(Source: Globalstar)

(Source: Globalstar)

TUPPER LAKE, NY — Mobile satellite services provider Globalstar said supply-chain bottlenecks that had slowed production of its Spot personal communications devices were now behind it and that the company will begin beta testing its new two-way products with key customers by the end of the year.

Anchored by its wholesale partnership with Apple, and an Apple cash infusion that came with it, Globalstar now has the financing to pursue developments of its own outside of the Apple direct-to-device agreement.

With Apple’s backing, Globalstar has contracted with MDA Corp. of Canada, with Rocket Lab as a significant subcontractor, for 17 Globalstar satellites to launch in 2025.

Timothy Taylor, Globalstar vice president for finance, told an Aug. 3 investor call that the new satellites are on schedule. The company did not provide an update on its search for a launch-service provider but has said in the past it had begun talks with several of them. Globalstar wants all 17 satellites launched in 2025, a period in which the demand for medium- and heavy-lift rockets will stress the supply of proven vehicles.

Globalstar officials are continuing their policy of not mentioning Apple’s name or anything about the progress of the direct-to-device rollout on the iPhone 14.

The broader space sector is divided over how big this market will be and how quickly it will develop beyond emergency SOS messages. Globalstar competitor Iridium, working on its own direct-to-device roadmap, has said it could be 10-15 years before this becomes a large source of revenue.

Apple is paying 95% of the capex for the 17 new satellites and will get 85% of the capacity of the network. Globalstar is focusing its pitch to investors on what it plans to do with the remaining 15% of capacity, including its legacy businesses — one-way and two-way devices — in addition to its commercial IoT business, and its Band 53 terrestrial spectrum.

Qualcomm has agreed to integrate Band 53 into its chipsets, and Globalstar has set high expectations for how private terrestrial networks will adopt the technology.

Globalstar Chairman James Monroe did not name any specific partners or MoUs but said the work with Qualcomm is in “final engineering validation” and that he expected announcements soon. “The engineering is driven by the technical demands of the individual projects, not by our public company reporting calendar,” Monroe said.

He said the two-way devices are scheduled to enter commercial service this year and to sharply increase Globalstar’s per-subscriber revenue. The company is confident enough in this to have raised the low end of its forecasted 2023 revenue to $200 million from the previous $185 million.

Globalstar Chief Executive David Kagan. (Source: Globalstar)

Globalstar Chief Executive David Kagan. (Source: Globalstar)

Globalstar Chief Executive David Kagan said introduction of the two-way devices “is not just a product launch. This is also an entire infrastructure platform launch. Half of the infrastructure is already at every gateway that we need it to be. We’re seeing a significant uptick in unique messages processed as much as 30%.”

Globalstar must maintain a minimum cash balance under its Apple agreement and said that as of June 30 it had $65 million in cash and equivalents, double the level reported as of Dec. 31, 2022.

(Source: Globalstar)

(Source: Globalstar)

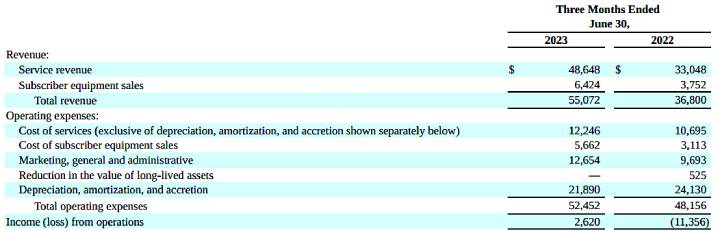

Revenue for the first three months of 2023, at $55.1 million, was up 50% from the same quarter last year. Despite an increase in operating costs, Globalstar reported operating income of $2.6 million for the three months ending June 30, compared to a loss of $11.4 million for the same period a year ago.

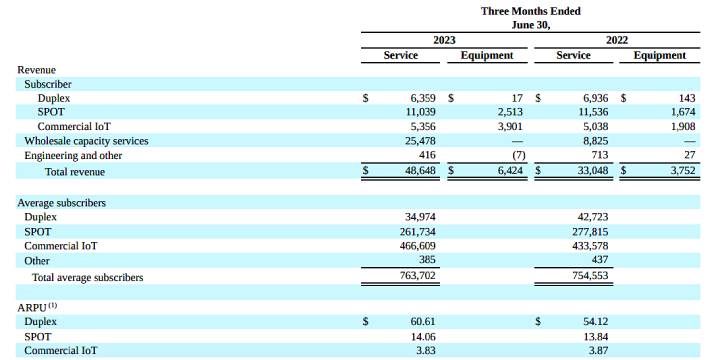

Service revenue in Q2 was $48.6 million, up 47% from a year earlier.

Globalstar reported wholesale capacity service revue — that’s Apple — of $25.5 million in Q2, similar to Q1 and a level the company said would remain stable in the coming quarters.

Commercial IoT subscribers continue to increase and totaled 466,600 as of June 30, up 7.6% from a year ago. These subscribers paid an average of $3.83 per month during the period. They now account for 61% of Globalstar’s subscriber base.

Read more from Space Intel Report.