Originally published by Space Intel Report on May 9, 2025. Read the original article here.

(Source: EchoStar May 9 investor presentation)

(Source: EchoStar May 9 investor presentation)

LA PLATA, Maryland — EchoStar Corp., which has regulatory rights to deploy a global S-band mobile direct-to-device (D2D)/IoT service but has done little to deploy it, said it will move only when the installed base of smartphones and other devices compatible with D2D is ready.

In a May 9 investor call, Chief Executive Hamid Akhavan insisted that any D2D service launched now would be either premature or, if using terrestrial spectrum instead of satellite spectrum, would be hobbled by regulatory restrictions to prevent interference with neighboring cell service.

“There may be a natural question as to why it is taking time,” Akhavan said. “The answer is: We would not have built a system that is not at the 5G LORAN standard, simply because one of the benefits of the business case is that it is built into standard handsets. We do not have to manufacture or subsidize or uniquely market and distribute. It will be built into every device.

‘If I had a satellite today, I would not launch it today’

“Those chipsets are in the making now. If I had a satellite today, I would not launch it today. If there are no devices to talk to, what is the point of depreciating the expensive asset without being able to get revenue from it?”

Akhavan shares the view of owners of mobile satellite spectrum, including Iridium Communications, Globalstar and Viasat, that using terrestrial radio frequencies to provide D2D will be forced to limit their coverage anywhere near national borders where terrestrial wireless operators are operating.

Iridium has said that only a handful of nations are large enough to accommodate the kind of service planned by SpaceX Starlink, Lynk Global and AST SpaceMobile, which use spectrum from terrestrial wireless network providers under a revenue-sharing scheme.

“Anybody doing that is planning to do that soon is going to be regional,” Akhavan said. “You are going to have incredible restrictions. Within hundreds of kilometers of a border you are going to start interfering with neighboring countries’ carriers and networks.

“There are bits and pieces of sub-critical solutions that are not of any interest to us. Our interest is a universal solution, everywhere, no interference, no coverage holes, no restrictions. For that nobody is ahead of us and I don’t believe anybody is going to be ahead of us.”

“It is not that we are late. If anyone else is doing it earlier, either they are doing it not based on 3GPP 5G standards, or they are doing it with devices that are not compatible with it,” he said.

EchoStar is managing the buildout of the Boost terrestrial wireless network in the United States, competing with incumbents T-Mobile, AT&T and Verizon, all of whom are looking at a D2D service managed by an operator with a satellite constellation that would use telco spectrum. It is a challenger’s position that requires heavy investment.

EchoStar has begun launching what is planned as a 28-satellite constellation to provide narrowband IoT. It is not a D2D service that goes to unmodified smartphones.

(Source: EchoStar mobile)

(Source: EchoStar mobile)

The company also operates, via its Ireland-based EchoStar Mobile, a network that provides specialized mobile devices connecting to a large S-band satellite in geostationary orbit over Europe. But here too, EchoStar’s plans for D2D are far more ambitious.

“We are not focusing on that” as a model, Akhavan said of the EchoStar Mobile business. “Our aspiration for direct to device is to bring in the service that would be indistinguishable from what you use from the device in your pocket, anywhere in the world. That is our aspiration and nobody in the world does that in a proper way today.”

Akhavan said that while EchoStar already has, in-house, all the ingredients of a D2D service — terrestrial spectrum, both S-band globally and AWS-4 in the United States, a satellite service arm in Hughes Network Systems and a spectrum portfolio purchased over 15 years — it is not opposed to working with a partner. The most logical choice for a partner would be a company willing to invest in the global satellite infrastructure that would provide the service.

Akhavan said EchoStar’s S-band “is not utilized in such a way that we would have to clear it or clean it, like L-band and others have to do.” L-band satellite operators likely would argue that, depending on the D2D service, they do not see their current services needing major repackaging to accommodate D2D.

(Source: EchoStar May 9 SEC filing)

(Source: EchoStar May 9 SEC filing)

