deployed on the company’s MRV.

U.S. Space Systems Command has indicated the growing importance the military places on in-space servicing and advanced rendezvous and proximity operations with the creation of the Space Access, Mobility and Logistics program earlier this year.

Explore More:

Thales Alenia Space-Led Team Wins $225M for LEO In-Orbit Refueling Mission

Orbital Service Providers Respond to Call for ‘Space Tugs’

Podcast: Secure World Foundation on Space Sustainability and Commercial Partnerships

Podcast: Astroscale on Space Debris, Climate Change and Euthanasia for Satellites