Credit: Ovzon

Credit: Ovzon

LA PLATA, Maryland — Mobile satcom-on-the-move hardware and service provider Ovzon AB reported a large increase in revenue and a smaller operating loss for the first six months of 2022 and said the back half of the year looked to be just as good.

Sweden-based Ovzon, which has been leasing capacity from fleet operator Intelsat and others as it waits out production delays on its first satellite, now expects Ovzon 3 to finish testing at prime contractor Maxar Technologies in time for shipment to Europe’s Guiana Space Center spaceport, on the northeast coast of South America, for a launch between December and February aboard an Ariane 5 rocket.

Ovzon 3 is likely to be paired for the launch with Germany’s Heinrich Hertz civil/military telecommunications technology demonstration satellite for a launch to geostationary-transfer orbit.

The satellite’s completion by Maxar had been delayed because of a shortage of Honeywell-built reaction wheels during the Covid pandemic. Ovzon 3 is expected to enter thermal-vacuum testing at Maxar this autumn.

Credit: Ovzon

Credit: Ovzon

In an Aug. 18 investor call, Ovzon Chief Executive Per Norén said the overall environment for Ovzon’s products, mainly for civil government and military organizations, continues to improve, with the Ukraine war acting as a catalyst.

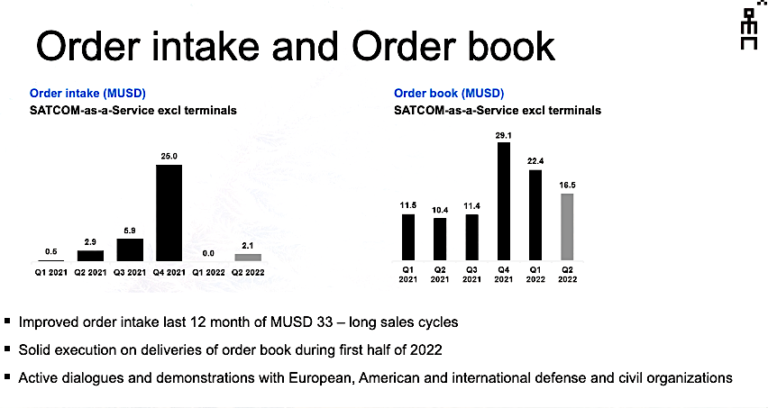

But despite the favorable environment, Ovzon’s customer set of government agencies has sales cycles that are long, meaning prospects are not contracted until months after the initial interest is shown.

An example of this, he said, is the steerable beam capacity on the Intelsat IS-39 satellite, which has not been sold and is now a drain on Ovzon profit.

“Not many organizations have the $7 million or $8 million or $9 million to spend” on short notice, Norén said. “It’s government procurement procedure. “I am positive that we will be able to do something. It’s difficult to predict when.”

While Ovzon purchased capacity on the IS-39 and IS-37 satellites, Intelsat has purchased capacity on Ovzon 3, which includes an Ovzon-designed and built on-board processor that Ovzon believes has no equivalent in the market.

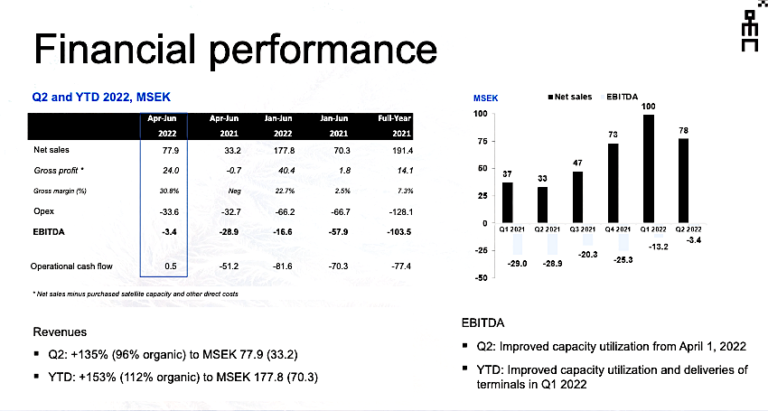

Ovzon expects 2022 revenue to be sharply higher than 2021. Net sales for the first six months of 2022 totaled 178 million Swedish krona ($17.1 million), compared to 191 million krona for all of 2021. Credit: Ovzon

Ovzon expects 2022 revenue to be sharply higher than 2021. Net sales for the first six months of 2022 totaled 178 million Swedish krona ($17.1 million), compared to 191 million krona for all of 2021. Credit: Ovzon

The Ovzon-built processor can assure communications with Ovzon mobile user terminals even if a gateway Earth station, or teleport, is somehow not available by using customer terminals as teleports, Norén said.

Intelsat’s lease totaled $56.2 million but is being reduced because of the Ovzon 3 delays. A 5% decrease has already been notified, with another 10% likely to be confirmed later this year, bringing the contract to $47.8 million.

The company said that despite the reduction in the committed volume, it does not see the decline having an impact on Ovzon 3’s revenue ramp.

Ovzon’s business model is to sell mobile broadband capability — preferably on Ovzon 3, but also on third-party satellites — to communicate with Ovzon’s mobile satcom terminals.

Most customers take a bundled offering including the terminals and a service-level agreement. Some, like the U.S. Defense Department, purchase terminals outright. The U.S. DoD ordered 50 Ovzon T6 terminals in late 2021.

Credit: Ovzon

Credit: Ovzon

It was to accommodate this kind of demand that Ovzon switched terminal production to Sweden-based Syntronic, which assures volume production to build inventory and reduce the time from a contract signing to revenue generation.

In addition to the U.S. military, Ovzon customers include the UK Ministry of Defence; the Colombian government for election monitoring and, since 2021, the Italian Fire and Rescue Service.

Norén said the current series of consolidations in the industry — among them the merger of mobile satellite service providers Viasat and Inmarsat, and fleet operator SES’s purchase of DRS Global Enterprise Solutions — are good news for Ovzon.

DRS, which is now part of SES Government Solutions, is an occasional Ovzon competitor and partner. “DRS and SES do not have the unique satcom-as-aservice offering that we have,” Norén said. “We can collaborate with them.”

“Consolidation is an opportunity for us to be more nimble. It’s an advantage to us as a smaller company.”

He did not speculate on whether Ovzon’s improving business made the company an acquisition target. Ovzon shares, traded on the Nasdaq Nordic Market, were up 10.7% in Aug. 18 trading following the release of its H1 2022 financials.

Read more from Space Intel Report.