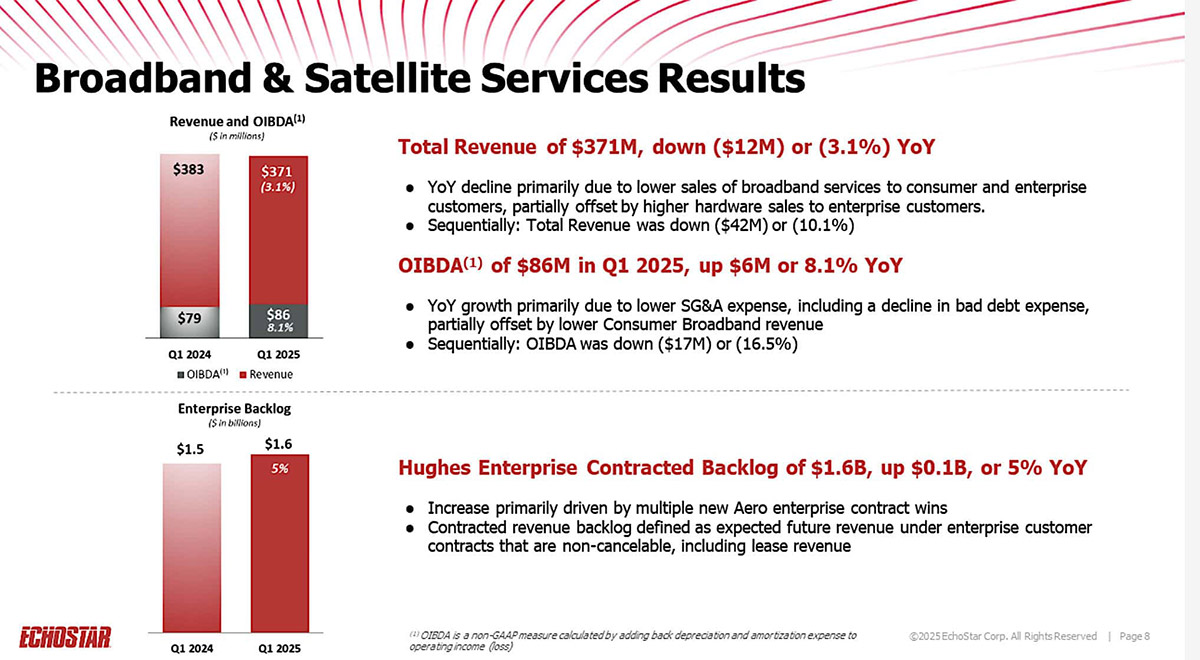

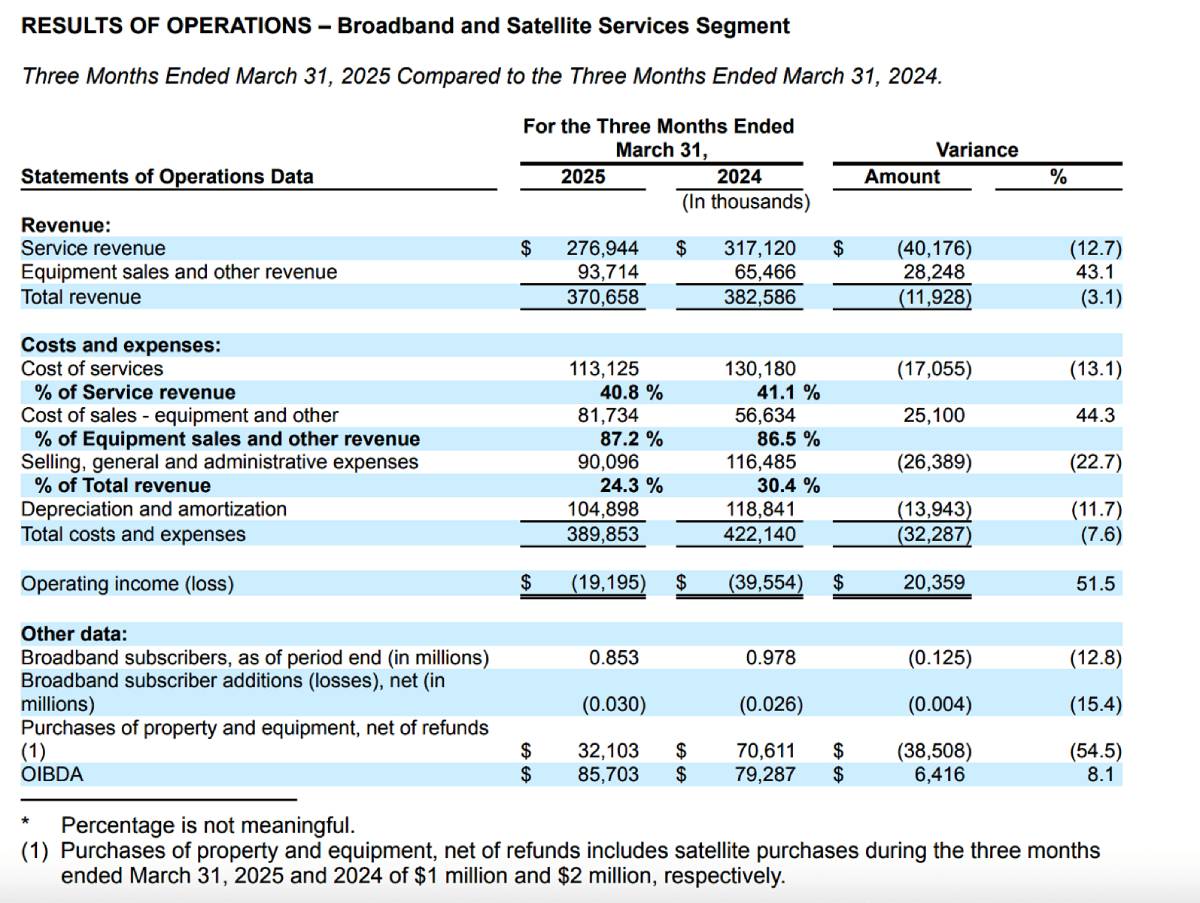

For the three months ending March 31, EchoStar’s Hughes satellite and broadband division reported an operating loss of $19.2 million on revenue of $371 million. Revenue was down 3% from a year ago.

Service revenue, at $277 million, was down 12.7%. The company attributed the decline to lower sales to both North American and international consumer and enterprise customers.

Hughes’s Ka-band broadband service reported a subscriber base of 853,000 as of March 31, down 12.8% from a year ago. The company is focusing on enterprise customers and has made inroads in in-flight connectivity, notably with contracts with Delta Air Lines for Delta’s regional U.S. fleet.

Hughes recently joint Airbus’s HBCplus program, which allows Airbus’s airline customers to select their preferred broadband connectivity service from a catalogue, with the antenna hardware installed at Airbus’s factory before delivery.

Hughes equipment sales and other revenue increased 43% during the quarter, to $94 million, on sales to North American enterprise customers.

Originally published by Space Intel Report on May 9, 2025. Read the original article here.