Saudi Arabia sent two astronauts to the International Space Station on May 21, 2023 with Axiom’s Ax-2 mission onboard the SpaceX Falcon 9 rocket. (Source: Saudi Space Agency)

Saudi Arabia sent two astronauts to the International Space Station on May 21, 2023 with Axiom’s Ax-2 mission onboard the SpaceX Falcon 9 rocket. (Source: Saudi Space Agency)

WASHINGTON – As countries in the Middle East increasingly come to recognize the economic and strategic importance of space capabilities, many are leveraging partnership arrangements to rapidly expand their footprint in the sector.

These partnerships span the breadth of capabilities from communications and remote sensing to launch, satellite manufacturing, exploration and even human spaceflight. For several countries, particularly the oil-producing members of the Gulf Cooperation Council, space is a key element of an economic diversification strategy.

Steven Bochinger, executive advisor to Euroconsult, the Paris-based consultancy and market research firm, said the proliferation and variety of cooperative arrangements involving Middle East countries reflects the fact that the region, after years of relative inactivity, is finally getting serious about space.

“With regard to the Middle East, it used to be an underdeveloped space ecosystem, with a few activities but no agencies or strategy,” Bochinger said in an interview. “What we’ve seen over the last five years is that it’s getting more mature and more serious.”

In a written response to questions, Dr. Saoud Al Shoaili, head of Oman’s growing National Space Program (NSP) within the Ministry of Transport, Communications and Information Technology (MTCIT), said a lack of knowledge among key decisionmakers about space’s potential to benefit other areas of the economy was a key challenge to prioritizing space development. “It is only recently the sector has been recognized as an economic player and a national budget was allocated to develop it,” he said.

Part of the NSP’s mission, Al Shoaili said, is conducting workshops with the various stakeholders in Oman to spread the word about the benefits of space technology and applications. “We work closely, especially with government agencies to help them identify the applications that respond to their needs.”

UAE: Space Exploration to Drive Growth

One of the region’s biggest space players is the United Arab Emirates (UAE), which in 2014 established a space agency with an initial goal of launching a mission to Mars, dubbed Hope. At the time, the UAE was already active in satellite telecommunications and remote sensing but lacked an overarching strategy to pull it all together.

That changed in 2016 with the release of the UAE’s first space policy, which listed economic diversification, international cooperation and expanded utilization of space to protect vital national sectors—security, economic and social—among its main principles and goals. “We aim to position the United Arab Emirates among the world’s leading nations in space sciences before 2021,” Sheikh Khalifa Bin Zayad Al Nahyan, former president of the UAE, said in a statement included in the policy.

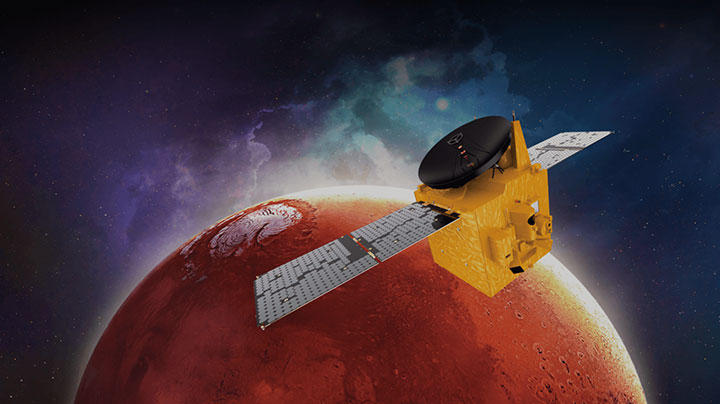

The Emirates Mars Mission, Hope (Misbar Al-Amal) was launched July 19, 2020, and went into orbit around Mars on February 9, 2021. (Source: UAE Space Agency)

The Emirates Mars Mission, Hope (Misbar Al-Amal) was launched July 19, 2020, and went into orbit around Mars on February 9, 2021. (Source: UAE Space Agency)

The UAE’s partnership principle was readily apparent in Hope, which was developed in cooperation with several U.S. entities, including the Laboratory for Atmospheric and Space Physics in Boulder, Colo. Launched in July 2020 aboard a Japanese HIIA rocket, Hope became the first Arab spacecraft to reach Martian orbit in February 2021 – a date that by design coincided with the 50th anniversary of the UAE’s founding – and continues to study the red planet’s atmosphere.

Saudi Arabia: Embracing a Strategy to Advance Space Capabilities

Saudi Arabia, whose capital of Riyadh is the longtime home to the 21-nation Arabsat satellite telecommunications consortium, and which has long been active in national space endeavors, established the Saudi Space Commission in late 2018. That organization officially became the Saudi Space Agency earlier this year with the objective of establishing the country as a regional and international leader in space.

