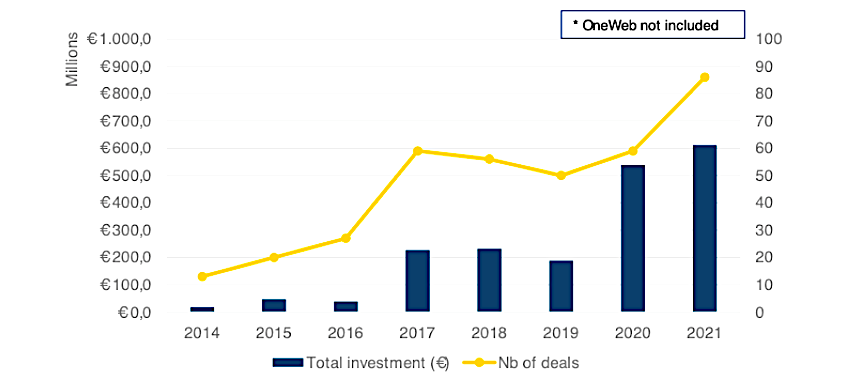

The European Space Policy Institute (ESPI) annual space-funding survey found a record 611.5 million euros from 86 transactions in the EU in 2021, up from 535 million euros in 2020, also a record. Credit: ESPI

The European Space Policy Institute (ESPI) annual space-funding survey found a record 611.5 million euros from 86 transactions in the EU in 2021, up from 535 million euros in 2020, also a record. Credit: ESPI

PARIS — The European Commission, the European Investment Bank and InvestEU on April 27 opened Cassini Fund, which aims to invest 1 billion euros ($1.06 billion) through 2027 into space startups through partnerships with European investment funds.

Cassini’s goal is to invest in around 60 space startups per year once it is fully operational by creating 4-6 new investment funds per year.

Cassini arrives at a time when once-hesitant European markets are now much more favorably disposed to providing capital to early-stage space startups, so much so that many of these companies are now pleading for a refocus.

Instead of grants or equity, they say, what’s needed is contracts from European government agencies to use their service or hardware. Having the European Commission, the European Space Agency (ESA) or the European Union Agency for the Space Program (EUSPA) — or national space agencies — as a reference will unlock future contracts and capital.

But the European Commission remains concerned that young companies are still tempted to sell equity to UI.S.-based venture capital investors or, worse, move their operations to the United States because of the difficulty of securing financing in Europe.

“Europe is not short of vibrant start-ups that have disruptive ideas and technologies,” European Commission Vice President Thierry Breton said in January in announcing Cassini. “But many of our start-ups cannot get sizable equity investment in the EU once they need to scale up. They have no choice but to turn to non-EU investors. This is a major loss for Europe. The Cassini Fund will be a game changer.”

Breton said Cassini would be complemented by an EIB-managed debt facility to aid startup space companies for which debt financing is otherwise difficult to secure.

The European Investment Fund (EIF) typically invests for a period of between five and 20 years before exiting.

Cassini will be run according to the same selection criteria as the rest of the European Investment Fund. Credit: European Commission

Cassini will be run according to the same selection criteria as the rest of the European Investment Fund. Credit: European Commission

The InvestEU Equity term sheet sets multiple conditions for what it calls the Financial Intermediaries, or the fund managers that will manage the investment. Funding on behalf of Cassini will be at least 7.5% of the total commitments by the investment vehicle, and no more than 25%. On rare occasions, the 25% maximum may be waived.

InvestEU Equity will invest no more than 100 million euros in any given commitment. Fund managers must agree that the InvestEU investment will not be subordinated to other investors. At least 30% of the total capital raised for a fund will come from third-party investors.

The targeted investments in space run the gamut of hardware and applications from R&D to manufacturing of components for full satellite, launch vehicle or ground-based systems.

Also included are “data processing, analytical tools and artificial intelligence for use with space data or other data sources” as well as “space exploration and autonomous exploration vehicles.”

InvestEU will be maintaining a list of venture capital funds that have been cleared for participation in Cassini. Currently four funds have been cleared: Primo Space of Italy, in which the EIF has invested 30 million euros; Orbital Ventures/Promus Ventures of Luxembourg, which has received 40 million in EIF commitments; Vsquared Ventures of Germany and UVC Partners, also of Germany.

Read more from Space Intel Report.