Arabsat Chief Strategy Officer Abdulhadi Al Hasani. Credit: World Space Risk Forum video

Arabsat Chief Strategy Officer Abdulhadi Al Hasani. Credit: World Space Risk Forum video

PARIS — Satellite fleet operator Arabsat said software-defined satellites are the future of geostationary-orbit companies and offer a defense against market encroachment by constellations of low-orbiting satellites.

Riyadh, Saudi Arabia-based Arabsat also dismissed market forecasts showing a regular decline in video broadcasting, saying the company’s direct-to-home television business is holding steady in hits home region, in part because video streaming is not as develop in the Middle East and North Africa as it is in Europe and North America.

“The experts look into crystal balls and say [satellite-delivered] video is disappearing, but in our part of the world it has been quite strong,” said Abdulhadi Al Hasani, Arabsat’s chief strategy officer. “It is not growing, but it is plateauing, so we don’t see huge new demand, but we don’t see catastrophic changes, either.”

Arabsat has 10 satellites in orbit and has two on order. The latest order, of Arabsat 7A, is a Thales Alenia Space Space Inspire model, which is softwaredefined and offers its owner large flexibility in determining its footprint, target markets and frequency plan.

Arabsat 7A, to operate from Arabsat’s 30.5 degrees east, will have a Ku-band high-throughput-satellite payload in addition to its role of replacing the Arabsat 5A satellite when it retires.

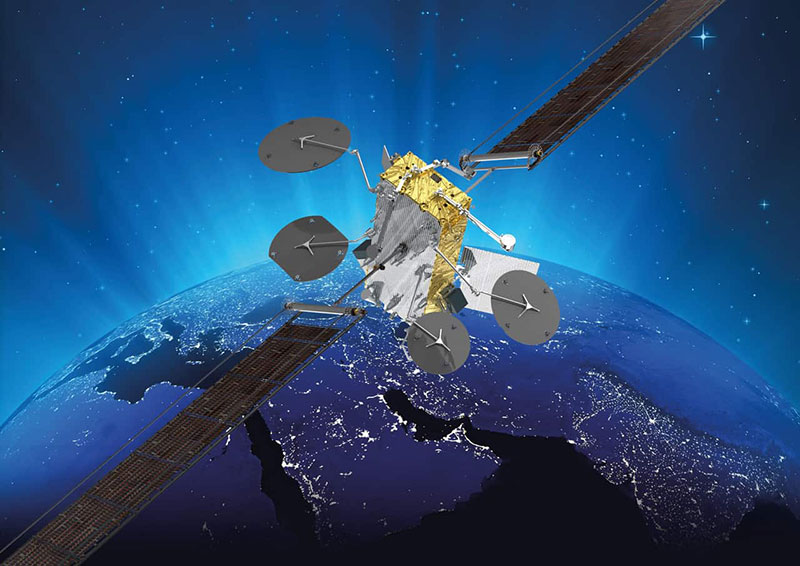

Arabsat 7A satellite, under construction by Thales Alenia Space. Credit: Thales

Arabsat 7A satellite, under construction by Thales Alenia Space. Credit: Thales

This new generation of satellite — Airbus Defence and Space and Boeing Satellite Systems have introduced their own models, and Airbus has already sold half a dozen of its design, called OneSat — is a way of future-proofing a business model over the 15-20 years of a geostationary satellite’s service life.

“Arabsat believes that software-defined satellites are the future of the GEO industry and are our secret weapon to combat competition from the lower orbits,” Al Hasani said here Sept. 13 at Euroconsult World Satellite Business Week.

Al Hasani said Arabsat has been turning away customers who want what he called “ad hoc” capacity for short periods of time. In addition, Arabsat is going after regional government universal service obligation programs designed to deploy broadband access in unserved areas.

Like other satellite operators, Arabsat is moving to a business of direct contact with customers rather than remaining a satellite wholesaler dealing in longterm contracts with distribution partners.

“The growth in demand will come from data. We don’t like it, but data is becoming more and more monetized,” he said. “That’s why we need to move down the value chain, to get closer to customers. We are investing in our infrastructure there.”

This is where the company eventually will meet competition from broadband constellations now being developed, starting with SpaceX Starlink and OneWeb. Both these constellations started out as mainly providers of consumer broadband. Both have now switched — OneWeb completely, Starlink only partially — toward a B2B model.

Arabsat’s response to these coming competitors is becoming clearer. Al Hasani said the company would order a Ka-band HTS satellite either late this year or early in 2023.

He said he would like the satellite, called Badr-9, to launch in 2025-2026 — “We need that satellite desperately,” he said — but realizes this may not be possible. As an interim step, Arabsat is looking to lease Ka-band capacity in the region from another satellite operator. How simple this will be is unclear; he said “we have spoken to people who have Ka-band that we can work with.”

“We are seeing a lot of demand for Ka-band HTS service in different areas,” Al Hasani said. “Some of it is long-term and some is ad hoc. We need to cater to that right now and we don’t have the capacity.

Read more from Space Intel Report.