Saudi Arabia is expected to release a space strategy soon that will drive significant investments across a number of initiatives, Bochinger said.

Those investments are happening already. In August 2023, for example, Houston-based Axiom Space, which is developing a commercial space station, announced it had secured $350 million in investment from a group led by Aljazira Capital of Riyadh and South Korean pharmaceutical company Boryung Co.

In a statement, Aljazira chief executive Naif AlMesned stressed the importance of innovation across various sectors. “In line with the Saudi Vision 2030’s transformative approach, we acknowledge the need for technology toward the advancement of human life. To that end, we are excited to support Axiom Space along its journey of building for beyond.”

In a statement to Constellations, Axiom Space Chief Financial Officer Mike Lungariello said the company’s global orientation is reflected in its investor and customer base. “We see the relationship with Aljazira and more broadly with Saudi Arabia as synergistic, allowing Axiom Space to play a role in supporting one nation’s ambitions to become a significant player in the space sector while propelling the region’s space capabilities forward,” he said.

Saudi Arabia’s space ambitions extend to satellite manufacturing, as evidenced by the October announcement that Hong Kong-based ASPACE would invest a reported $266 million to set up a 4.5 million square-meter satellite manufacturing facility in Riyadh that is scheduled to open in October 2024. “It’s all about capability building,” Bochinger said of this and other Middle East partnership arrangements, both announced and as-yet-unannounced.

Additional Space Partnerships

Some other notable partnerships involving emerging Middle East space players include:

Oman

- Oman’s National Aerospace Services Company, the sultanate’s leading space company, signed a contract with UK Launch Services Inc. to deliver a master plan for an Omani spaceport. The master plan for the Etlaq Spaceport on the Arabian Sea is scheduled to be unveiled in January 2024 at the Middle East Space Conference in Muscat, Oman.

Turkey

-

Sierra Nevada Corp., a U.S. company, in 2022 announced a memorandum of cooperation with the Turkish Space Agency and the Turkish engineering firm, ESEN Sistem Entegrasyo, in the area of low Earth orbit, lunar and astronaut programs. Serdar Hüseyin Yildirim, president of the Turkish Space Agency, said leveraging Sierra Space’s technologies will bring “tremendous benefits for our industries and future space projects.”

Turkey’s first astronaut is scheduled for launch to the International Space Station in January 2023 as part of the Axiom-3 mission. (Source: Turkish Space Agency)

Turkey’s first astronaut is scheduled for launch to the International Space Station in January 2023 as part of the Axiom-3 mission. (Source: Turkish Space Agency)

Cem Ugur, director general of ESEN, said the partnership will help build the Turkish space economy. “As we work in partnership to further propel Sierra Space’s advanced technologies and commercial space projects, we can advance commercial space development for those around the world,” he said in a statement.

UAE

- The UAE entered a partnership with U.S. Earth observation service provider Planet to create a satellite-based atlas of at-risk areas in an unspecified country for climate change resilience. “This project is an act of data diplomacy from the UAE to a country facing disproportionate risks from climate change, and it’s vital to help it access the digital tools and resources to manage for a sustainable and secure future,” Salem Butti Al Qubaisi, director general of the UAE Space Agency, said in a statement.

- The UAE Space Agency in November inked a deal with the EDGE Group, the Abu Dhabi-based defense technology company, to develop a constellation of three synthetic aperture radar (SAR) imaging satellites. A noteworthy aspect of this arrangement, Bochinger said, is that it involves two Middle Eastern entities, as opposed to an outside player with more advanced space capabilities. Bochinger said he hopes and expects to see intraregional partnerships blossom as the Middle East space industry matures.

Bahrain

- Another example of a regional partnership is the Kingdom of Bahrain’s first satellite, Light 1, which was built in cooperation with the UAE Space Agency. Deployed in December 2021 from the International Space Station, Light 1 is a CubeSat designed to monitor gamma ray flashes from thunderstorms and cumulus clouds. That project helped pave the way for Bahrain’s first all-domestic satellite, Al Munther, now under construction. Dr. Mohammed Ibrahim Al Aseeri, chief executive of the Bahrain National Space Science Authority, announced in November that the Earth observing satellite was 55% complete and scheduled to launch in 2024.

These partnerships and programs are just the tip of the iceberg, Bochinger said, adding that in 2023, Middle East organizations entered into 20-30 partnership arrangements in Earth observation alone. He concluded, “In my opinion, the Middle East is going to be the fastest growing region for space worldwide.”

Explore More:

Podcast: The Opportunities, Challenges and Future of the Middle East Space Sector

Exploring the MENA Space Sector’s Dynamic Investment Landscape

How Regional Players Are Using Space to Strengthen Non-Space Sectors

Network Operators Anchor on 5G

Earth Observation Market Trends to More Growth and Value from Data