Originally published by Northern Sky Research on December 19, 2023. Read the original article here.

2023 has brought about a lot of change in the satellite communications industry, not least the widespread consolidation that has taken place over the course of the year. In May, we saw the closing of Viasat’s acquisition of Inmarsat; three months later came the announcement that Echostar and DISH would merge; and finally, in September, the Eutelsat and OneWeb consolidation closed. The Viasat/Inmarsat and Eutelsat/OneWeb combinations are surely part of the companies’ wider response to mega-constellations as a whole. GEO operators who have traditionally operated in markets such as mobility, video and consumer broadband have concluded that they must respond to Starlink entering the market and certainly must act before even more Non-GEO capacity comes online.

As well as consolidation, satellite operators’ financial results have also shifted as a result of more Non-GEO capacity coming on to the market, with the impact being seen in several different areas. NSR’s Satellite Operator Financial KPIs, 13th Edition report noted that that the two operators with the largest US consumer broadband businesses, Hughes and Viasat, are seeing declines in their US consumer broadband revenues now as they are in direct competition with Starlink in the North American market. Following their 2022 consumer broadband revenue declines, both operators have this year diversified their markets through consolidation and have launched new GEO-capacity (with the caveat that the Viasat-3 Americas satellite suffered an antenna anomaly rendering only 10% of its capacity useable) which should boost their financial results in the coming years.

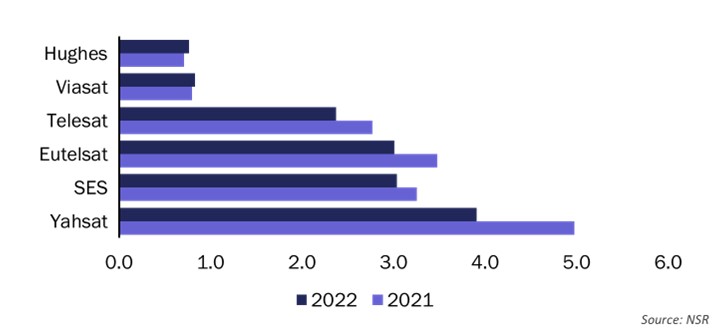

Across the board, it is clear that mega-constellations are having an impact on backlog, with committed backlog decreasing in 2022 for traditional FSS operators. NSR tracks a metric called years of backlog to annual revenue which reflects how many years of annual revenues an FSS operator has booked in its backlog. The industry average for this metric fell from 3.0 in 2018 to 2.3 in 2022 which points to shrinking contract durations. This is partly due to satellite customers negotiating shorter contracts as they await more satellite capacity supply in the coming years, and partly due to the weakness in the video segment which has traditionally seen long term contracts for satellite capacity.

Years of backlog to annual revenue ratio, 2021 and 2022 (Source: NSR)

Years of backlog to annual revenue ratio, 2021 and 2022 (Source: NSR)

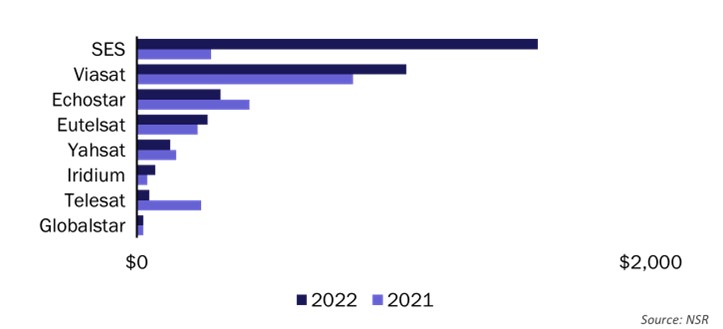

Although CapEx cycles differ for individual operators, 2022 was a year of increased capital spending for SES, Viasat and Eutelsat compared to the previous year with heavy investments being made in their next-generation networks. Will these investments pay off in their 2023 results and beyond? It remains to be seen, but they are at least investing in order to improve their systems and networks in a period of intense change. Although Telesat’s capital expenditures were lower in 2022 than 2021, the announcement in 2023 that they have switched manufacturers from Thales Alenia Space to MDA for the Lightspeed LEO constellation signifies the start of increased expenditures (over USD3.5 billion) as they attempt to catch up with what is now looking like a six-year delay from their original Lightspeed announcement.

CapEx (USD million), 2021 and 2022 (Source: NSR)

CapEx (USD million), 2021 and 2022 (Source: NSR)

The Bottom Line

The arrival of Starlink on the market and the imminent influx of even more capacity is impacting the financial results of industry players in many ways, from decreasing backlog, decreasing consumer broadband revenues to increasing CapEx. However, it is not all doom and gloom for legacy satellite operators. NSR anticipates a strong market outlook in the coming years thanks to the significant industry consolidation that has taken place in 2023, not forgetting the upcoming C-band proceeds which will boost liquidity and balance sheets of key players to support future growth strategies.

Originally published by Northern Sky Research on December 19, 2023. Read the original article here.