Credit: NASA

Credit: NASA

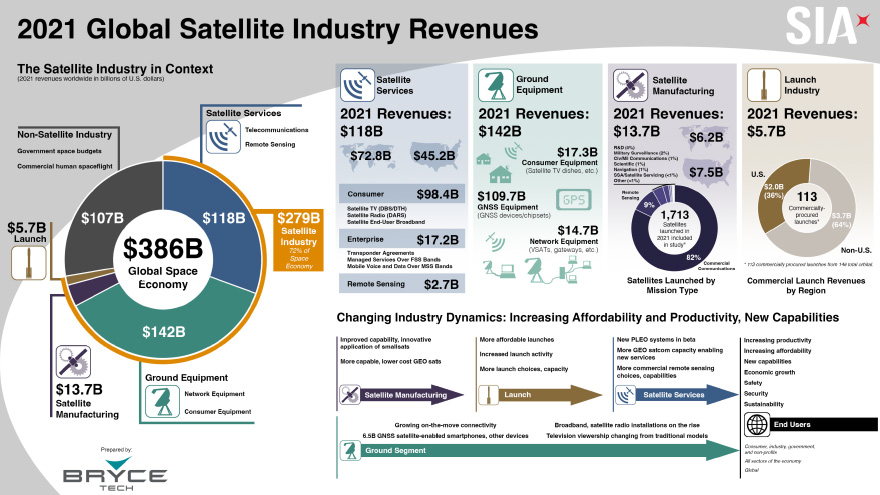

WASHINGTON — Satellites have become more affordable than ever before, largely due to improvements in capacity, high data throughput and more launch options, according to the 2022 SIA State of the Satellite Industry report. This dynamic took hold in a year that saw the most satellites ever put into orbit along with a dramatic increase in available bandwidth and a continued shift to larger constellations of small satellites.

Production at scale, miniaturization, virtualization, efficiencies in the use of orbital spectrum and additional launch vehicles have all contributed to cost reductions in satellite manufacturing, services and launch according to the SIA.

Technologies and platforms that are just emerging or becoming more widely available are expected to continue driving down relative costs in the future. This is particularly true of ground networks that are starting to catch up with the on-orbit trends of the last 5 to 10 years. For example, software-defined ground networks that are as dynamic and flexible as software-defined satellites. Virtualization, automation and orchestration of terrestrial networks, as well as cloud-based, hybrid and ground station as-a-service (GSaaS) options are already showing promise in driving down costs and keeping pace with expanding on-orbit capacity.

The Trend Toward More Affordable Satellites

Between 2013 and 2021, the overall throughput per kg of satellite weight increased six times as more HTS and VHTS satellites went from the production floor into orbit. During the same time, the manufacturing cost per Gbps of capacity has dropped by 90%. As a result of these manufacturing improvements, satellite service now costs one-tenth of what is did in 2013 and the number of satellite broadband subscribers has increased 50%, SIA reported. Deploying satellites has also gotten less expensive with reusable launch vehicles and more ridesharing options. Launch industry revenue increased by only 7.5% from 2020 levels, even as the number of launches rose by 28%. Those costs are expected to continue on the decline as dozens of small launch vehicles and several next-generation medium to heavy launch vehicles become operational within a few years.

“The satellite industry is continuing to experience increased affordability, productivity while delivering new capabilities,” said Nick Boensch, a program analyst with Bryce Space Technology who spoke about the report during a webinar. “The…affordability of the satellites continues to astonish me.”

Very high throughput satellites (VHTS) and high throughput satellites (HTS) have contributed most significantly to driving down the average cost per Gbps, Boensch noted. Many recently deployed HTS have anywhere from 20 to 1,000 times the bandwidth of traditional FSS satellites, with ViaSat boasting data speeds of up to 1 Tbps. These capabilities have also led to lower-cost GEO satellites and more options for commercial remote sensing. Software-defined payloads are lowering service costs by delivering more speed and flexibility for different missions and spectrum areas. At the same time, improved sensors, inter-satellite links, cloud-integrated ground stations and miniaturized technologies are further transforming the industry.

