ALEXANDRIA, Va. — The rapid growth of optical inter-satellite links (ISL) has caused mixed reactions among ground service providers. In its 2022 report on Ground Segment Market Prospects, Euroconsult named ISLs among the “threats for the overall ground segment market.”

An optically interconnected mesh network of satellites inevitably shrinks the footprint of the ground station. Satellites no longer have to wait to downlink over a particular site. They can relay data to another bird in view of a ground station, providing a constant connection with LEO and MEO constellations. As Euroconsult noted, the architecture allows for global coverage with lower latency, smaller ground infrastructure and fewer constraints associated with landing rights.

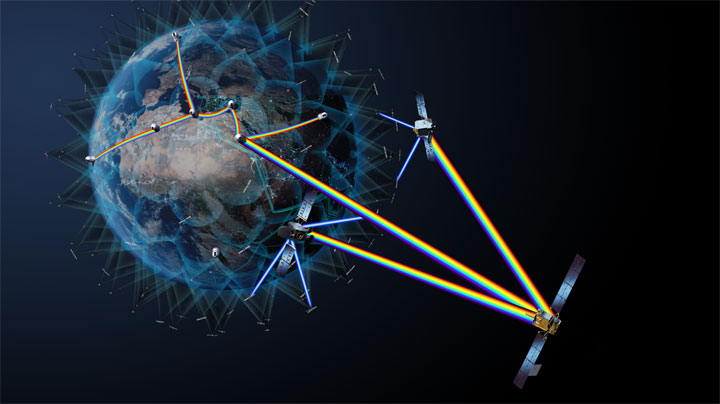

A laser communication network between satellites envisioned by the European Space Agency. Governments and militaries have been driving the growth of the optical terminal market. (Source: ESA)

A laser communication network between satellites envisioned by the European Space Agency. Governments and militaries have been driving the growth of the optical terminal market. (Source: ESA)

Over the next five years, the global market for laser communications terminals is expected to exceed $6 billion with optical crosslinks as the leading growth segment. By the end of the decade, approximately 34,000 laser communications terminals will be launched on 8,900 satellites.

Much of this growth is being driven by government and military applications such as DARPA’s Blackjack program or the Space Development Agency’s (SDA) laser-linked transport layer—the Proliferated Warfighter Space Architecture. Commercial mega-constellation operators, like Starlink and OneWeb have contributed significantly to ISL growth, with both companies announcing their next-generation satellites will be fully optically interconnected.

How I Learned to Stop Worrying and Love Satellite Crosslinks

While there are concerns about how the mesh network concept could disrupt the ground market and pave the way to optical ground sites, others see a complementary technology capable of accelerating ground demand.

“The reality is, any data that is produced in space needs to come down, one way or the other,” Leaf Space USA Managing Director Jai Dialani told Constellations.

Whether it’s a direct downlink, a data relay satellite or an optically connected satellite in the same orbital plane, there is no removing the ground from the equation. A satellite that passes data between crosslinks can increase contact utilization of any given antenna, effectively allowing satellite operators to make more passes on the same site.

“The unique challenge that optical crosslinks present is it creates more demand on existing ground stations,” Dialani said during a panel discussion at the 2023 SmallSat Symposium.

Pam Lugos, VP of Business Development Satcom Products at Communications & Power Industries (CPI),

reaffirmed that optical crosslinks would create new pressures on manufacturers. “While there may be fewer ground stations, their capabilities have to increase to be able to accommodate all of this [traffic],” she said.

More Passes, Higher Utilization

For Leaf Space, a ground segment-as-a-service provider (GSaaS), increased utilization of existing ground sites may be a challenge, but it is not necessarily a problem. The company currently operates a network of 17 antennas in 12 countries and has plans to add more this year. In just the last year, the company saw demand on its network nearly double and averaged 9,000 passes per month.

Once an antenna is at around 75-80% capacity, it becomes more difficult to schedule new users, Dailani noted. The use of inter-satellite links could push more ground stations to capacity sooner, requiring operators to evaluate capacity at existing sites and plan for expansion.

Leaf Space successfully deployed and activated a new proprietary ground station in the Azores in September 2022, adding to its global GSaaS network. (Source: Leaf Space)

Leaf Space successfully deployed and activated a new proprietary ground station in the Azores in September 2022, adding to its global GSaaS network. (Source: Leaf Space)

“That doesn’t mean they’re a threat to ground stations,” said Dialani. “With more passes, [the ground station] gets increasingly utilized and with increased utilization comes scheduling challenges… So, you double capacity at existing locations as a way to resolve those challenges.”

Over the last five years, the total number of active ground sites has diminished, according to Euroconsult. This has coincided with the decline in satellite broadcasting, the consolidation around larger sites that can offer better returns and the growth of leasing and sharing models, like GSaaS. The number of ground sites is expected to continue to drop through the next decade while the number of deployed antennas will grow by nearly 50%. As the trend suggests, companies tend to take advantage of existing locations to deploy new ground segments or antennas, avoiding the costs, regulatory hurdles and infrastructure demands of building a completely new site.

Adding Capacity and Capabilities

More capable antennas, like phased arrays that can link to multiple orbits, multiple frequencies, and even multiple satellites simultaneously, could help increase the capacity and flexibility of ground stations. However, their high price point will likely make traditional parabolic antennas an attractive option for some ground operators in the coming years. Dailani was open to the possibility that phased arrays could help address scheduling challenges, but it would require heavy demand to close the business case.

Other strains on the ground station related to backhauling larger volumes of data from the gateway to the cloud or data center have become less of a concern. The increased adoption of digital ground solutions has helped reduce the time and cost of deploying ground systems, while increasing flexibility and the ability to automate workflows.

There is no denying that optical crosslinks will be a game-changer in creating fully connected constellations. They’ll add speed, security and data throughput in space. Moreover, the U.S. Department of Defense’s technical standards for optical terminals will support interoperability.

Industry leaders are now raising the prospects of terabyte-class satellites and working to overcome the technical challenges associated with optical ground stations. But these developments, particularly optical ground, are still years away. RF ground stations will continue to dominate into the next decade and will continue to become more capable, cost-effective and flexible through increased digitalization, hardware virtualization and multi-capable antennas.

Explore More:

Podcast with Mynaric: Laser Terminals as a Global Market Disruptor

Digitalization of Ground Service, Market Changes: What’s Next for GSaaS?

Podcast with Leanspace: Building Your Own Ground Segment