Iridium CEO Matt Desch, left, and Qualcomm CEO Cristiano Amon on signing their agreement. Ten months later, Qualcomm has concluded that its customers, the mobile-phone manufacturers, have not demonstrated enough enthusiasm for direct-to-device to make it worthwhile. (Source: Qualcomm)

Iridium CEO Matt Desch, left, and Qualcomm CEO Cristiano Amon on signing their agreement. Ten months later, Qualcomm has concluded that its customers, the mobile-phone manufacturers, have not demonstrated enough enthusiasm for direct-to-device to make it worthwhile. (Source: Qualcomm)

LA PLATA, Maryland — Qualcomm Technologies Inc. is terminating its agreement with mobile satellite services provider Iridium Communications to embed Iridium connectivity into Qualcomm’s Snapdragon mobile platform, saying smartphone manufacturers have not adopted the technology.

The announcement, made by Iridium on Nov. 9, comes at a time when the satellite industry is deeply conflicted about whether so-called direct-to-device (D2D) or direct-to-cell connectivity is going to be a hit with smartphone owners.

It comes just a few days after Qualcomm’s former chief executive and chairman, Dr. Paul E. Jacobs — now CEO of mobile satellite operator Globalstar — expressed doubts about whether D2D would ever advance beyond the current Globalstar-Apple service offering emergency messaging to become a profitable business.

Jacobs’s remarks drew dismissive comments on social media, especially by those who have endorsed the investment story told by AST SpaceMobile and Lynk Global. Both these companies say they have solved the problem and will, with their constellations under development, offer broadband to unmodified smartphones using terrestrial spectrum licensed to mobile network operators.

But others in the industry ask why mobile network operators have not rushed to invest in Lynk Global if D2D’s immediate potential is so large?

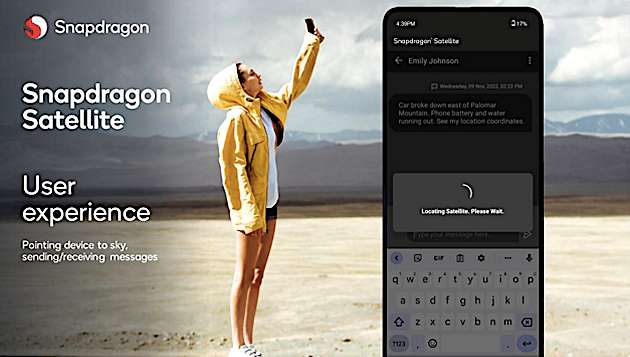

Qualcomm says its customers have not adopted the Snapdragon Satellite product. (Source: Qualcomm)

Qualcomm says its customers have not adopted the Snapdragon Satellite product. (Source: Qualcomm)

Apple is investing several hundred million dollars into the project, much of it to finance a new generation of Globalstar satellites.

News stories have recounted how people out of cell coverage and in distressed have used their Apple phones and the Globalstar connectivity to call for help in emergencies.

These stories are real, but much of the buzz around D2D has been over whether it can be expanded to provide voice and then broadband connectivity equivalent to what is available on today’s smartphones within cellular coverage.

Neither Apple nor Globalstar has endorsed the idea that a broadband D2D link, or anything resembling that, was around the corner.

Iridium hasn’t either. Iridium Chief Executive Matt Desch has been among the most vocal in trying to tamp down expectations. But Desch has become a convert to the idea that the technology — Iridium of course favors the use of satellite-licensed spectrum — can evolve into something of wider appeal than an emergency SOS button for people in emergencies.

“While I’m disappointed that this partnership didn’t bear immediate fruit, we believe the direction fo the industry is clear toward increased satellite connectivity in consumer devices,” Desch said in a Nov. 9 statement on the Qualcomm decision. “Led by Apple today, MNOs [terrestrial mobile network operators] and device manufacturers still plan, over time, to provide their customers with expanded coverage and new satellite-based features, and our global coverage and regulatory certainty make us well suited to be a key player in this emerging market.

“User experience will be critical to their success, and we’ve proven that we can provide a reliable, global capability to mobile users,” Desch said.

Iridium said that the end of the Qualcomm relationship will enable it to “re-engage with smartphone OEMs, other chipmakers and smartphone operating system developers that the company had been collaborating with previously.”

It should have been obvious to investors that the end of the Qualcomm deal will have no material effect on Iridium’s 2023 financials. The company said it is still targeting $1 billion in annual revenue by 2030.

But even a company that has been persistently modest in its statements about D2D cannot hold back a tide of investor enthusiasm.

The Iridium announcement was made after the stock market closed. In after-market trading on the Nasdaq exchange, its shares were down 8%.