2021 Global Satellite Industry Revenues. Credit: SIA

2021 Global Satellite Industry Revenues. Credit: SIA

On the manufacturing side, affordability has been driven by scaling production for more standardized modular satellites that are both more sophisticated and compact. In 2021, Smallsats (<600 kg) accounting for nearly three-quarters of all satellites launched. Unique specialized payloads continue to drive revenues despite accounting for only a small fraction of production.

The ground segment, which accounted for the largest portion of global satellite industry revenue, generally tracked the affordability of satellite services, particularly consumer and network equipment. For the second year in a row, ground equipment was the largest portion of global satellite industry revenues, bringing in $141.7 billion—almost 20% more than satellite services and 25 times as much as the launch sector. GNSS equipment accounted for the largest portion of ground revenue, driven by satellite navigation-enabled devices for air, maritime, surveying and rail, as well as a notable increase in the number of connected and automated driving systems. The consumer ground segment for LEO broadband constellations remains relatively expensive, Boensch told Constellations. He added that companies will need to achieve lower costs for ground terminals through economies of scale and technology maturation if they aim to reach more consumers and become competitive.

Affordable Ground Networks Continue Evolving

There has been no interruption in the yearslong trend of more satellites in orbit, more sensors, more capability and dramatically more data. Because satellites are limited in the data they can store or process on board, this has created new demands on traditional ground stations, many of which are not equipped to meet the accelerated bandwidth management and other requirements of newer constellations.

Older infrastructure can’t be scaled economically to accommodate multi-orbit, multi-band network architectures. This affects legacy GEO ground stations most significantly. While the issue is not yet critical, the ground segment is still susceptible to the market disruptions that have shaken up the rest of the industry.

In the past, ground systems accounted for only a fraction of the cost of a satellite. While they have not necessarily become more expensive, the pace of cost savings for the ground have not been as dramatic as other parts of the industry. For example, the ground system for a recently launched Indonesian Pasifik Satelit Nusantara (PSN) high throughput satellite cost three times as much as the payload. Partly, this was because of the lower cost of HTS satellites and the tendency for higher capacity in space to increase complexities on the ground, including additional labor to deliver services. But it also indicates how the platforms and technologies that have made satellites more efficient and affordable, could have a similar effect on ground systems.

“The old ways of doing business will not cost-effectively scale to meet the new needs of high-capacity, high-throughput satellites,” said Stuart Daughtridge, SIA board member and Vice President of Advanced Technology at Kratos. “New ground system architecture and new operating models will be needed to handle this growth.”

The cloud-based GSaaS model offered by Microsoft, Amazon and KSAT is one of the industry changes that promises to move the needle toward more affordable space ground networks. GSaaS is seen as an attractive option for smaller industry participants who pay by the pass and can access their assets virtually anytime from anywhere. The model reduces CapEx investment and can provide command and control, data processing and storage services at a fraction of the cost of building a system from scratch.

Virtualization of standalone hardware components may be all some companies need to achieve cost-saving benefits. Software applications that take the place of dedicated hardware are helping to achieve greater agility and faster innovation cycles and can make it easier to integrate those components with terrestrial networks, like cloud services or 5G. At this time, almost every piece of a ground station can be virtualized. However, orchestrating those components into unified, software-defined space networks will be something for larger, more complex missions and business.

Phased array or self-configuring antennas could also help commercial ground equipment keep pace with the growth of LEO broadband providers. Though currently expensive, their cost is expected to come down as the customer base grows and production increases.

The 2022 SIA report shows the continued effects of disruptive technology on the cost per bit from orbit, the cost per kg of satellite and the cost of launching payloads. Those trends have been highly beneficial for consumers and the industry as a whole. As the industry continues to grow, so will the need for scalable space and ground networks that can adapt to greater levels of operations efficiency and integration cycles.

Explore more:

Webinar: Software-Defined Satellites Meet Software-Defined Ground

A New and Emerging Software-Defined Satellite Industry

5 Reasons Why the Ground Segment Needs Virtualisation